Atul Ltd | Annual Report 2017-18

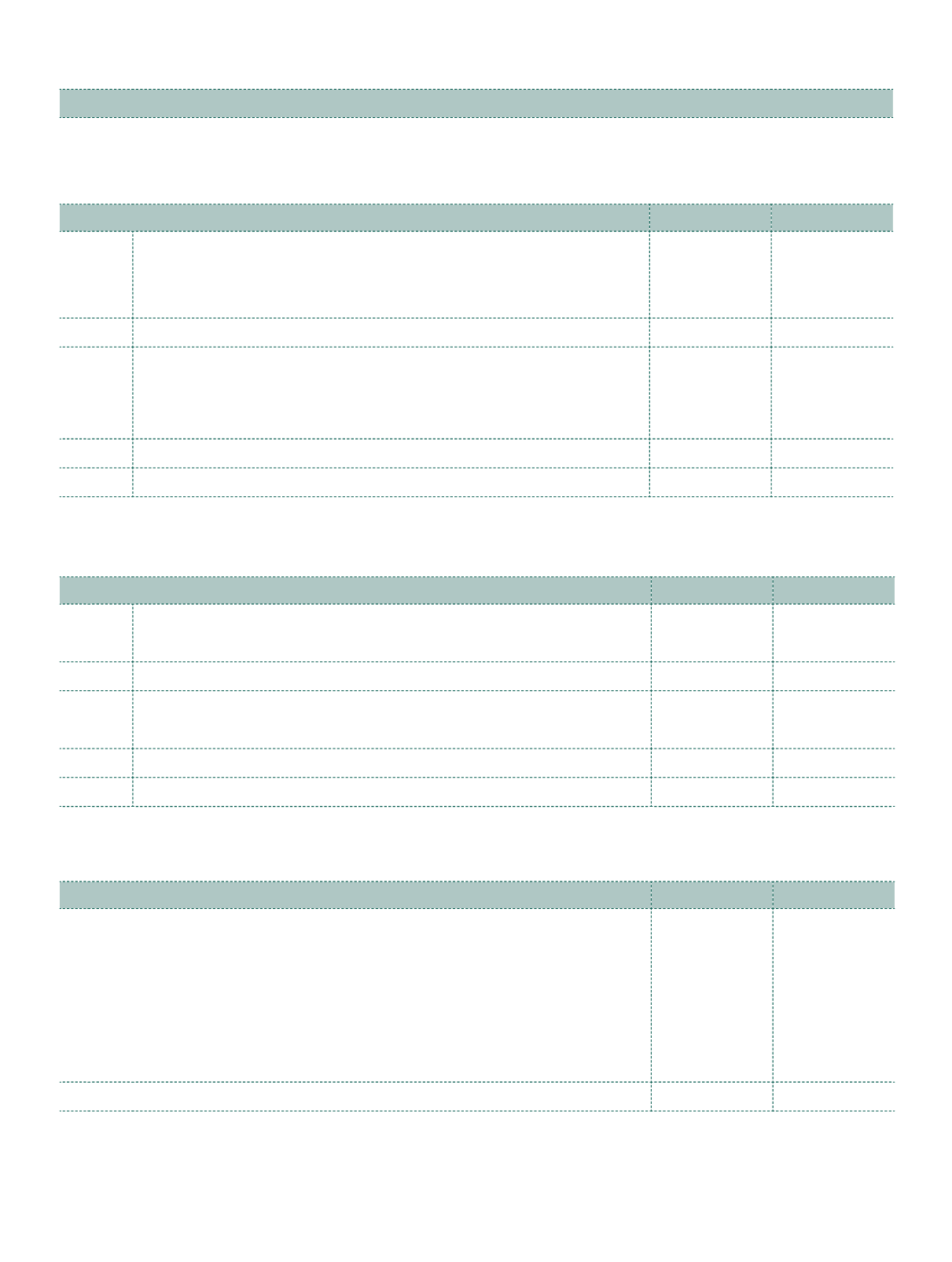

Note 27.5 Current and Deferred tax

(continued)

The major components of income tax expense for the years ended March 31, 2018 and March 31, 2017 are:

a) Income tax expense recognised in the Statement of Profit or Loss:

(

`

cr)

Particulars

2017-18

2016-17

i)

Current tax

Current tax on profit for the year

103.04

81.80

Adjustments for current tax of prior periods

(0.83)

(2.07)

Total current tax expense

102.21

79.73

ii)

Deferred tax

(Decrease) | Increase in deferred tax liabilities

138.74

61.26

Decrease | (Increase) in deferred tax assets

(114.11)

(25.77)

Total deferred tax expense | (benefit)

24.63

35.49

Income tax expense

126.84

115.22

b) Income tax expense recognised in the Statement of Other Comprehensive Income:

(

`

cr)

Particulars

2017-18

2016-17

i)

Current tax

Remeasurement gain | (loss) on defined benefit plans

0.95

0.86

Total current tax expense

0.95

0.86

ii)

Deferred tax

Effective portion of gain | (loss) on cash flow hedges

0.02

(0.25)

Total deferred tax expense | (benefit)

0.02

(0.25)

Income tax expense

0.97

0.61

c) The reconciliation between the statutory income tax rate applicable to the Company and the effective

income tax rate of the Company is as follows:

Particulars

2017-18

2016-17

a) Statutory income tax rate

34.61%

34.61%

b) Differences due to:

i)

Expenses not deductible for tax purposes

0.93%

0.75%

ii)

Income exempt from income tax

(1.56%)

(2.17%)

iii)

Income tax incentives

(0.55%)

(3.48%)

iv)

Others

(1.43%)

(0.94%)

Effective income tax rate

32.00% 28.77%

Notes

to the Financial Statements