sūƥĚ ǨǮȦǬ /ŞƎŕūNjĚĚ ċĚŠĚǛƥ ūċŕĿijîƥĿūŠƙ ȳČūŠƥĿŠƭĚēȴ

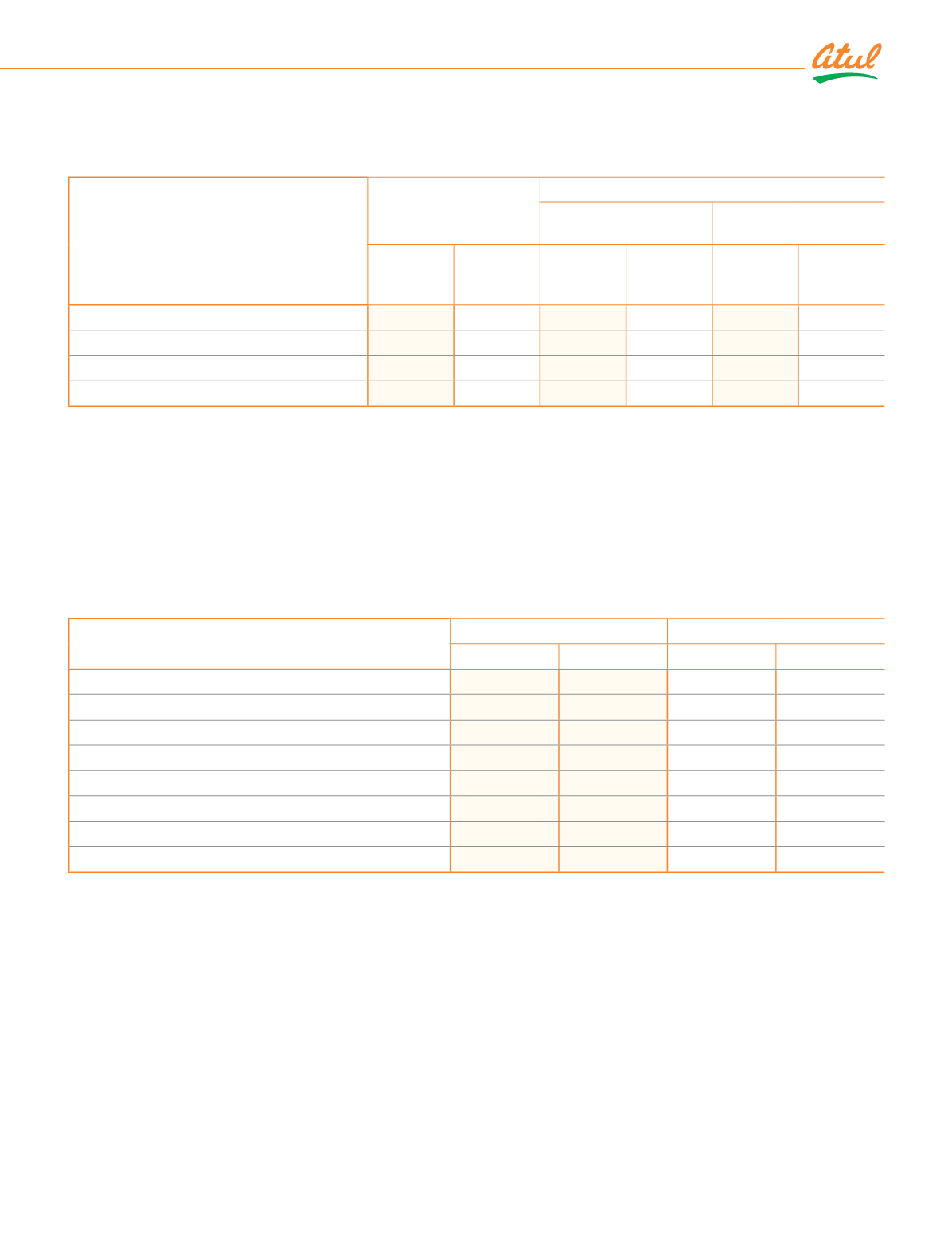

Sensitivity analysis

¹ĺĚ ƙĚŠƙĿƥĿDŽĿƥNj ūlj ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ ƥū ČĺîŠijĚƙ ĿŠ ƥĺĚ DžĚĿijĺƥĚē ƎƑĿŠČĿƎîŕ îƙƙƭŞƎƥĿūŠƙ ĿƙȠ

