Note 28.7 Fair value measurements (continued)

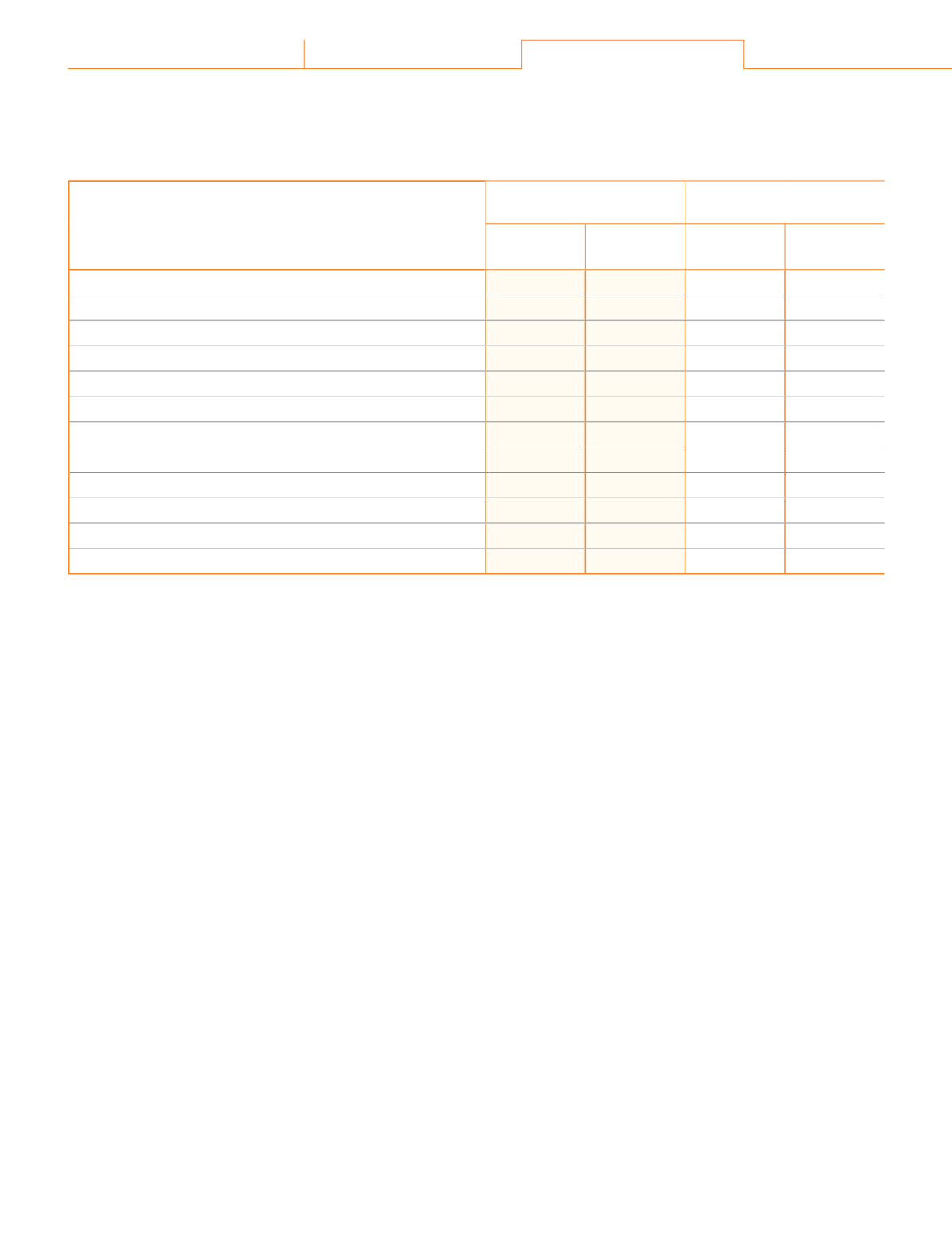

ēȴ GîĿƑ DŽîŕƭĚ ūlj ǛŠîŠČĿîŕ îƙƙĚƥƙ îŠē ŕĿîċĿŕĿƥĿĚƙ ŞĚîƙƭƑĚē îƥ îŞūƑƥĿƙĚē Čūƙƥ

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

Carrying

amount

Fair value Carrying

amount

Fair value

Financial assets

Investments:

Preference shares

ǫȦǨǪ

ǫȦǨǪ

5.72

5.72

Government securities

0.01

0.01

0.01

0.01

Loans

ǪȦǯǨ

ǪȦǯǨ

7.07

7.07

Security deposits for utilities and premises

1.76

1.76

1.10

1.10

Finance lease receivable

1.33

1.33

1.25

1.25

¹ūƥîŕ ǛŠîŠČĿîŕ îƙƙĚƥƙ

13.26

13.26

15.15

15.15

Financial liabilities

Borrowings

-

-

0.01

0.01

Security deposits

22.39

22.39

19.80

19.80

¹ūƥîŕ ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙ

22.39

22.39

19.81

19.81

The carrying amounts of trade receivables, cash and cash equivalents, other bank balances, dividend receivables, other

receivables, trade payables, capital creditors, other liabilities are considered to be the same as their fair values due to the

current and short-term nature of such balances.

