123

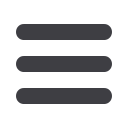

Note 28.12 Interest in joint venture company

(continued)

Statement of Profit and Loss

for the year ended March 31, 2016

(

`

cr)

Particulars

2015-16

2014-15

Revenue

Revenue from operations

30.74

22.03

Other income

0.44

0.75

31.18

22.78

Expenses

Cost of materials consumed

17.71

12.89

Purchase of stock-in-trade

1.43

1.60

Changes in inventories of finished goods, work-in-progress

and stock-in-trade

(0.41)

0.08

Finance costs

0.01

0.01

Depreciation and amortisation expenses

0.06

0.40

Other expenses

5.42

3.74

24.22

18.72

Profit before tax

6.96

4.06

Tax expense

Current tax

2.37

1.40

Deferred tax

0.04

(0.08)

2.41

1.32

Net profit | (loss)

4.55

2.74

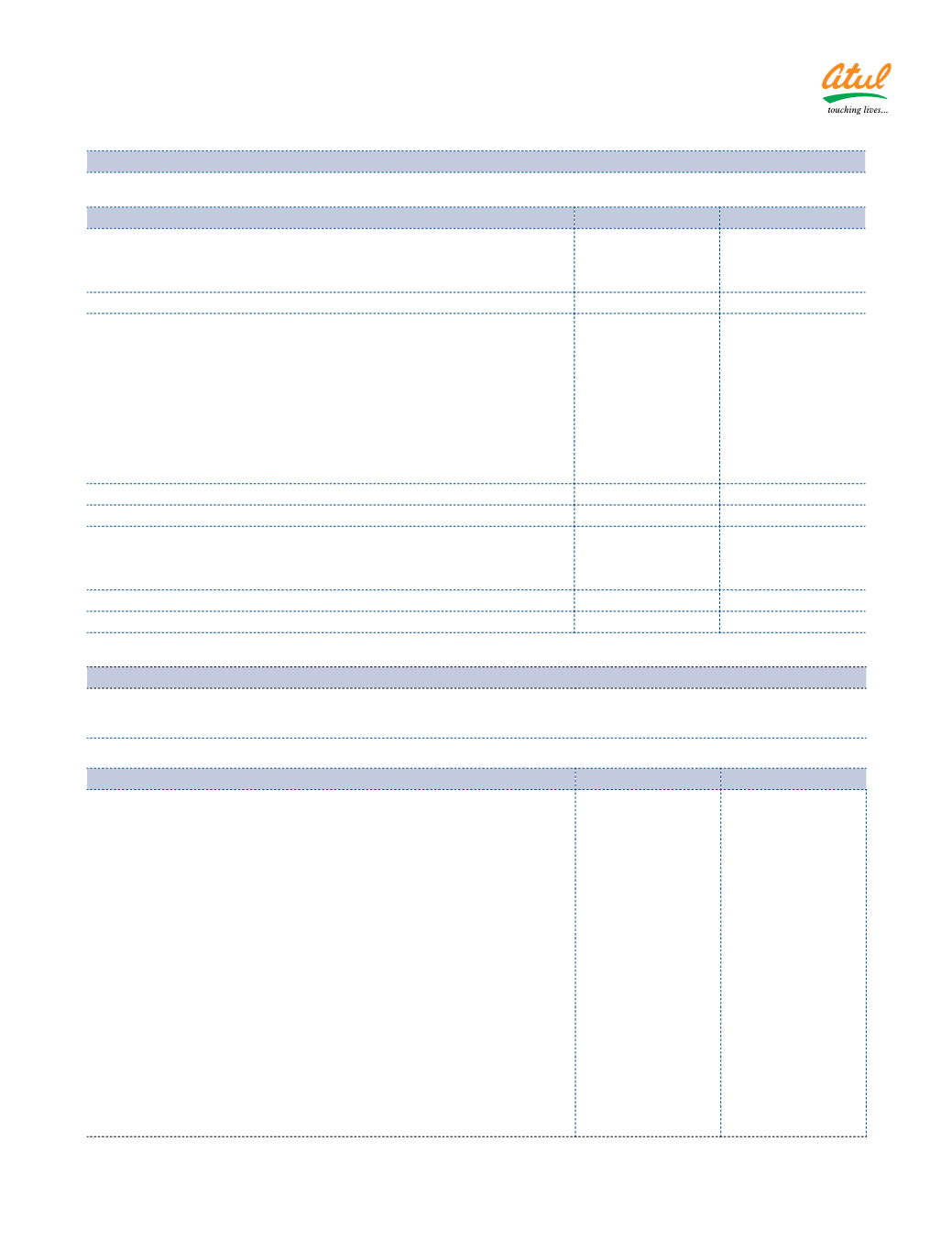

Note 28.13 Disclosure requirement under MSMED Act, 2006

The Company has certain dues to suppliers (trade and capital) registered under Micro, Small andMedium Enterprises

Development Act, 2006 (‘MSMED Act’). The disclosures pursuant to the said MSMED Act are as follows:

(

`

cr)

Particulars

2015-16

2014-15

Principal amount due to suppliers registered under the MSMED Act

and remaining unpaid as at year end

2.78

1.31

Interest due to suppliers registered under the MSMED Act and

remaining unpaid as at year end

0.01

0.34

Principal amounts paid to suppliers registered under the MSMED Act,

beyond the appointed day during the year

0.28

0.23

Interest paid, other than under Section 16 of MSMED Act, to suppliers

registered under the MSMED Act, beyond the appointed day during

the year

–

–

Interest paid, under Section 16 of MSMED Act, to suppliers registered

under the MSMED Act, beyond the appointed day during the year

0.34

–

Interest due and payable towards suppliers registered under MSMED

Act, for payments already made

–

0.08

Further interest remaining due and payable for earlier years

–

0.26