115

Notes

to Consolidated financial statements

(

`

cr)

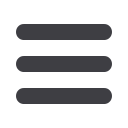

NOTE 13 LONG-TERM LOANS AND ADVANCES

As at

March 31, 2013

As at

March 31, 2012

(a) Loans and advances to related parties:*

(i) Secured, considered good

11.29

11.29

(ii) Unsecured, considered good

5.02

5.01

(b) Others:

(i) Capital advances

6.99

6.63

(ii) Security deposits

5.56

5.67

28.86

28.60

* An amount of

`

11.29 cr (Previous year

`

11.29 cr) is given to an associate company as a secured loan. The

said company is registered under BIFR and is implementing its revival plan. First charge over all their assets has

been assigned exclusively in favour of the Company. The Company has also given an unsecured loan of

`

3.59

cr (Previous year

`

FU DV 3URPRWHU·V FRQWULEXWLRQ UHSD\DEOH LQ WZR HTXDO LQVWDOPHQWV LQ ÀQDQFLDO \HDU

2017-18 to 2019-20). Considering the progress of the revival plan and the present market value of assets,

these amounts included under loans and advances are considered as good and recoverable.

(

`

cr)

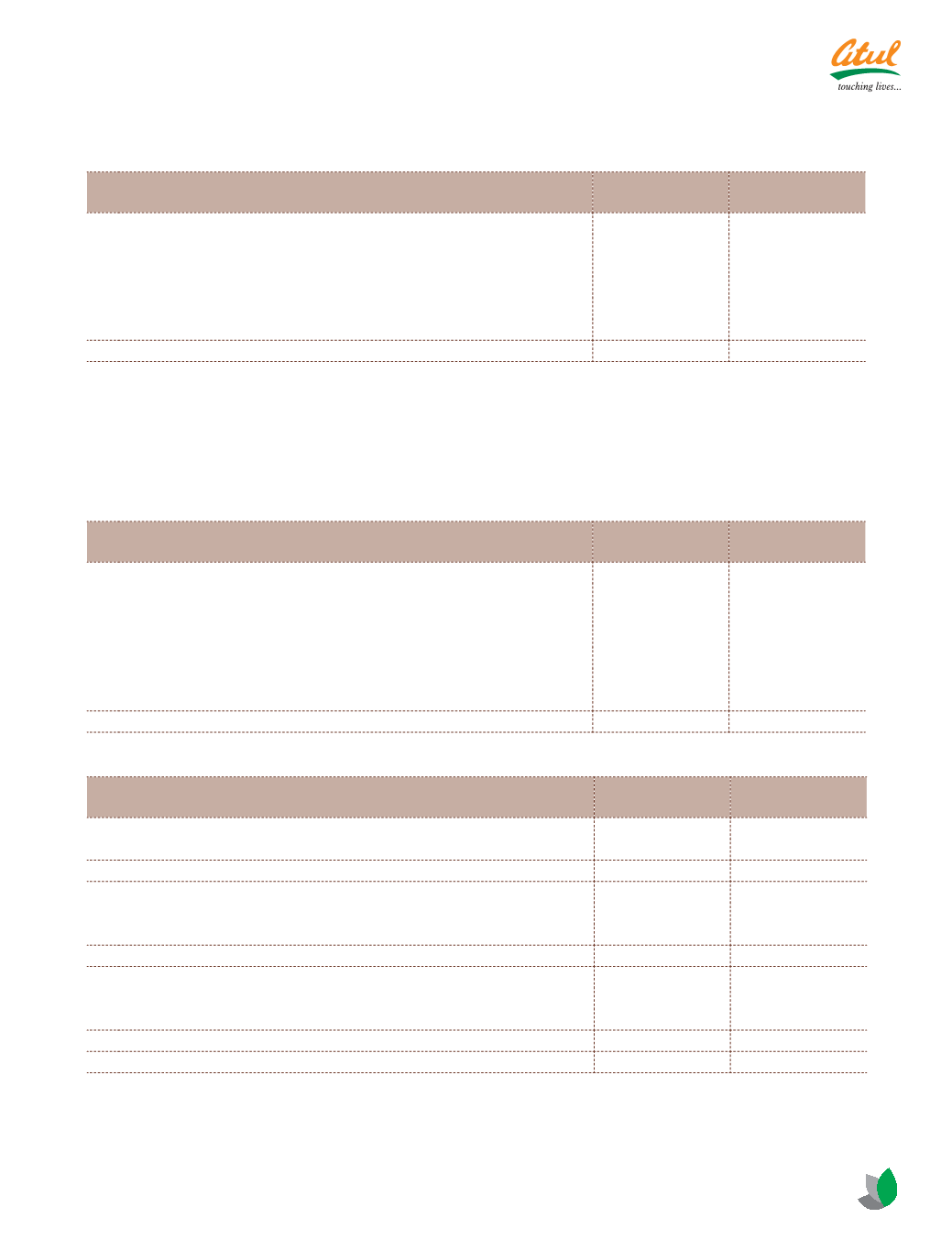

NOTE 14 OTHER NON-CURRENT ASSETS

As at

March 31, 2013

As at

March 31, 2012

(a) %DODQFH ZLWK EDQN LQ À[HG GHSRVLWV ZLWK PDWXULW\ EH\RQG PRQWKV

0.05

0.31

(b) Balance with Goverment departments:

Tax paid under protest

10.51

10.51

Tax paid in advance, net of provisions

8.28

7.48

VAT receivable

20.32

14.64

Prepaid expenses

0.06

-

Security deposit (see Note 11 (e))

2.03

2.00

41.25

34.94

(

`

cr)

NOTE 15 INVENTORIES *

As at

March 31, 2013

As at

March 31, 2012

(a) Raw materials and packing materials

56.30

50.28

Add: Goods-in-transit

20.26

24.31

76.56

74.59

(b) Work-in-progress

118.75

108.27

(c) Finished goods

111.88

114.88

Add: Goods-in-transit

27.79

1.89

139.67

116.77

(d) Stock-in-trade

2.92

3.45

(e) Stores, spares and fuel

28.58

29.58

Add: Goods-in-transit

-

0.49

28.58

30.07

366.48

333.15

* At cost and net realisable value whichever is lower.