21

Directors’ Report

Dear Members,

The Board of Directors (Board) presents the Annual Report of Atul Ltd together with the audited statement of accounts for the

year ended March 31, 2015.

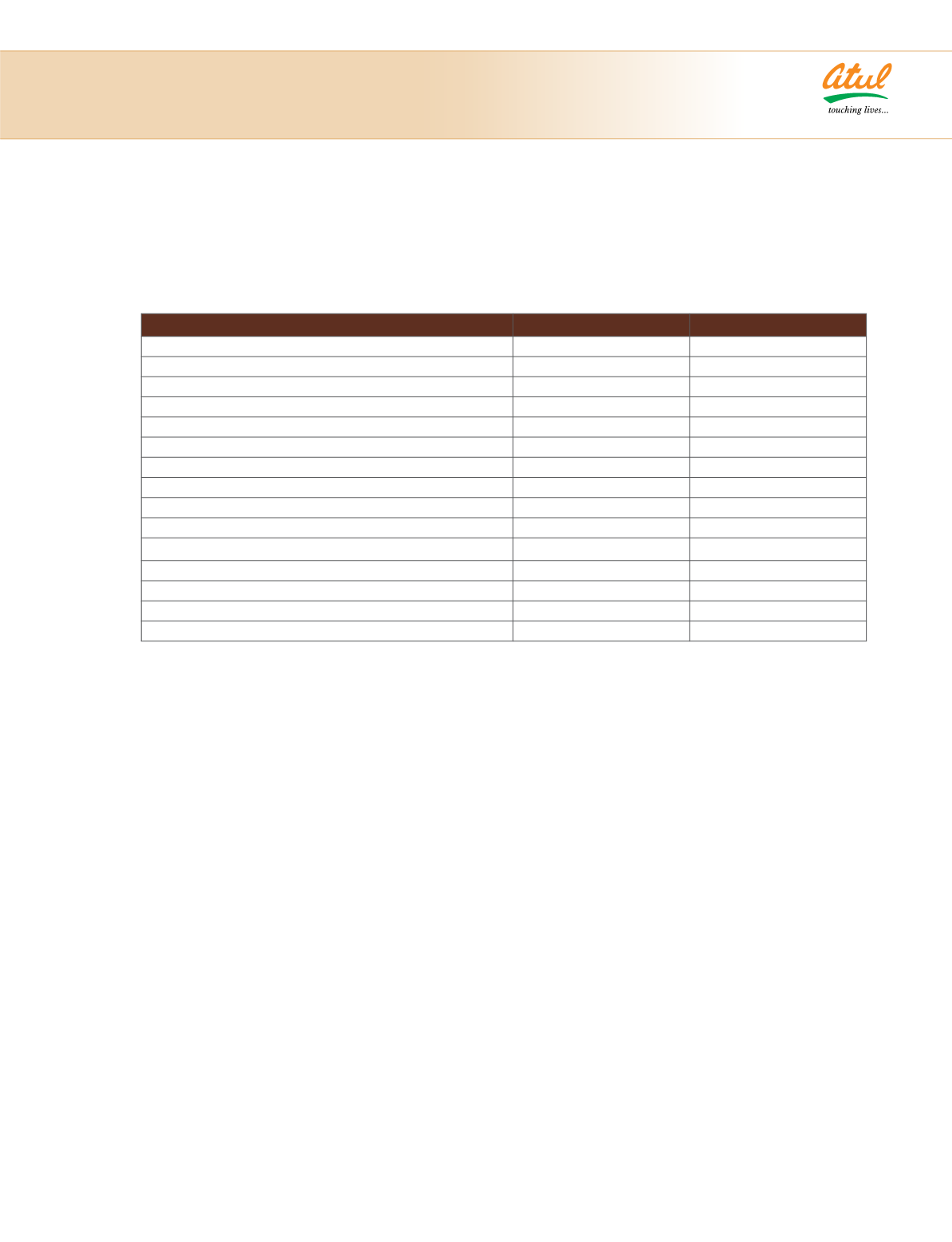

2014-15

2013-14

Sales

2,510

2,307

Revenue from operations

2,556

2,365

Other income

15

40

Total revenue

2,571

2,405

Profit before tax

312

297

Provision for tax

95

84

Profit for the year

217

213

Profit available for appropriation

217

213

Balance brought forward

664

498

Disposable surplus

881

711

Appropriations

General reserve

-

21

Proposed dividend

25

22

Dividend distribution tax

5

4

Balance carried forward

851

664

1. Financial Results

(

`

cr)

2.

Performance

Sales increased by 9% from

`

2,307 cr to

`

2,510 cr

aided by both higher volumes (5%) and prices (4%).

Sales in India increased by 7% from

`

1,199 cr to

`

1,283 cr. Sales outside India increased by 11% from

`

1,108 cr to

`

1,227 cr. PBT in previous year included

`

20 cr of one-time dividend received; including such

one-time income, the Earning per share increased from

`

71.74 to

`

73.30. While the operating profit before

working capital changes increased by 6% from

`

360 cr

to

`

383 cr, the net cash flow from operating activities

increased by 125% from

`

141 cr to

`

317 cr, mainly on

account of the reduction in working capital and other

current assets.

Sales of Life Science Chemicals (LSC) Segment

decreased by 8% from

`

738 cr to

`

676 cr, mainly

because of lower sales in Crop Protection Business;

its EBIT decreased by 21% from

`

150 cr to

`

119

cr. Sales of Performance and Other Chemicals (POC)

Segment increased by 17% from

`

1,569 cr to

`

1,834 cr, supported by growth in Aromatics,

Colors and Polymers Businesses; its EBIT increased

by 40% from

`

173 cr to

`

242 cr. More details are

given in the Management Discussion and Analysis

(MDA) Report.

The Company reduced its borrowings (including

current maturities on long-term borrowings) by 20%

from

`

351 cr to

`

281 cr despite the growth in sales

and payments towards capital expenditure of

`

192 cr.

The Company improved its credit rating from ‘AA‘

(double A) to ‘AA+’ (double A plus) for its long-term

borrowings awarded by Credit Analysis & Research

Ltd (CARE). Its rating for short-term borrowings and

commercial paper remained at ‘A1+’ (A1 plus), the

highest possible awarded by CARE.

The Company completed 4 projects with an

investment of

`

33 cr which are expected to generate

sales of

`

143 cr at full capacity utilisation.

3.

Dividend

The Board recommends payment of dividend of

`

8.50 per share on 2,96,61,733 Equity shares of

`

10 each fully paid up. The dividend will entail

an outflow of

`

30.34 cr (including dividend

distribution tax) on the paid-up Equity share capital

of

`

29.66 cr.

4.

Conservation of energy, technology

absorption, foreign exchange earnings and

outgo

Information required under Section 134 (3) (m) of

the Companies Act, 2013, read with Rule 8 (3) of

the Companies (Accounts) Rules, 2014, as amended

from time to time, forms a part of this Report which

is given at page number 26.

5.

Insurance

The Company has taken adequate insurance to

cover the risks to its people, plants and machineries,

buildings and other assets, profit and third parties.