Atul Ltd | Annual Report 2017-18

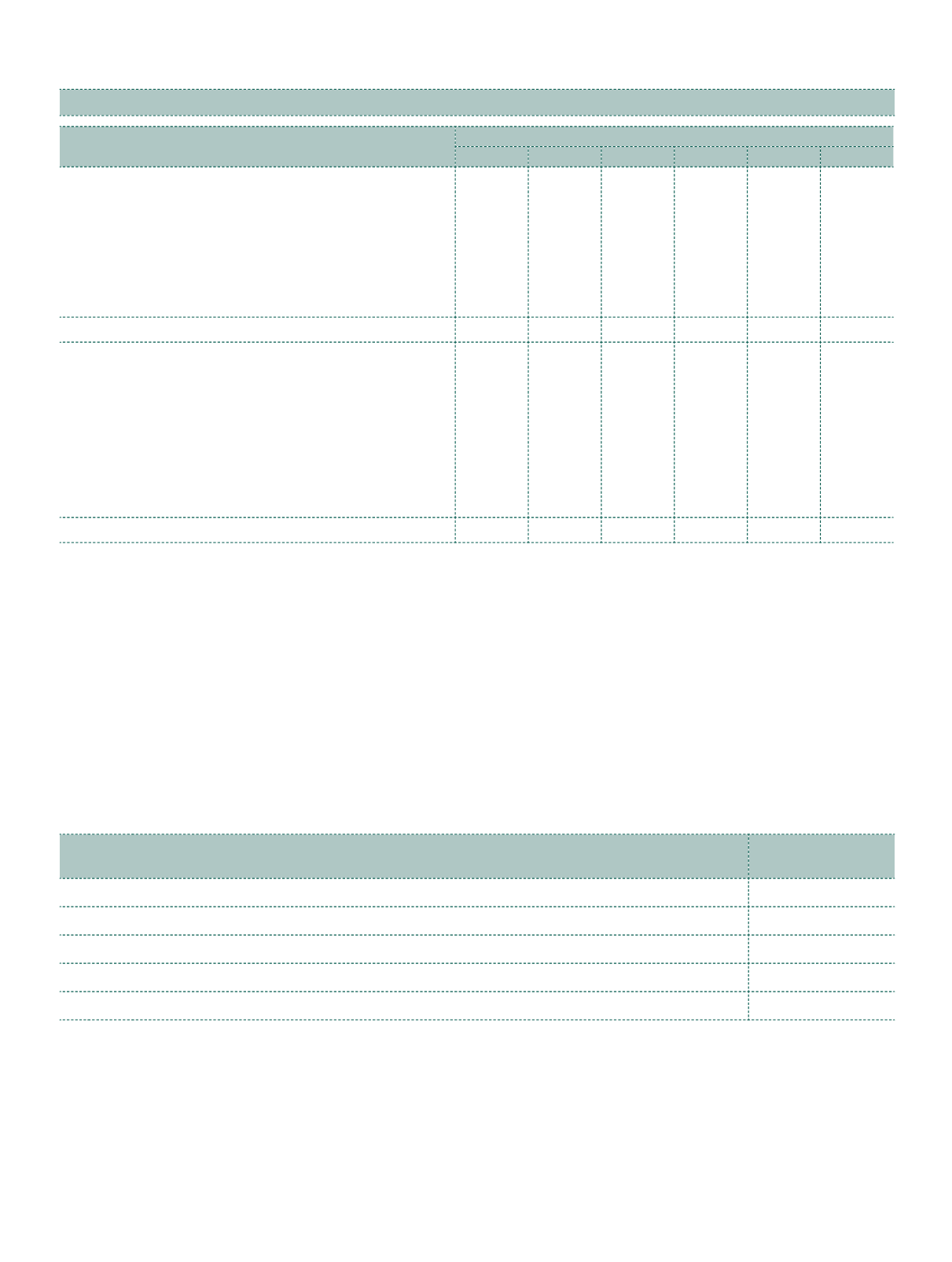

Particulars

As at March 31, 2017

US$ mn

` cr

€ mn

` cr

£mn

` cr

Financial assets

Trade receivables

37.67

244.26

2.43

16.80

0.10

0.77

Dividends receivable

–

–

–

–

0.65

5.25

Less:

Hedged through derivatives

1

Currency range options

7.65

49.60

–

–

–

–

Net exposure to foreign currency risk (assets)

30.02 194.66

2.43

16.80

0.75

6.02

Financial liabilities

Borrowings

10.67

69.15

–

–

–

–

Trade payables

8.07

52.33

0.22

1.52

0.01

0.04

Less:

Hedged through derivatives

1

Foreign exchange forward contracts

9.00

58.35

–

–

–

–

Currency swaps

1.67

10.80

–

–

–

–

Net exposure to foreign currency risk (liabilities)

8.07

52.33

0.22

1.52

0.01

0.04

1

Includes hedges for highly probable transactions up to next 12 months

c)

Management of credit risk

Credit risk is the risk of financial loss to the Company if a customer or counterparty fails to meet its contractual

obligations.

Trade receivables

Concentrations of credit risk with respect to trade receivables are limited, due to the customer base being

large, diverse and across sectors and countries. All trade receivables are reviewed and assessed for default on a

quarterly basis.

Historical experience of collecting receivables of the Company is supported by low level of past default and hence

the credit risk is perceived to be low.

Reconciliation of loss allowance provision – Trade receivables

(

`

cr)

Particulars

Loss allowance on

Trade receivables

Loss allowance as on March 31, 2016

3.80

Changes in loss allowance

(0.64)

Loss allowance as on March 31, 2017

3.16

Changes in loss allowance

(0.56)

Loss allowance as on March 31, 2018

2.60

Other financial assets

The Company maintains exposure in cash and cash equivalents, term deposits with banks, investments in Government

securities, preference shares and loans to subsidiary companies. The Company has diversified portfolio of investment with

various number of counterparties which have secure credit ratings, hence the risk is reduced. Individual risk limits are set for

each counterparty based on financial position, credit rating and past experience. Credit limits and concentration of exposures

are actively monitored by the treasury department of the Company.

Notes

to the Financial Statements

Note 27.8 Financial Risk Management

(continued)