Schedules

forming part of the accounts

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

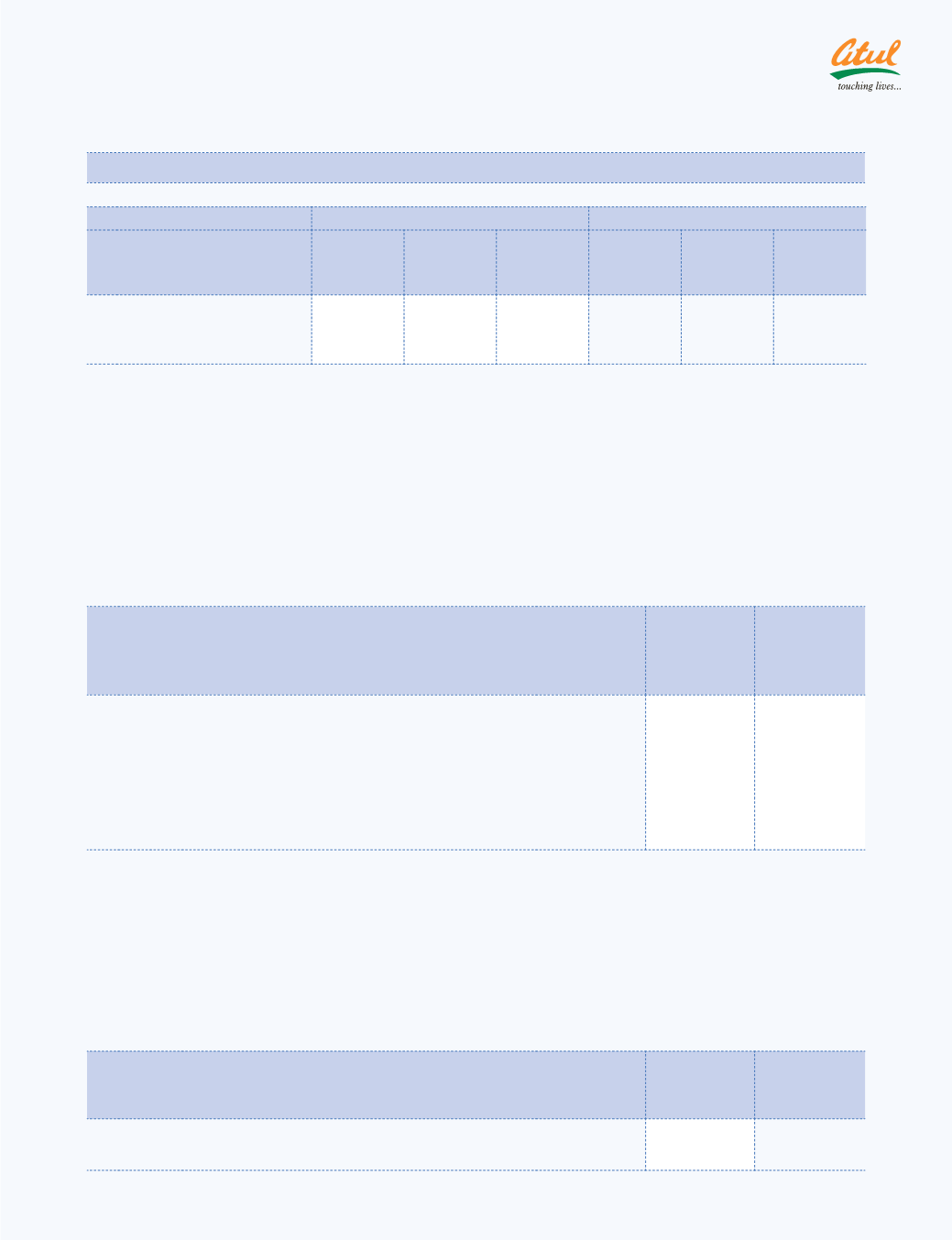

17 Loans and advances in nature of loans

(

`

crores)

Particulars

Amount

outstanding

as at March

31, 2011

Maximum

balance

during the

year

(i) Subsidiary:

Ameer Trading Corporation Ltd (including interest)

13.40

13.40

(ii) Associate company:

Amal Ltd

14.88

21.29

(iii) Loan to other:

Atul club

1.42

1.42

Note:

(a) No repayment Schedule for (i) and (iii)

(b) Loans given to employees as per the policy of the Company are not considered.

18 Employee benefits

(a) Defined benefit plans:

Expenses recognised for the year ended on March 31, 2011 (included in Schedule 13 of Profit and Loss

Account)

(

`

crores)

Particulars

2010-11

Gratuity

funded

2009-10

Gratuity

funded

1 Current service cost

1.40

1.38

2 Interest cost

2.36

2.06

Amounts receivable or payable in foreign currency on account of the following:

Current Year

Previous Year

Particulars

US$

equivalent

(crores)

Euro

equivalent

(crores)

Others

equivalent

(crores)

US$

equivalent

(crores)

Euro

equivalent

(crores)

Others

equivalent

(crores)

Debtors

2.62

0.27

-

2.34

0.45

0.01

Creditors

0.57

-

0.13

0.92

-

0.02

Loans Taken

2.51

-

-

1.44

-

-

(c) Financial derivatives hedging transactions:

Pursuant to the announcement issued by the Institute of Chartered Accountants of India dated March

29, 2008 in respect of forward exchange contracts and currency and interest rate swaps, the Company

has applied the Hedge accounting principles set out in the Accounting Standard (AS) 30 ‘Financial

Instruments: Recognition and Measurement’. Accordingly, range forward contracts are marked to market

and the loss aggregating

`

5.09 crores (Previous year

`

15.03 crores) arising consequently on contracts

that were designated and effective as hedges of future cash flows has been recognized directly in the

hedging reserve account. Actual gain or loss on exercise of these range forward contracts or any part

thereof is recognised in the Profit and Loss account. Hedge accounting will be discontinued if the hedging

instrument is sold, terminated or no longer qualifies for hedge accounting.

86 | 87