Particulars

Change in assumptions

TŞƎîČƥ ūŠ ēĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ

Increase in

assumptions

Decrease in

assumptions

As at

March 31,

2019

As at

March 31,

2018

As at

March 31,

2019

As at

March 31,

2018

As at

March 31,

2019

As at

March 31,

2018

Discount rate

1.00% 1.00% (3.10%)

(3.39%)

3.37% 3.70%

Attrition rate

1.00% 1.00% (0.20%)

(0.09%)

0.21% 0.10%

Rate of return on plan assets

1.00% 1.00% (3.10%)

(3.39%)

3.37% 3.70%

Salary escalation rate

1.00% 1.00% 3.31% 3.67% (3.11%)

ȳǩȦǪǩɼȴ

The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant. In

practice, this is unlikely to occur, and changes in some of the assumptions may be correlated. When calculating the sensitivity

ūlj ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ ūċŕĿijîƥĿūŠ ƥū ƙĿijŠĿǛČîŠƥ îČƥƭîƑĿîŕ îƙƙƭŞƎƥĿūŠƙȡ ƥĺĚ ƙîŞĚ ŞĚƥĺūē ȳƎƑĚƙĚŠƥ DŽîŕƭĚ ūlj ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ

obligation calculated with the projected unit credit method at the end of the reporting period) has been applied while calculating

ƥĺĚ ēĚǛŠĚē ċĚŠĚǛƥ ŕĿîċĿŕĿƥNj ƑĚČūijŠĿƙĚē ĿŠ ƥĺĚ îŕîŠČĚ ¬ĺĚĚƥȦ

The methods and types of assumptions used in preparing the sensitivity analysis did not change as compared to the prior year.

Major categories of plan assets are as follows:

(

`

cr)

Particulars

As at March 31, 2019

As at March 31, 2018

Unquoted

in % Unquoted

in %

Government of India assets

1.18

ǨȦǫǪɼ

1.18

2.60%

Debt instruments

Corporate bonds

1.05

2.26%

0.99

2.18%

Investment funds

Insurance fund

ǪǧȦǪǧ

89.03%

ǪǩȦǦǭ

ǯǪȦǮǩɼ

Others

2.71

5.83%

0.02

ǦȦǦǪɼ

Special deposit scheme

0.16

ǦȦǩǪɼ

0.16

0.35%

46.51

100.00% 45.42

100%

Risk exposure

¹ĺƑūƭijĺ Ŀƥƙ ēĚǛŠĚē ċĚŠĚǛƥ ƎŕîŠƙȡ ƥĺĚ ūŞƎîŠNj Ŀƙ ĚNJƎūƙĚē ƥū î ŠƭŞċĚƑ ūlj ƑĿƙŒƙȡ ƥĺĚ Şūƙƥ ƙĿijŠĿǛČîŠƥ ūlj DžĺĿČĺ îƑĚ ēĚƥîĿŕĚē

below:

i)

Asset volatility

The plan liabilities are calculated using a discount rate set with reference to bond yields, if plan assets underperform this

NjĿĚŕēȡ ƥĺĿƙ DžĿŕŕ ČƑĚîƥĚ î ēĚǛČĿƥȦ qūƙƥ ūlj ƥĺĚ ƎŕîŠ îƙƙĚƥ ĿŠDŽĚƙƥŞĚŠƥƙ îƑĚ ĿŠ ǛNJĚē ĿŠČūŞĚ ƙĚČƭƑĿƥĿĚƙ DžĿƥĺ ĺĿijĺ ijƑîēĚƙ îŠē ĿŠ

government securities. These are subject to interest rate risk. The Company has a risk management strategy where the

îijijƑĚijîƥĚ îŞūƭŠƥ ūlj ƑĿƙŒ ĚNJƎūƙƭƑĚ ūŠ î ƎūƑƥljūŕĿū ŕĚDŽĚŕ Ŀƙ ŞîĿŠƥîĿŠĚē îƥ î ǛNJĚē ƑîŠijĚȦ ŠNj ēĚDŽĿîƥĿūŠƙ ljƑūŞ ƥĺĚ ƑîŠijĚ îƑĚ

corrected by rebalancing the portfolio. The Company intends to maintain the above investment mix in the continuing

years.

159

Standalone

|

Notes to the Financial Statements