203

Note 29.10 Offsetting financial assets and liabilities

The below Note presents the recognised financial instruments that are offset or subject to enforceable master netting

arrangements and other similar Agreements, but not offset as at March 31, 2018 and March 31, 2017.

a) Collateral against borrowings

The Group has hypothecated | mortgaged financial instruments as collateral against its borrowings. Refer Note 17 for

further information on financial and non-financial collateral hypothecated | mortgaged as security against borrowings.

b) Master netting arrangements – not currently enforceable

Agreements with derivative counterparties are based on an ISDA Master Agreement. Under the terms of these

arrangements, only where certain credit events occur (such as default), the net position owing | receivable to a single

counterparty in the same currency will be taken as owing and all the relevant arrangements terminated. As the Group

does not presently have a legally enforceable right of set-off, these amounts have not been offset in the Balance Sheet.

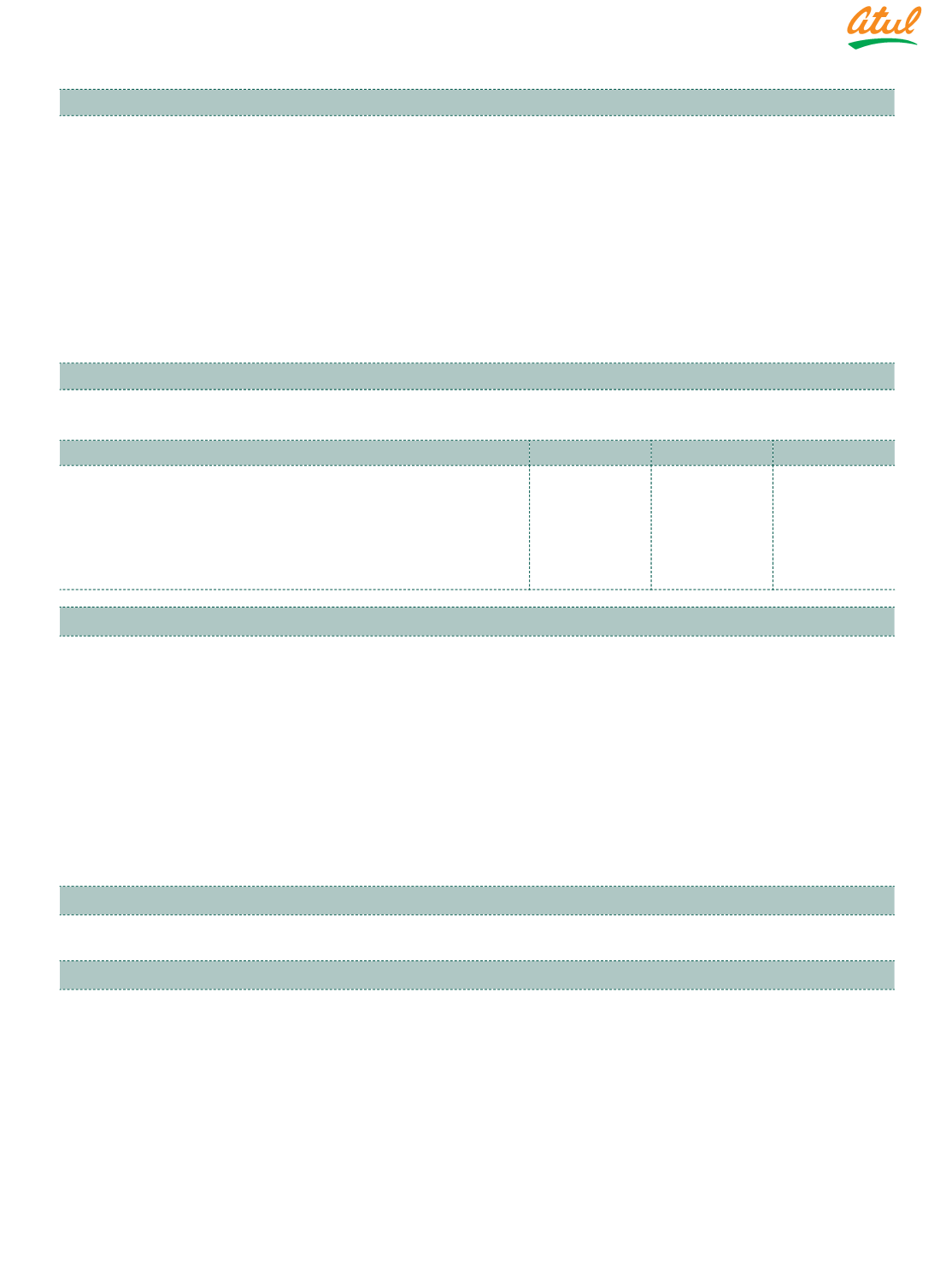

Note 29.11 Earnings per share

Earning per share (EPS) - The numerators and denominators used to calculate basic and diluted EPS:

Particulars

2017-18

2016-17

Profit for the year attributable to the Equity Shareholders

`

cr

281.24

323.35

Basic | Weighted average number of equity shares outstanding during

the year

Number

2,96,61,733 2,96,61,733

Nominal value of equity share

`

10

10

Basic and diluted EPS

`

94.82

109.01

Note 29.12 Leases

a) Operating lease

The Group has taken various residential and office premises under operating lease or leave and license Agreements. These

are generally cancellable having a term between 11 months and 3 years and have no specific obligation for renewal.

Payments are recognised in the Statement of Profit and Loss under 'Rent' in Note 28.

b) Finance lease

The Group has taken on lease a parcel of land from Gujarat Industrial Development Corporation for a period of 99 years

with an option to extend the lease by another 99 years on expiry of lease at a rental that is 100% higher than the current

rental. However, the Group has no specific obligation for renewal. The Group has considered that such a lease of land

transfers substantially all of the risks and rewards incidental to ownership of land, and it has thus accounted for the same

as Finance lease.

Note 29.13 Rounding off

Figures less than

`

50,000 have been shown at actual in brackets.

Note 29.14 Interests in other entities

a) Subsidiary companies

The subsidiary companies of the Group at March 31, 2018 are set out below. Unless otherwise stated, they have Share

capital consisting solely of equity shares that are held directly by the Group, and the proportion of ownership interests

held equals the voting rights held by the Group. The country of incorporation or registration is also their principal place

of business.

Notes

to the Consolidated Financial Statements