131

Risk exposure

Through its defined benefit plans, the Company is exposed to a number of risks, the most significant of which are detailed

below:

i)

Asset volatility

The plan liabilities are calculated using a discount rate set with reference to bond yields, if plan assets underperform

this yield, this will create a deficit. Most of the plan asset investments is in fixed income securities with high grades

and in Government securities. These are subject to interest rate risk. The Company has a Risk Management strategy

where the aggregate amount of risk exposure on a portfolio level is maintained at a fixed range. Any deviations

from the range are corrected by rebalancing the portfolio. The Company intends to maintain the above investment

mix in the continuing years.

ii)

Changes in bond yields

A decrease in bond yields will increase plan liabilities, although this will be partially offset by an increase in the

value of bond holdings.

The Company actively monitors how the duration and the expected yield of the investments are matching the

expected cash outflows arising from the employee benefit obligations. The Company has not changed the processes

used to manage its risks from previous periods. Investments are well diversified, such that the failure of any single

investment will not have a material impact on the overall level of assets.

A large portion of assets in 2017 consists of insurance funds, although the Company also invests in corporate

bonds and special deposit schemes. The plan asset mix is in compliance with the requirements of the respective

local regulations.

Expected contributions to post-employment benefit plans for the year ending March 31, 2018 are

`

2.71 cr.

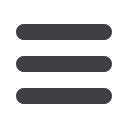

The weighted average duration of the defined benefit obligation is 5 years (2015-16: 5 years). The expected

maturity analysis of gratuity is as follows:

(

`

cr)

Particulars

Less than a

year

Between

1 - 2 years

Between

2 - 5 years

Over

5 years

Total

Defined benefit obligation (gratuity)

As at March 31, 2017

7.45

5.75

20.50

17.20

50.90

As at March 31, 2016

8.15

5.55

25.44

26.46

65.60

b) Defined contribution plans:

Amount of

`

9.36 cr (March 31, 2016:

`

9.15 cr) is recognised as expense and included in the Note 24 'Contribution to

Provident and Other funds'.

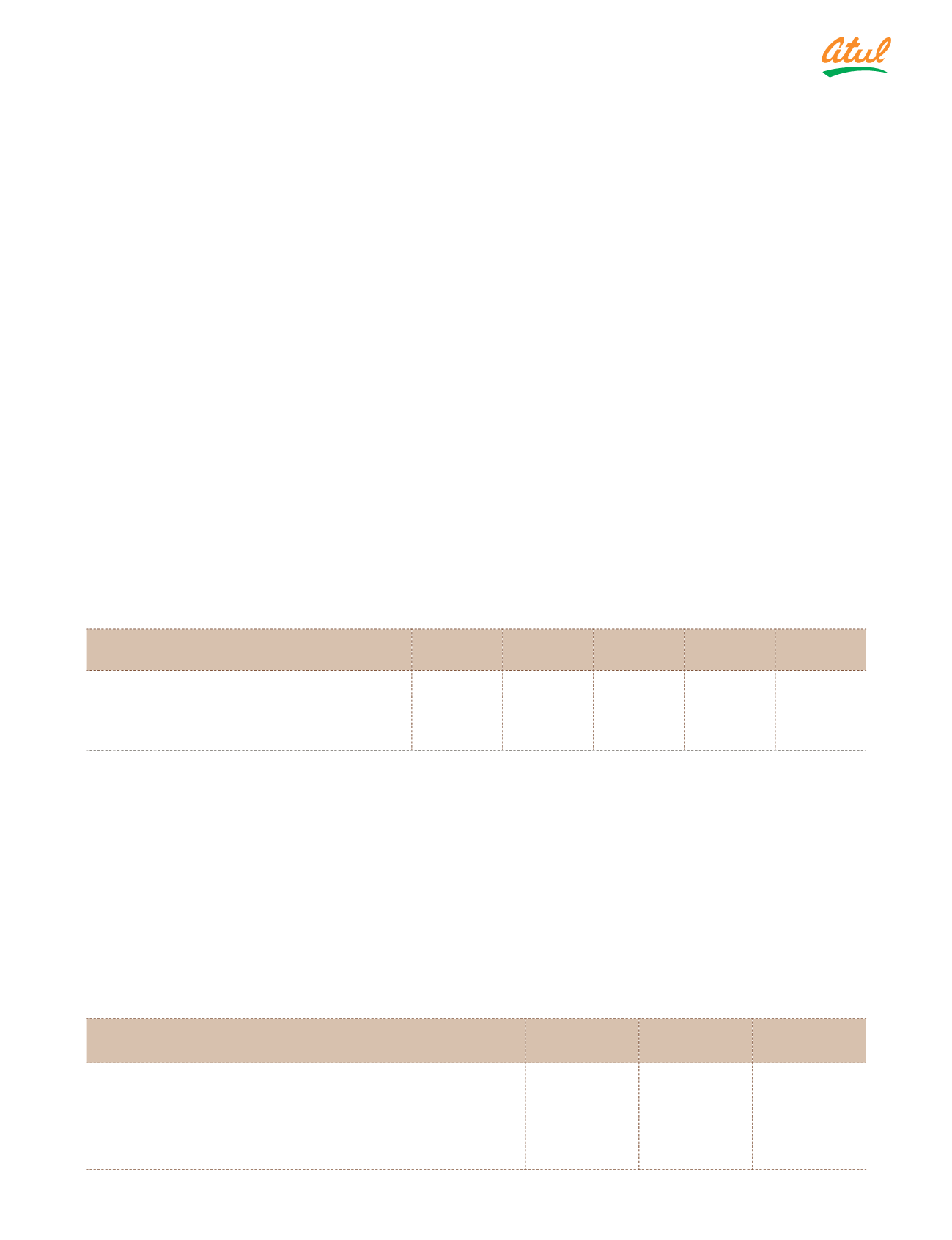

c) Provident Fund:

The Company has established an Employee Provident Fund Trust administered by the Company to which both the

employee and the employer make monthly contribution equal to 12% of basic salary of employee respectively. The

Company's contribution to the Provident Fund for all employees is charged to Statement of Profit and Loss. In case of

any liability arising due to short fall between the return from its investments and the administered interest rate, the same

is required to be provided for by the Company. The actuary has provided an actuarial valuation and indicated that the

interest shortfall liability is

`

Nil. The Company has contributed the following amounts towards Provident Fund during the

respective period ended:

(

`

cr)

Expenses recognised for the year ended March 31, 2017

(included in Note 24)

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

i)

Defined benefit obligation

9.14

10.90

10.14

ii)

Fund

9.16

11.04

10.40

iii)

Net asset | (liability)

0.03

0.14

0.26

iv)

Charge to the Statement of Profit and Loss during the year

0.20

0.17

0.23

Notes

to the Financial Statements