119

(

`

cr)

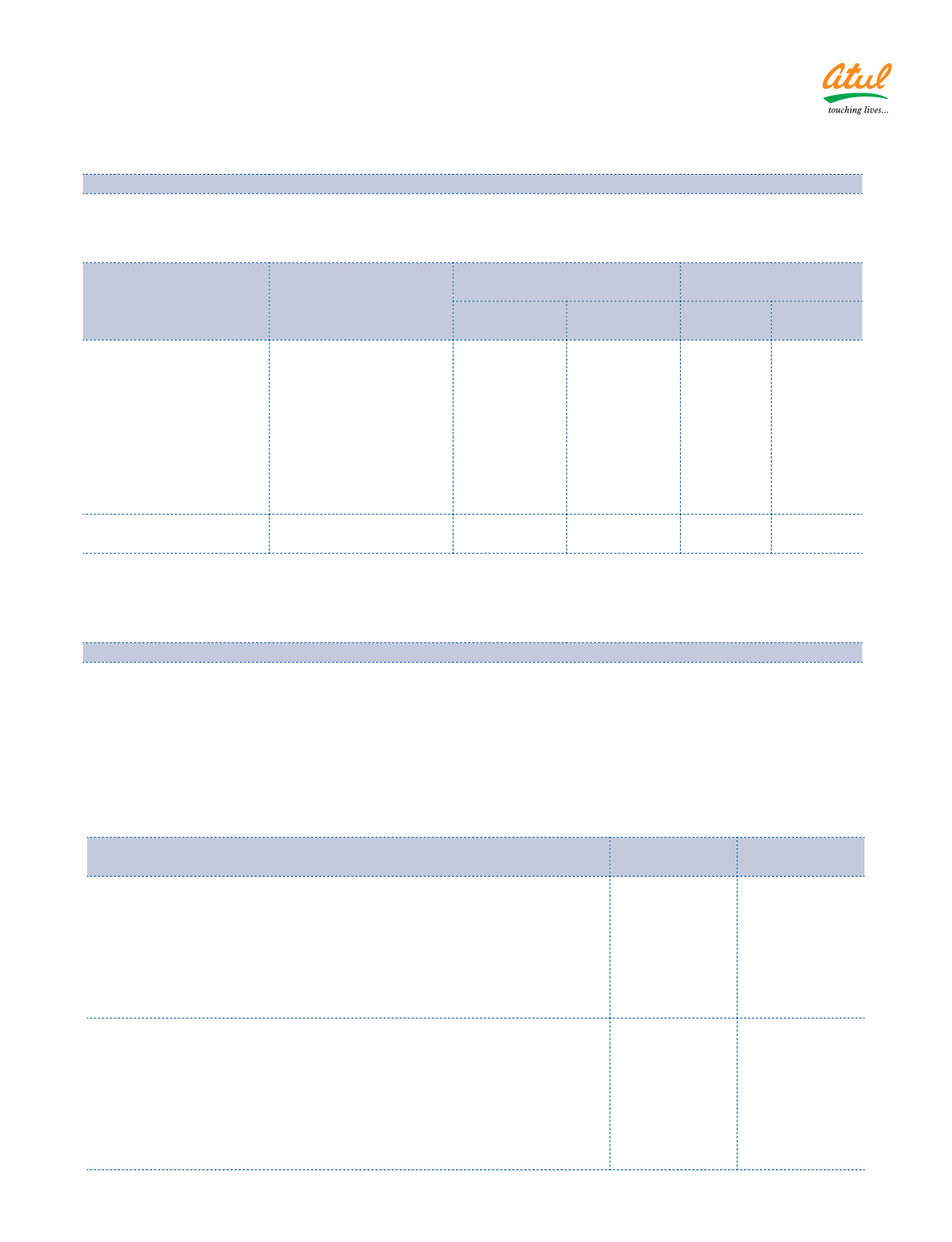

Note 28.10 Loans and advances in the nature of loans

Disclosures pursuant to the Regulation 34(3) read with Para A of Schedule V to the SEBI (Listing

obligations and disclosure requirements) Regulations, 2015 read with Section 186 (4) of the Companies

Act, 2013.

Particulars

Purpose

Amount outstanding as at

Maximum balance

during the year

March 31,

2016

March 31,

2015

2015-16 2014-15

i) Subsidiary company:

Atul Finserv Ltd

–

–

–

4.12

Atul Bioscence Ltd

Seed funding support as

promoters

4.30

4.30

4.30

4.30

ii) Associate company:

Amal Ltd

Interest free loan,

pursuant to Board for

Industrial and Financial

Reconstruction order

14.88

14.88

14.88

14.88

Corporate guarantee

Atul Europe Ltd

Facilitate trade finance

– GBP 10,00,000

Notes:

a) Loans given to employees as per the policy of the Company are not considered.

b) The loanee did not hold any shares in the share capital of the Company.

Note 28.11 Employee benefits

Funded schemes

a)

Defined benefit plans:

Gratuity: The Company operates a gratuity plan through the ‘Atul Employees Gratuity Trust’. Every employee

is entitled to a benefit equivalent to fifteen days salary last drawn for each completed year of service in line

with the Payment of Gratuity Act, 1972 or Company scheme whichever is beneficial. The same is payable at

the time of separation from the Company or retirement, whichever is earlier. The benefits vest after five years

of continuous service.

Expenses recognised for the year ended on March 31, 2016 (included in Note 25)

(

`

cr)

Particulars

2015-16

2014-15

Gratuity

Gratuity

1 Change in present value of obligation:

a) Present value of obligation at beginning of the year

44.44

41.79

b) Current service cost

2.10

2.27

c) Interest cost

3.55

3.88

d) Actuarial loss | (gain)

2.27

2.13

e) Benefits paid

(5.09)

(5.63)

f) Present value of obligation at the end of the year

47.27

44.44

2 Change in fair value of plan assets:

a) Fair value of plan assets at beginning of the year

44.44

41.79

b) Expected return on plan assets

3.55

3.63

c) Actuarial loss | (gain)

(0.79)

1.90

d) Contributions

5.16

2.75

e) Benefits paid

(5.09)

(5.63)

f) Fair value of plan assets at end of the year

47.27

44.44

Notes

to the Financial Statements