Atul Ltd | Annual Report 2012-13

Notes

to Consolidated financial statements

(

`

cr)

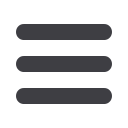

NOTE 4 LONG-TERM BORROWINGS

Non-current

Current maturities

As at

As at

As at

As at

March 31,

2013

March 31,

2012

March 31,

2013

March 31,

2012

(a) Term loans

Secured:

(i) Rupee term loans from banks

8.84

16.41

3.81

19.04

LL

5XSHH WHUP ORDQV IURP ÀQDQFLDO LQVWLWXWLRQV

41.66

52.08

10.42

13.13

(iii) Foreign currency term loans from banks

70.77

20.78

6.86

4.80

LY )RUHLJQ FXUUHQF\ WHUP ORDQV IURP ÀQDQFLDO

institutions

43.06

61.81

22.66

2.14

Unsecured:

(v) Rupee term loans from banks

0.02

0.09

0.34

0.02

(vi) Rupee term loans

0.01

-

-

-

164.36

151.17

44.09

39.13

(b) Deposits, unsecured:

(i) Public deposits from related parties

-

-

-

0.83

(ii) Public deposits from others

-

-

-

6.66

-

-

-

7.49

Amount disclosed under the head ‘Other Current

Liabilities’ (see Note 9)

(44.09)

(46.62)

164.36

151.17

-

-

(

`

cr)

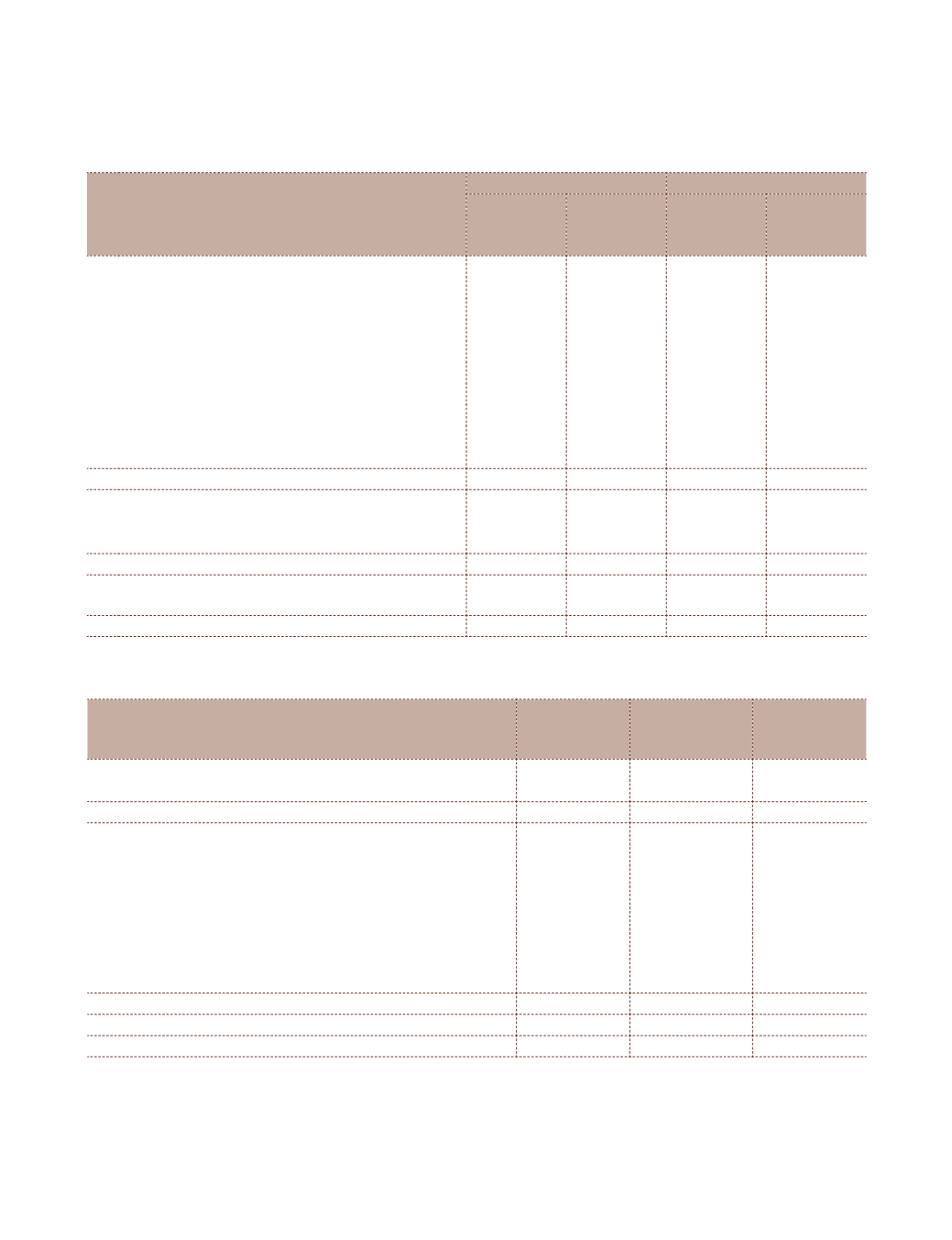

NOTE 5 DEFERRED TAX LIABILITIES (NET)

As at

March 31,

2013

Charge |

(credit) during

the year

As at

March 31,

2012

Deferred tax liabilities:

on account of timing difference in depreciation

35.17

5.76

29.41

35.17

5.76

29.41

Deferred tax assets:

on account of timing difference in

(a) Provision for leave encashment

6.81

0.95

5.86

(b) Provision for doubtful debts

0.95

0.56

0.39

(c) Provision for doubtful advances

0.06

-

0.06

(d) Voluntary retirement scheme

0.19

(0.21)

0.40

(e) Expenses disallowed under Section 40 (ia)

of the Income Tax Act, 1961

-

(0.39)

0.39

8.01

0.91

7.10

Deferred tax liabilities | (assets) of subsidiary companies

0.12

(0.34)

0.46

Net deferred tax liabilities | (assets)

27.28

4.51

22.77