133

Note 27.5 Current and Deferred tax

(continued)

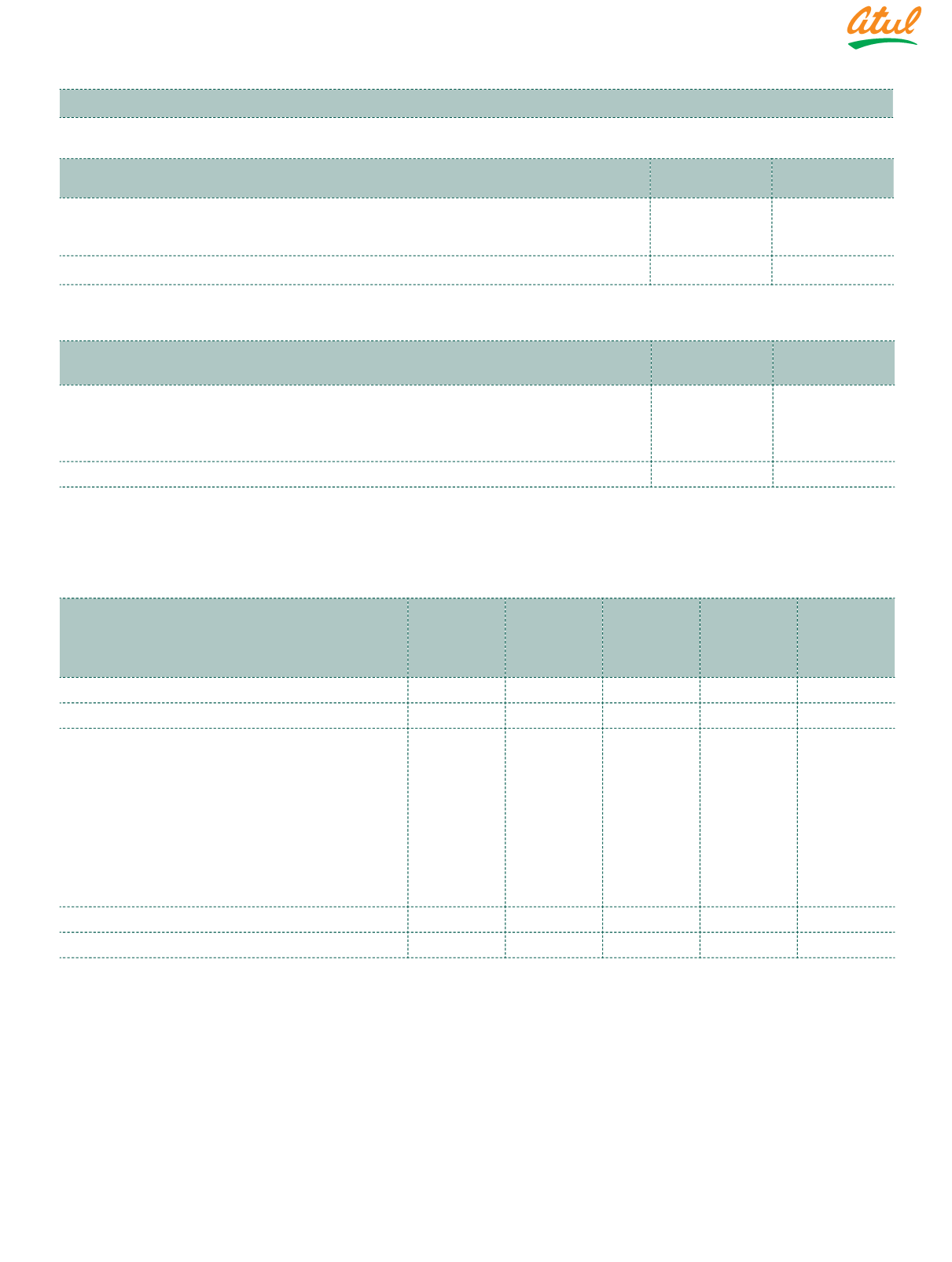

d) Current tax assets

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Opening balance

–

3.11

Add: Tax paid in advance, net of provisions during the year

0.67

(3.11)

Closing balance

0.67

–

e) Current tax liabilities

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Opening balance

1.99

–

Add: Current tax payable for the year

102.21

79.73

Less: Taxes paid

(96.19)

(77.74)

Closing balance

8.01

1.99

f) Deferred tax liabilities (net)

The balance comprises temporary differences attributable to the below items and corresponding movement in deferred

tax liabilities | (assets):

(

`

cr)

Particulars

As at

March 31,

2018

(Charged) |

Credited to

profit or loss

| OCI | equity

As at

March 31,

2017

(Charged) |

Credited to

profit or loss

| OCI | equity

As at

March 31,

2016

Property, plant and equipment

140.33

1.59

138.74

61.26

77.48

Total deferred tax liabilities

140.33

1.59

138.74

61.26

77.48

Provision for leave encashment

(8.58)

0.46

(9.04)

(1.23)

(7.81)

Provision for doubtful debts

(0.91)

0.19

(1.10)

0.22

(1.32)

Provision for doubtful advances

–

–

–

0.07

(0.07)

Investment properties

(6.21)

(2.26)

(3.95)

(0.18)

(3.77)

Unrealised MTM losses on derivatives (CIRS)

–

1.75

(1.75)

(1.75)

–

Cash flow hedges

0.02

0.27

(0.25)

0.06

(0.31)

MAT credit entitlement

–

22.90

(22.90)

(22.90)

–

Total deferred tax assets

(15.68)

23.31 (38.99)

(25.71)

(13.28)

Net deferred tax liabilities | (assets)

124.65

24.90

99.75

35.55

64.20

g) Unrecognised temporary differences

The Company has not recognised deferred tax liability

|

asset associated with fair value gain

|

(loss) on equity share

measured at OCI as based on the Management projection of future taxable income and existing plan, it is not probable

that such difference will reverse in the foreseeable future.

h) Effective income tax rate

The effective income tax rate up to March 31, 2018 was 34.61%. The increase in effective income tax rate to 34.94%

was announced in Union Budget 2018 which was substantively enacted on March 29, 2018 and has been in effect

from April 01, 2018. As a result, the relevant deferred tax balances has been remeasured using revised effective income

tax rate.

Notes

to the Financial Statements