Atul Ltd | Annual Report 2013-14

(

`

cr)

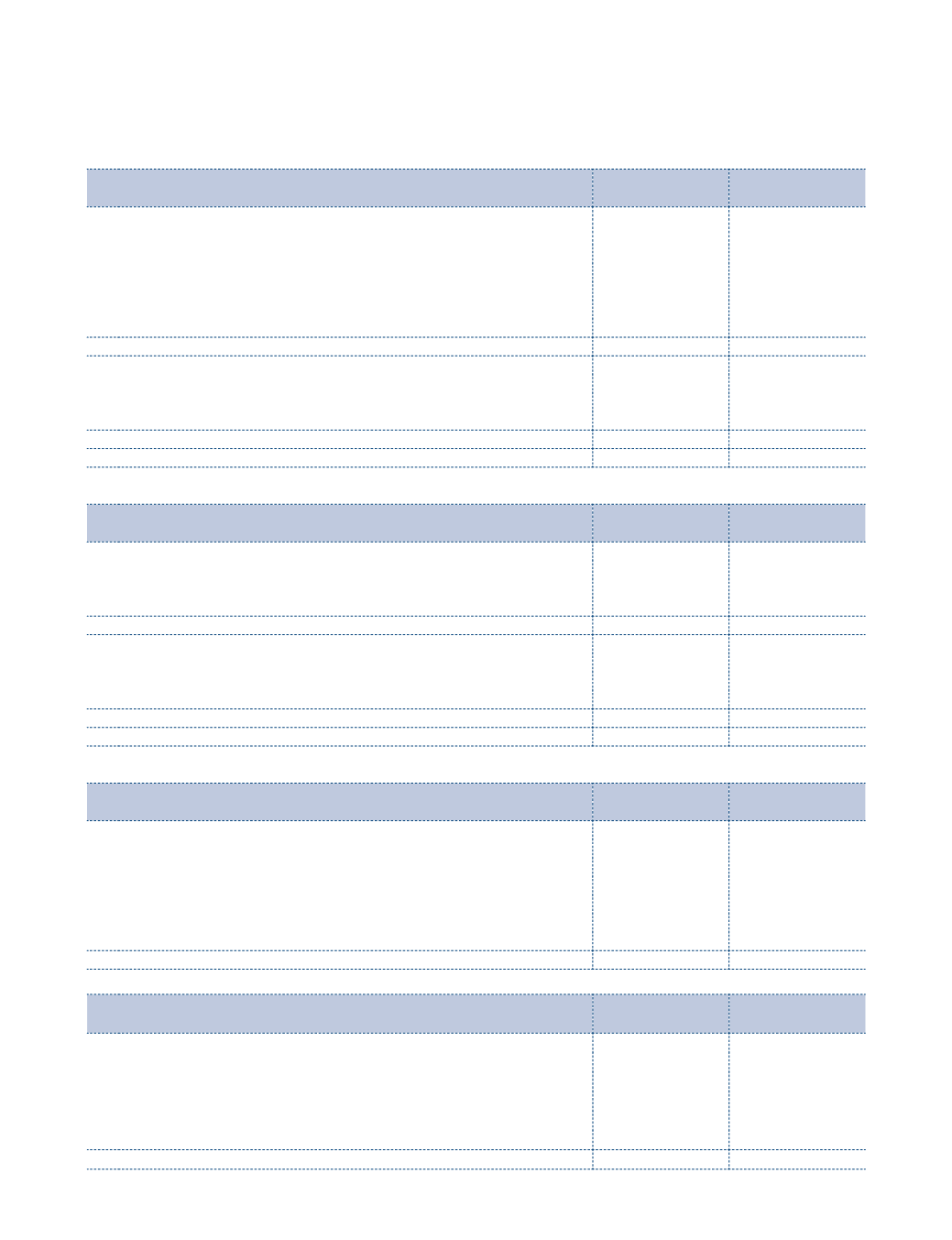

NOTE 17 TRADE RECEIVABLES

As at

March 31, 2014

As at

March 31, 2013

(a) Trade receivables outstanding for more than six months from the

date they became due for payment:

(i) Unsecured, considered good

From related parties

2.06

1.93

From others

4.20

3.63

(ii) Doubtful

2.36

2.62

Less: Provision for doubtful debts

2.36

2.62

6.26

5.56

(b) Others:

(i) Unsecured, considered good

From related parties

3.01

4.87

From others

427.81

341.25

430.82

346.12

437.08

351.68

(

`

cr)

NOTE 18 CASH AND BANK BALANCES

As at

March 31, 2014

As at

March 31, 2013

(a) Cash and cash equivalents:

(i) Balances with banks

In current accounts

17.92

9.74

(ii) Cash on hand

0.14

0.15

18.06

9.89

(b) Other Bank balances:

Earmarked balances with banks

(i) Unclaimed dividend | interest on public deposit

1.17

1.03

(ii) Short-term bank deposits (including margin money deposits)

1.82

3.94

2.99

4.97

21.05

14.86

(

`

cr)

NOTE 19 SHORT-TERM LOANS AND ADVANCES

As at

March 31, 2014

As at

March 31, 2013

Loans and advances, Unsecured, considered good to:

(a) Related parties

2.14

4.62

(b) Others:

(i) Advances recoverable in cash or kind

80.84

70.21

(ii) Balances with statutory authorities

18.41

25.99

(iii) Sundry deposits

0.66

0.83

(iv) Others

0.83

0.19

102.88

101.84

(

`

cr)

NOTE 20 OTHER CURRENT ASSETS

As at

March 31, 2014

As at

March 31, 2013

(a) Export incentive receivable

34.29

16.91

(b) Asset held for sale

0.59

0.59

(c) Mark-to-Market gains on derivatives

2.55

–

(d) Sundry receivable

Doubtful

0.19

0.19

Less: Provision for doubtful receivable

0.19

0.19

37.43

17.50

Notes

to the Consolidated Financial Statements