¹ĺĚ ljîĿƑ DŽîŕƭĚƙ ljūƑ ŕūîŠƙ îŠē ĿŠDŽĚƙƥŞĚŠƥƙ ĿŠ ƎƑĚljĚƑĚŠČĚ ƙĺîƑĚƙ DžĚƑĚ ČîŕČƭŕîƥĚē ċîƙĚē ūŠ Čîƙĺ ǜūDžƙ ēĿƙČūƭŠƥĚē ƭƙĿŠij î ČƭƑƑĚŠƥ

lending rate at the time of inception.

GūƑ ǛŠîŠČĿîŕ îƙƙĚƥƙ îŠē ŕĿîċĿŕĿƥĿĚƙ ƥĺîƥ îƑĚ ŞĚîƙƭƑĚē îƥ ljîĿƑ DŽîŕƭĚȡ ƥĺĚ ČîƑƑNjĿŠij îŞūƭŠƥƙ îƑĚ ĚƐƭîŕ ƥū ƥĺĚ ljîĿƑ DŽîŕƭĚƙȦ

Note 28.8 Financial risk management

Riskmanagement is an integral part of the business practices of the Company. The framework of riskmanagement concentrates

on formalising a system to deal with the most relevant risks, building on existing Management practices, knowledge and

ƙƥƑƭČƥƭƑĚƙȦ ØĿƥĺ ƥĺĚ ĺĚŕƎ ūlj î ƑĚƎƭƥĚē ĿŠƥĚƑŠîƥĿūŠîŕ ČūŠƙƭŕƥîŠČNj ǛƑŞȡ ƥĺĚ ūŞƎîŠNj ĺîƙ ēĚDŽĚŕūƎĚē îŠē ĿŞƎŕĚŞĚŠƥĚē î

comprehensive risk management system to ensure that risks to the continued existence of the Company as a going concern

îŠē ƥū Ŀƥƙ ijƑūDžƥĺ îƑĚ ĿēĚŠƥĿǛĚē îŠē ƑĚŞĚēĿĚē ūŠ î ƥĿŞĚŕNj ċîƙĿƙȦ ØĺĿŕĚ ēĚǛŠĿŠij îŠē ēĚDŽĚŕūƎĿŠij ƥĺĚ ljūƑŞîŕĿƙĚē ƑĿƙŒ ŞîŠîijĚŞĚŠƥ

system, leading standards and practices have been considered. The risk management system is relevant to business reality,

pragmatic and simple and involves the following:

Ŀȴ

¤ĿƙŒ ĿēĚŠƥĿǛČîƥĿūŠ îŠē ēĚǛŠĿƥĿūŠȠ GūČƭƙĚē ūŠ ĿēĚŠƥĿljNjĿŠij ƑĚŕĚDŽîŠƥ ƑĿƙŒƙȡ ČƑĚîƥĿŠij ʈ ƭƎēîƥĿŠij ČŕĚîƑ ēĚǛŠĿƥĿūŠƙ ƥū ĚŠƙƭƑĚ

undisputed understanding along with details of the underlying root causes | contributing factors.

ĿĿȴ ¤ĿƙŒ ČŕîƙƙĿǛČîƥĿūŠȠ GūČƭƙĚē ūŠ ƭŠēĚƑƙƥîŠēĿŠij ƥĺĚ DŽîƑĿūƭƙ ĿŞƎîČƥƙ ūlj ƑĿƙŒƙ îŠē ƥĺĚ ŕĚDŽĚŕ ūlj ĿŠǜƭĚŠČĚ ūŠ Ŀƥƙ Ƒūūƥ ČîƭƙĚƙȦ ¹ĺĿƙ

involves identifying various processes generating the root causes and clear understanding of risk interrelationships.

iii) Risk assessment and prioritisation: Focused on determining risk priority and risk ownership for critical risks. This involves

assessment of the various impacts taking into consideration risk appetite and existing mitigation controls.

ĿDŽȴ ¤ĿƙŒ ŞĿƥĿijîƥĿūŠȠ GūČƭƙĚē ūŠ îēēƑĚƙƙĿŠij ČƑĿƥĿČîŕ ƑĿƙŒƙ ƥū ƑĚƙƥƑĿČƥ ƥĺĚĿƑ ĿŞƎîČƥȳƙȴ ƥū îŠ îČČĚƎƥîċŕĚ ŕĚDŽĚŕ ȳDžĿƥĺĿŠ ƥĺĚ ēĚǛŠĚē ƑĿƙŒ

îƎƎĚƥĿƥĚȴȦ ¹ĺĿƙ ĿŠDŽūŕDŽĚƙ î ČŕĚîƑ ēĚǛŠĿƥĿūŠ ūlj îČƥĿūŠƙȡ ƑĚƙƎūŠƙĿċĿŕĿƥĿĚƙ îŠē ŞĿŕĚƙƥūŠĚƙȦ

v) Risk reporting and monitoring: Focused on providing to the Board and the Audit Committee periodic information on risk

ƎƑūǛŕĚ ĚDŽūŕƭƥĿūŠ îŠē ŞĿƥĿijîƥĿūŠ ƎŕîŠƙȦ

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250

ǧǬǪ

Atul Ltd | Annual Report 2018-19