Schedules

forming part of the accounts

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

As per our attached report of even date

For and on behalf of the Board of Directors

For Dalal & Shah

Firm Registration No. 102020W

Sunil S Lalbhai

Chartered Accountants

Chairman & Managing Director

G S Patel

S S Baijal

B S Mehta

H S Shah

S Venkatesh

S M Datta

Partner

R A Shah

Samveg A Lalbhai

Membership No. F-037942

T R Gopi Kannan

V S Rangan

Managing Director

Mumbai

President, Finance &

B N Mohanan

Mumbai

May 13, 2011

Company Secretary

Directors

May 13, 2011

19 Included under Loans and Advances is an amount of

`

11.29 crores (Previous year

`

21.29 crores) given to

an associate company. The said company is registered under BIFR and is implementing its revival plan. First

charge over all their assets has been assigned exclusively in favour of the Company. The Company has also

given an unsecured loan of

`

3.59 crores (Previous year

`

Nil) as Promoters contribution (repayable in two

equal instalments in financial year 2015-16 and 2016-17). Considering the progress of the revival plan, the

present market value of assets, etc these amounts included under loans and advances are considered as good

and recoverable.

20 The Company has revalued (i) Leasehold land and (ii) Commercial land & building at Ahmedabad, Mumbai

and Delhi as at March 31, 2008 at fair market value as determined by an independent valuer appointed

for the purpose. Resultant increase in book value amounting to

`

107.47 crores has been transferred to

Revaluation Reserve.

21 In the opinion of the management, the diminution in the value of the investment as shown in Schedule 6,

held by the Company is temporary in nature and accordingly, no provision is considered necessary by the

management.

22 Significant accounting policies followed by the Company are as stated in the statement annexed to this schedule.

23 Figures of the previous year have been regrouped | recast | reclassifed wherever necessary.

24 Figures less than

`

50000 has been shown at actual in bracket as the figures have been rounded off to

nearest crores.

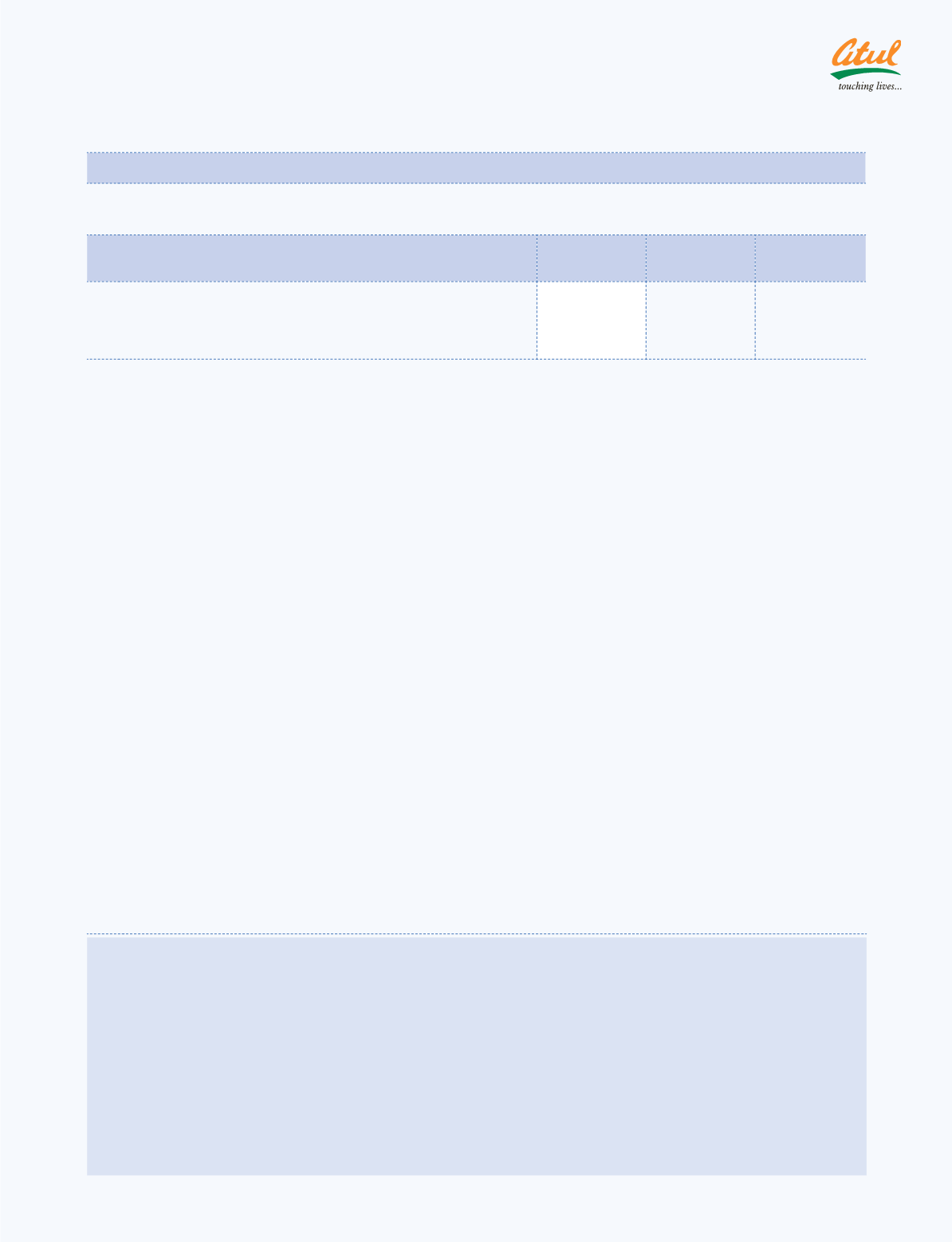

18 Employee benefits (contd)

Experience adjustments

(

`

crores)

Particulars

As at March

31, 2011

As at March

31, 2010

As at March

31, 2009

Experience adjustments on:

1 (Gain)| loss on plan liabilities

3.82

2.96

0.29

2 (Gain)| loss on plan assets

0.53

2.63

(2.18)

(b) Defined contribution plan:

Amount of

`

6.21 crores (Previous year

`

5.99 crores) is recognised as expense and included in the

Schedule 13 “Contribution to Provident and Other Funds” to the Profit and Loss Account.

(c) The estimates of future salary increases, considered in actuarial valuation, take account of inflation,

seniority, promotion and other relevant factors, such as supply and demand in the employment market.

Mortality rates are obtained from the relevant data.

(d) Amount recognised as an expense in respect of compensated leave absences is

`

2.42 crores (Previous

year

`

2.21 crores).

88 | 89