Atul Ltd | Annual Report 2010-11

Schedules

forming part of the accounts

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

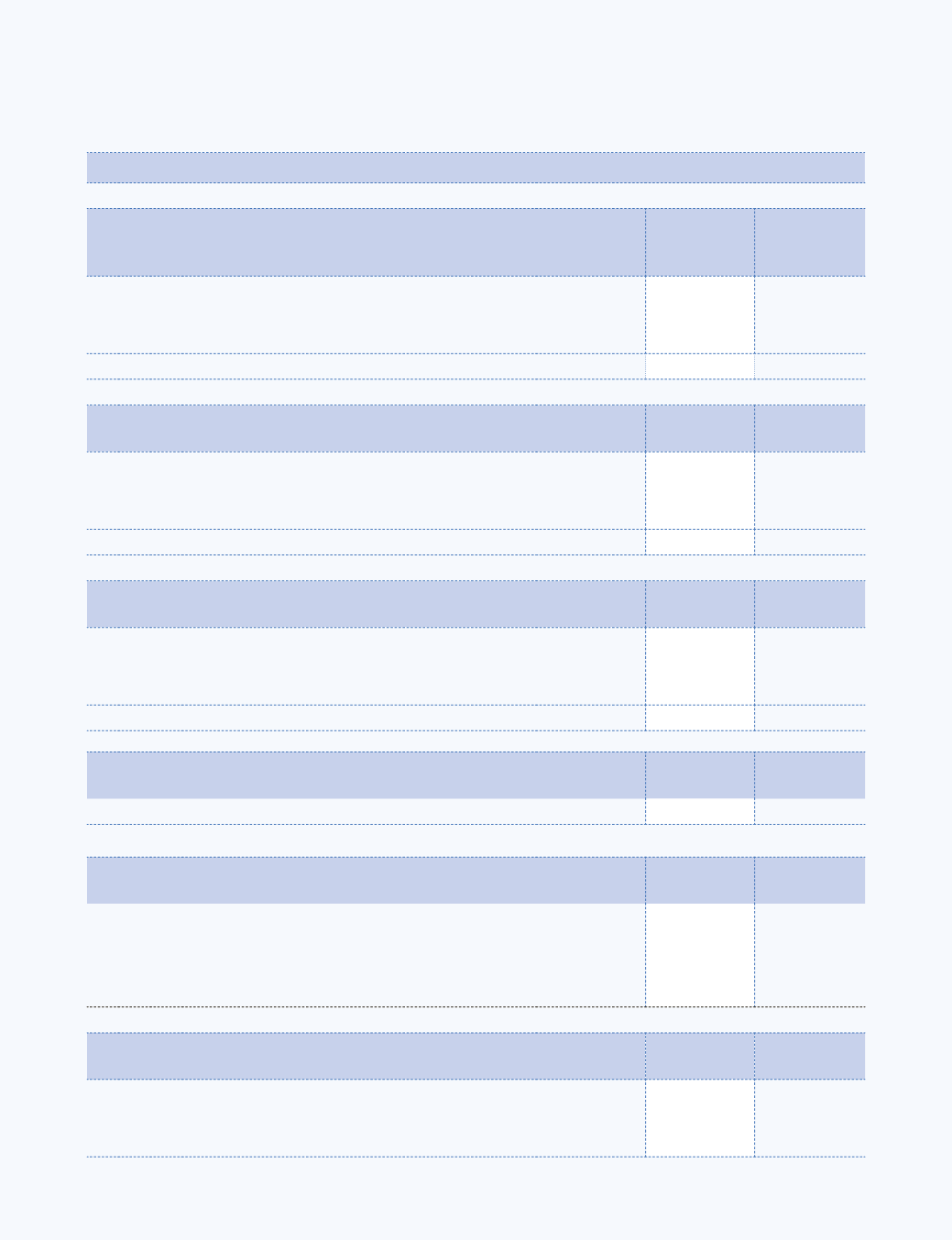

18 Employee benefits (contd)

(

`

crores)

Particulars

2010-11

Gratuity

funded

2009-10

Gratuity

funded

3 Expected return on plan assets

(2.46)

(2.21)

4 Employer contribution (receipt)

0.00

0.00

5 Actuarial losses | (gains)

0.53

0.84

Expenses recognised in Profit and Loss Account

1.83

2.07

Net assets | (liabilities) recognised in the Balance Sheet as at March 31, 2011

Particulars

Gratuity

funded

Gratuity

funded

1 Present value of defined benefit obligation

34.26

30.55

2 Fair value of plan assets

33.48

30.81

3 Funded status (surplus | (deficits))

0.78

0.26

Net assets | (liabilities)

0.78

0.26

Reconciliation of net assets | (liabilities) recognised in the Balance Sheet as at March 31, 2011

Particulars

Gratuity

funded

Gratuity

funded

1 Net assets | (liabilities) at beginning of the year

(2.14)

(0.38)

2 Employer expenses

4.58

2.59

3 Employer contribution

(1.65)

(1.95)

Net assets | (liabilities) at the end of the year

0.79

0.26

Particulars

Gratuity

funded

Gratuity

funded

Actual return on plan assets

5.35

4.81

Actuarial assumptions

Particulars

Gratuity

funded

Gratuity

funded

1 Discount rates

8.25% 8.25%

2 Expected rate of return on plan assets

8.00% 8.00%

3 Expected rate of salary increase

6.50% 6.50%

4 Mortality post-retirement

LIC (1994-96) LIC (1994-96)

Major category of plan assets as a percentage of total plan

Particulars

Gratuity

funded

Gratuity

funded

1 Unit linked insurance plan of various private insurance companies

approved by IRDA

90.95% 94.00%

2 In approved government securities

9.05% 6.00%