Atul Ltd | Annual Report 2017-18

Notes

to the Financial Statements

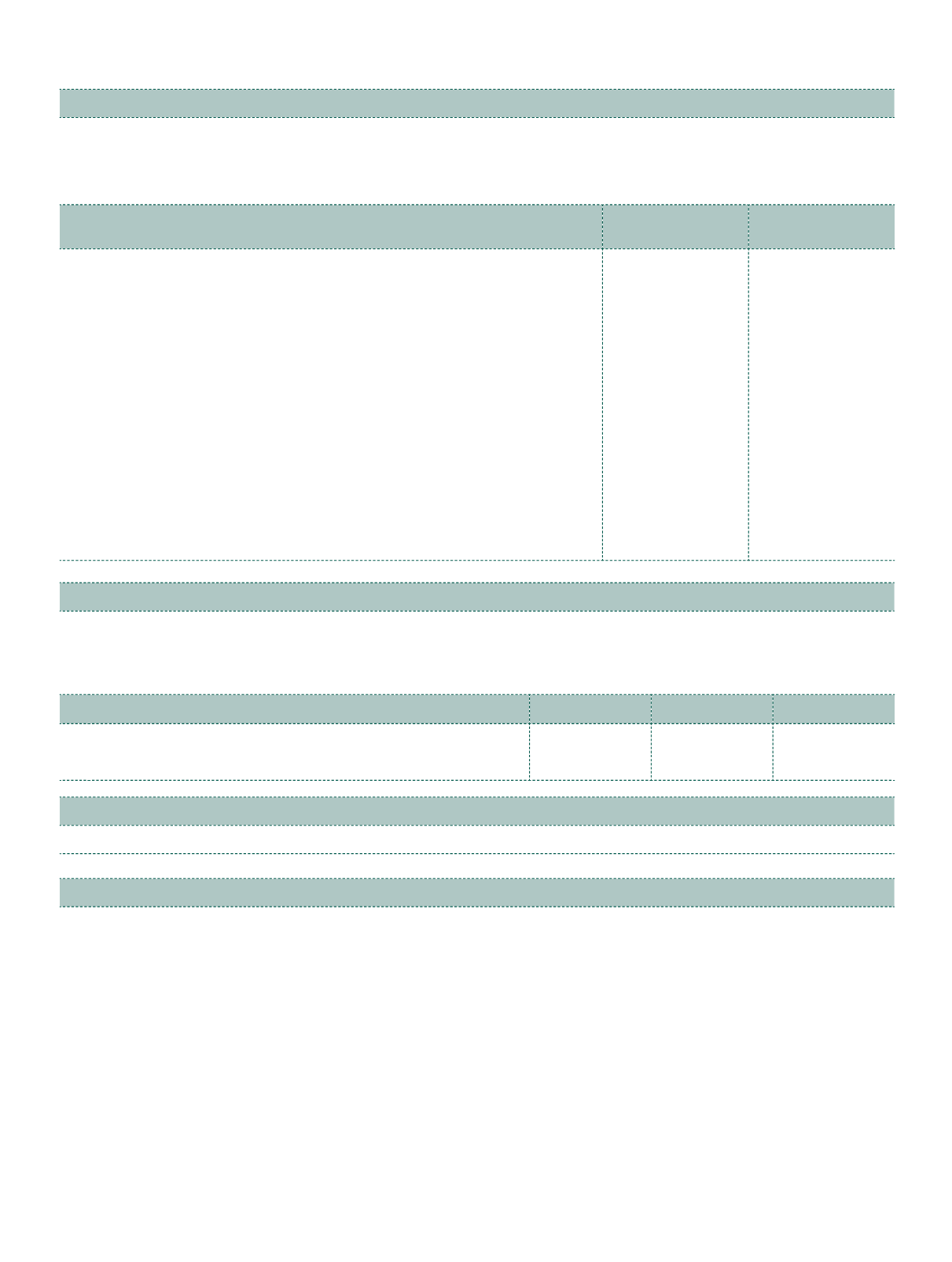

Note 27.14 Disclosure requirement under MSMED Act, 2006

The Company has certain dues to suppliers (trade and capital) registered under Micro, Small and Medium Enterprises

Development Act, 2006 (‘MSMED Act’). The disclosures pursuant to the said MSMED Act are as follows:

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Principal amount due to suppliers registered under the MSMED Act and remaining

unpaid as at year end

4.06

3.30

Interest due to suppliers registered under the MSMED Act and remaining unpaid

as at year end

0.02

0.02

Principal amounts paid to suppliers registered under the MSMED Act, beyond the

appointed day during the year

1.14

2.51

Interest paid, other than under Section 16 of MSMED Act, to suppliers registered

under the MSMED Act, beyond the appointed day during the year

–

–

Interest paid, under Section 16 of MSMED Act, to suppliers registered under the

MSMED Act, beyond the appointed day during the year

0.02

0.01

Interest due and payable towards suppliers registered under MSMED Act, for

payments already made

–

–

Further interest remaining due and payable for earlier years

–

–

Note 27.15 Expenditure on Corporate Social Responsibility initiatives

a) Gross amount required to be spent by the Company during the year is

`

7.39 cr

b) Amount spent during the year on:

(

`

cr)

Particulars

Paid

Payable

Total

i) Construction | acquisition of any asset

–

–

–

ii) On purposes other than (i) above

7.39

–

7.39

Note 27.16 Rounding off

Figures less than

`

50,000 have been shown at actual in brackets.

Note 27.17 Offsetting financial assets and liabilities

The below Note presents the recognised financial instruments that are offset, or subject to enforceable master netting

arrangements and other similar Agreements, but not offset, as at March 31, 2018 and March 31, 2017.

a) Collateral against borrowings

The Company has hypothecated | mortgaged financial instruments as collateral against a number of its borrowings. Refer

to Note 15 for further information on financial and non-financial collateral hypothecated | mortgaged as security against

borrowings.

b) Master netting arrangements – not currently enforceable

Agreements with derivative counterparties are based on an ISDA Master Agreement. Under the terms of these

arrangements, only where certain credit events occur (such as default), the net position owing | receivable to a

single counterparty in the same currency will be taken as owing and all the relevant arrangements terminated. As the

Company does not presently have a legally enforceable right of set-off, these amounts have not been offset in the

Balance Sheet.