129

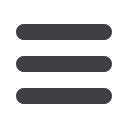

f) Deferred tax liabilities (net)

The balance comprises temporary differences attributable to the below items and corresponding movement in deferred

tax liabilities | (assets):

(

`

cr)

Particulars

As at

March 31,

2017

(Charged) |

Credited to

profit or loss

| OCI

As at

March 31,

2016

(Charged) |

Credited to

profit or loss

| OCI

As at

April 01,

2015

Property, plant and equipment

138.74

61.26

77.48

22.50

54.98

Total deferred tax liabilities

138.74

61.26

77.48

22.50

54.98

Provision for leave encashment

(9.04)

(1.23)

(7.81)

(0.41)

(7.40)

Provision for doubtful debts

(1.10)

0.22

(1.32)

0.18

(1.50)

Provision for doubtful advances

–

0.07

(0.07)

–

(0.07)

Investment properties

(3.95)

(0.18)

(3.77)

(0.25)

(3.52)

Voluntary Retirement Scheme

–

–

–

0.16

(0.16)

Unrealised MTM losses on derivatives (CIRS)

(1.75)

(1.75)

–

–

–

Effective portion of gains and loss on cash flow

hedges

(0.25)

0.06

(0.31)

(0.31)

–

MAT credit entitlement

(22.90)

(22.90)

–

–

–

Total deferred tax assets

(38.99)

(25.71)

(13.28)

(0.63)

(12.65)

Net deferred tax (asset) | liability

99.75

35.55

64.20

21.87

42.33

g) Unrecognised temporary differences

The Company has not recognised deferred tax liability associated with fair value gains on Equity share measured at OCI as

based on the Management projection of future taxable income and existing plan it is not probable that such difference will

reverse in the foreseeable future.

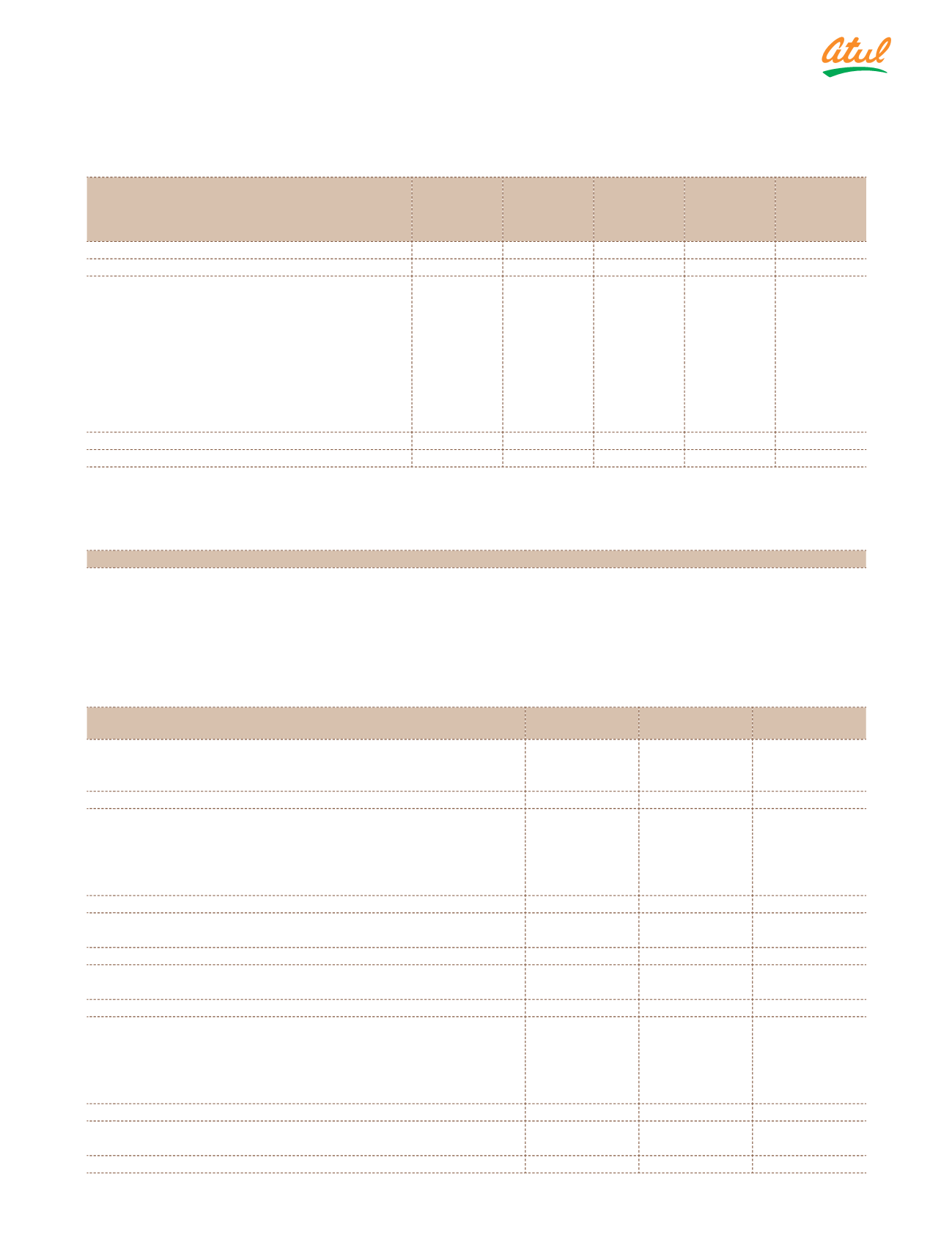

Note 27.6 Employee benefit obligations

Funded schemes

a) Defined benefit plans:

Gratuity

The Company operates a gratuity plan through the 'Atul Employees Gratuity Trust'. Every employee is entitled to a benefit

equivalent to 15 days salary last drawn for each completed year of service in line with the Payment of Gratuity Act, 1972 or

Company scheme whichever is beneficial. The same is payable at the time of separation from the Company or retirement,

whichever is earlier. The benefits vest after 5 years of continuous service.

Balance Sheet amount (Gratuity)

(

`

cr)

Particulars

Present value of

obligation

Fair value of

plan assets

Net amount

April 01, 2015

44.44

(44.44)

–

Current service cost

2.10

–

2.10

Interest expense | (income)

3.55

(3.55)

–

Total amount recognised in profit and loss

5.65

(3.55)

2.10

Remeasurement

Return on plan assets, excluding amount included in interest

expense | (income)

–

0.79

0.79

(Gain) | Loss from change in financial assumptions

0.36

–

0.36

Experience (gain) | loss

1.91

–

1.91

Total amount recognised in Other Comprehensive Income

2.27

0.79

3.06

Employer contributions

–

(5.16)

(5.16)

Benefit payments

(5.09)

5.09

–

March 31, 2016

47.27

(47.27)

–

Current service cost

2.52

–

2.52

Interest expense | (income)

3.69

(3.69)

–

Total amount recognised in profit and loss

6.21

(3.69)

2.52

Remeasurement

Return on plan assets, excluding amount included in interest

expense | (income)

–

(1.98)

(1.98)

(Gain) | Loss from change in financial assumptions

1.11

–

1.11

Experience (gain) | loss

(1.61)

–

(1.61)

Total amount recognised in Other Comprehensive Income

(0.50)

(1.98)

(2.48)

Employer contributions

–

(0.04)

(0.04)

Benefit payments

(5.81)

5.81

–

March 31, 2017

47.17

(47.17)

–

Notes

to the Financial Statements