41

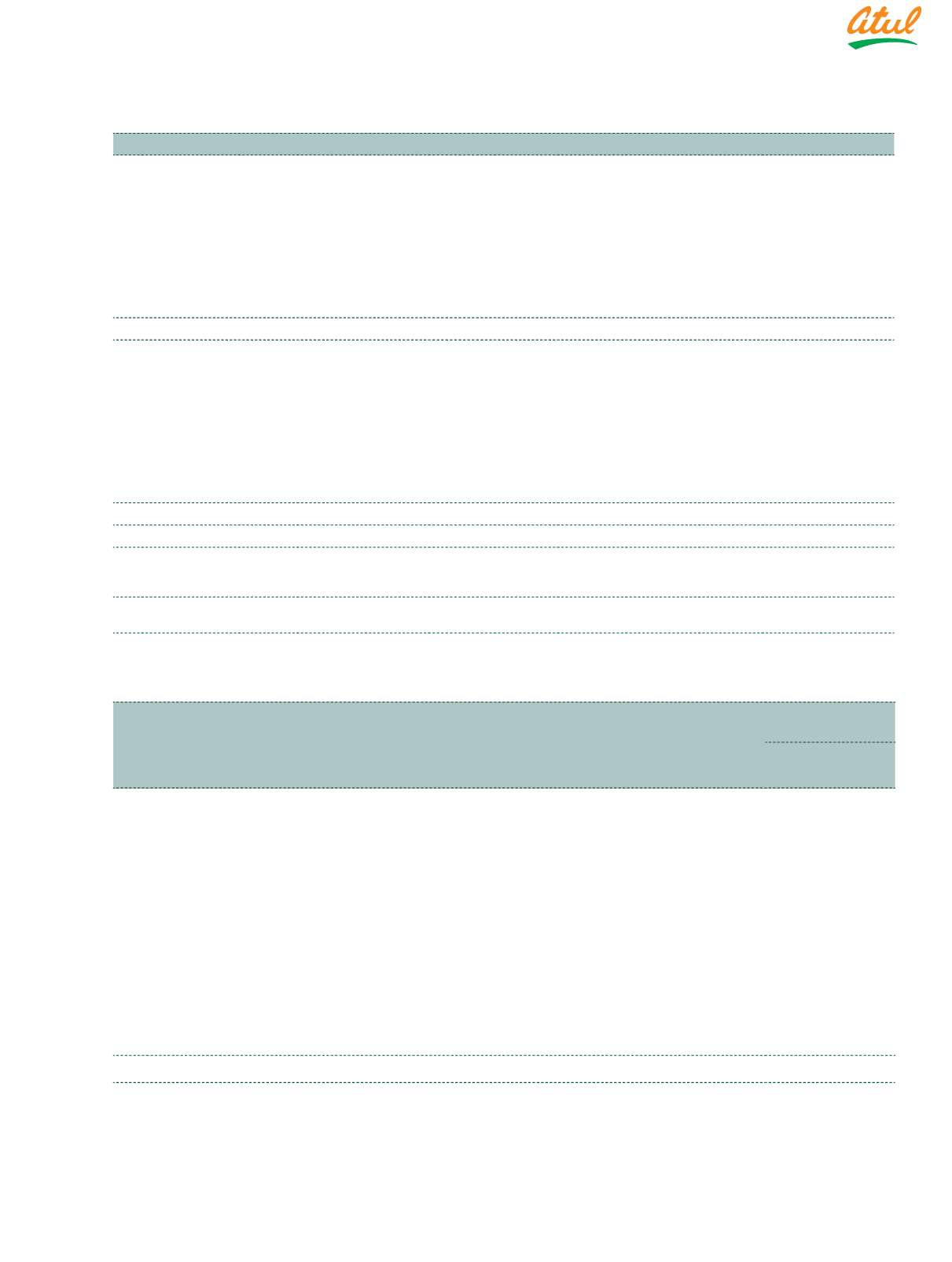

4.6.2 Remuneration to the other Directors

(

`

)

No. Particulars

R A Shah S S Baijal B S Mehta H S Shah S M Datta V S Rangan M M Chitale S A Panse B R Arora Total amount

01. Non-executive

Independent

Directors

a) Fee for

attending

the Board,

Committee

and other

meetings

– 4,20,000

– 1,50,000 3,15,000 2,80,000 1,40,000 2,10,000 2,10,000 17,25,000

b) Commission

– 13,60,000

– 4,80,000 9,60,000 8,71,000 8,00,000 8,00,000 8,00,000 60,71,000

Total 1

– 17,80,000

– 6,30,000 12,75,000 11,51,000 9,40,000 10,10,000 10,10,000 77,96,000

02. Non-executive

Non-independent

Directors

a) Fee for

attending

the Board,

Committee

and other

meetings

2,80,000

– 4,20,000

–

–

–

–

–

–

7,00,000

b) Commission 7,80,000

– 9,60,000

–

–

–

–

–

– 17,40,000

Total 2

10,60,000

– 13,80,000

–

–

–

–

–

– 24,40,000

Total (B) = (1+2) 10,60,000 17,80,000 13,80,000 6,30,000 12,75,000 11,51,000 9,40,000 10,10,000 10,10,000 1,02,36,000

Total managerial

remuneration

(A+B)

12,83,03,118

Overall ceiling as

per the Act

45,88,10,000

4.6.3 Remuneration to the Key Managerial Personnel other than the Managing Director | the Manager | the Whole-time Director

(

`

)

No. Particulars

Key Managerial

Personnel

CS

L P Patni

01. Gross salary

Salary as per provisions contained under Section 17(1)

of the Income Tax Act, 1961

49,37,226

Value of perquisites under Section 17(2)

of the Income Tax Act, 1961

7,33,563

Profits in lieu of salary under Section 17(3)

of the Income Tax Act, 1961

–

02. Stock option

–

03. Sweat Equity

–

04. Commission

–

05. Others

–

Total

56,70,789

4.7 Penalties | Punishment | Compounding of offences

There were no penalties | punishment | compounding of offences for the year ending March 31, 2018.