Atul Ltd | Annual Report 2015-16

Note 28.9 Derivatives

The use of Derivative instruments is governed by the policies of the Company approved by the Board, which

provide written principles on the use of such financial derivatives consistent with Risk Management strategy of the

Company.

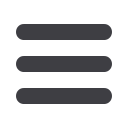

a) Derivatives outstanding as at Balance Sheet date:

*Fc in cr

No.

Particulars

Purpose

As at

March 31,

2016

As at

March 31,

2015

1 Forward exchange contracts

to sell US$

Hedge of firm commitment and highly

probable foreign currency sales

–

0.07

2 Forward exchange contracts

to buy US$

Hedge of firm commitment and highly

probable foreign currency purchases

0.80

0.20

3 Forward exchange contracts

to buy US$

Hedge of foreign currency loans

0.10

–

4 Currency options contracts -

Range options to sell US$

Hedge of firm commitment and highly

probable foreign currency sales

1.26

2.60

5 Currency options contracts -

Vanilla option to sell US$

Hedge of firm commitment and highly

probable foreign currency sales

0.66

–

6 Interest rate swaps US$

Hedge against exposure to variable

interest outflow on foreign currency

loans. Swap to pay fixed interest and

receive a variable interest based on LIBOR

on the notional amount

0.03

0.20

7 Currency swaps US$

Hedge against fluctuations in changes in

exchange rate and interest rate

0.50

0.83

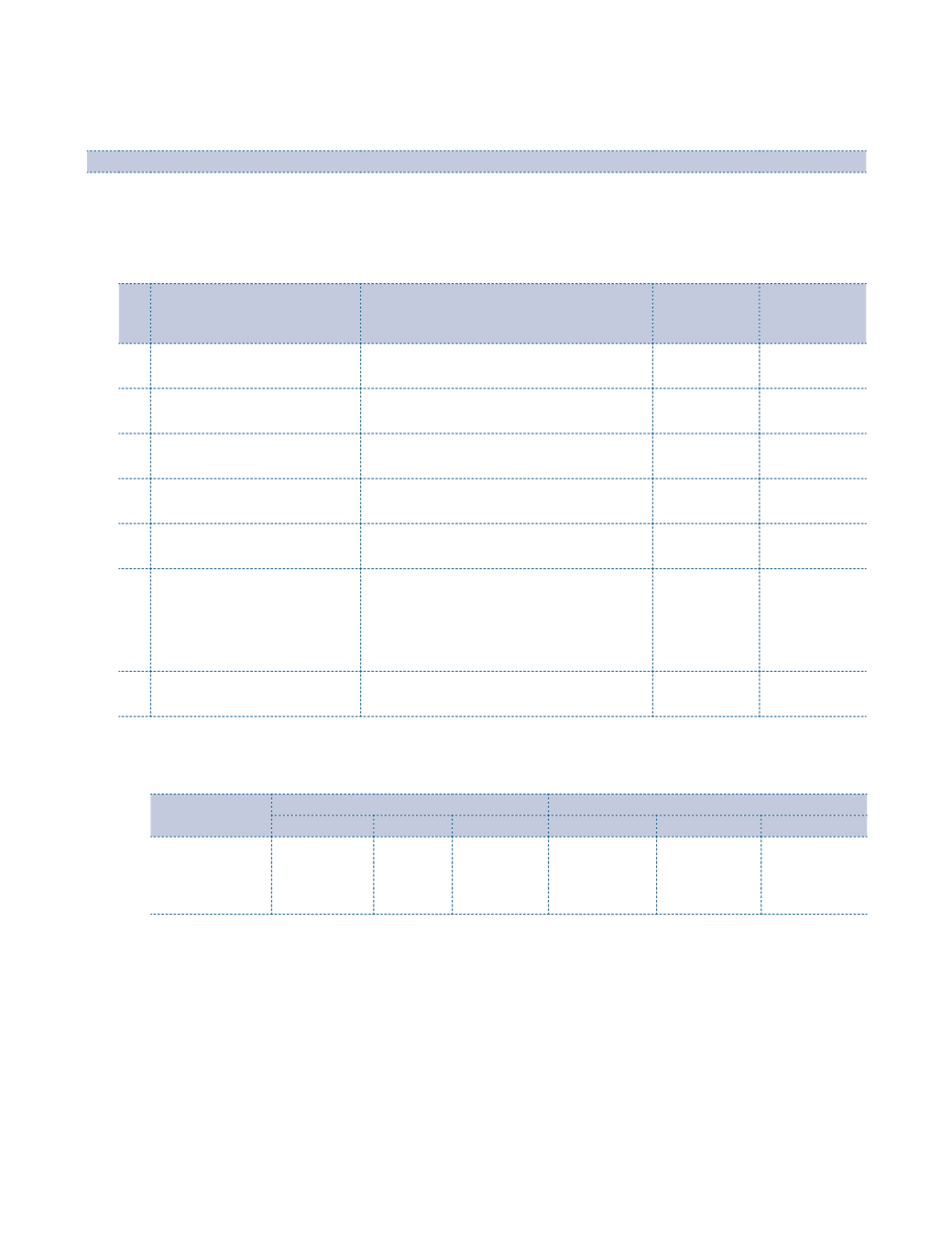

b) The year end foreign currency exposures that have not been hedged by a derivative instrument or

otherwise are given below.

*Fc in cr

Particulars

As at March 31, 2016

As at March 31, 2015

US$

€

Others

US$

€

Others

Debtors

3.08

0.12

0.01

2.98

0.24

0.01

Creditors

0.56

0.01

0.01

0.61

0.01

–

Loans Taken

0.83

–

–

0.73

–

–

c)

Financial derivatives hedging transactions:

Pursuant to the announcement issued by The Institute of Chartered Accountants of India dated

March 29, 2008 in respect of derivatives, the Company has applied the Hedge Accounting Principles set

out in the Accounting Standard-30 ‘Financial Instruments : Recognition and Measurement’. Accordingly,

derivatives are Marked-to-Market and the loss aggregating

`

0.70 cr (Previous year gain

`

0.11 cr) arising

consequently on contracts that were designated and effective as hedges of future cash flows has been

recognised directly in the hedging reserve account. Actual gain or loss on exercise of these derivatives or

any part thereof is recognised in the Statement of Profit and Loss. Hedge accounting will be discontinued

if the hedging instrument is sold, terminated or no longer qualifies for hedge accounting.

d) Forward exchange contracts to buy US$ to hedge foreign currency loans are accounted for as per Para 36

of the Accounting Standard - 11 ‘The effects of changes in Foreign Exchange Rates’.

*Fc = Foreign currency