175

unit has been determined based on the higher of fair value less costs of disposal and its value in use. The fair value less costs

of disposal has been determined based on closing quoted share price of Amal Ltd on an active market as on March 31, 2017.

The Group has carried out annual Goodwill impairment assessment as at March 31, 2017. The Management believes that any

reasonably possible change in the key assumptions may not cause the carrying amount to exceed the recoverable amount of the

cash generating units. Accordingly, there was no impairment recorded for the period March 31, 2017.

Note 4 (b) Biological assets

a) Biological assets of the Group consist of

i)

Immature tissue culture raised date palms that are classified as non-current biological assets. The Group has a

plucking cycle of about 4-5 months.

ii)

Mature tissue culture raised date palms that are classified as current biological assets.

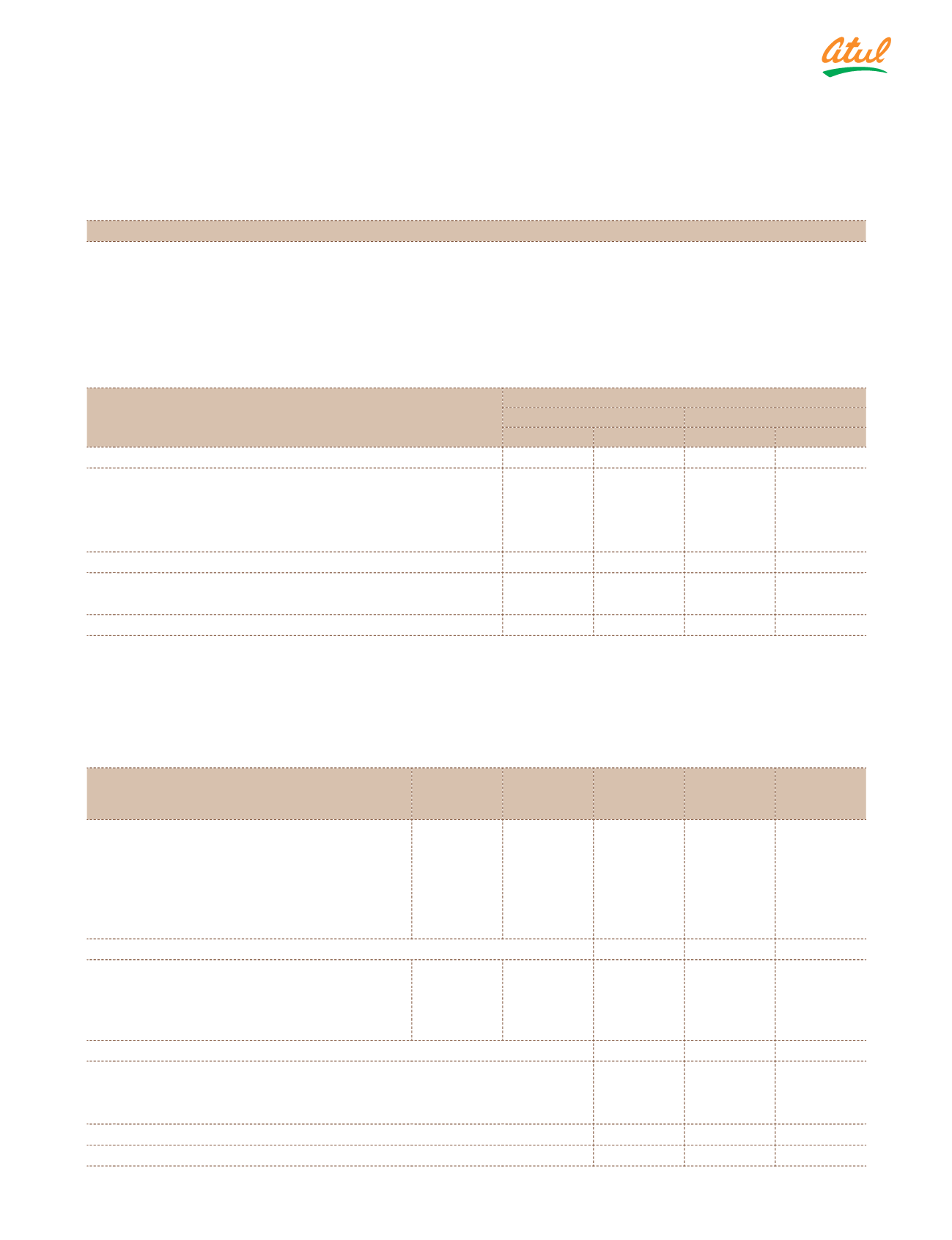

b) Reconciliation of changes to the carrying value of biological assets between the beginning and the end of the current year

are as follows:

(

`

cr)

Particulars

Tissue culture raised date palms

March 31, 2017

March 31, 2016

Mature

Immature

Mature

Immature

Opening balance

–

8.49

–

7.24

Increase due to production

0.22

–

–

1.25

Change due to biological transformation

1.85

(1.85)

–

–

Decrease due to sale

(0.22)

–

–

–

Change in fair value due to price changes

1.78

–

–

–

Closing balance

3.63

6.64

–

8.49

Current assets

3.63

–

–

0.29

Non-current assets*

–

6.64

–

8.20

Biological asset shown in Balance Sheet

3.63

6.64

–

8.49

* Non-current biological asset is expected to take more than 12 months from reporting date to become ready for

dispatch.

As at March 31, 2017 the Group had 14,535 mature plants (March 31, 2016 and April 01, 2015: Nil) and 30,897

immature plants (March 31, 2016: 59,048 and April 01, 2015: 95,595).

During current year the Group has sold 1,986 plants (March 31, 2016: Nil).

(

`

cr)

Note 5 Investments accounted for using the

equity method

Place of

business

% of

ownership

interest

As at

March 31,

2017

As at

March 31,

2016

As at

April 01,

2015

a) Investment in equity instruments (fully

paid-up)

Unquoted investment in joint venture

company:

Rudolf Atul Chemicals Ltd

India

50%

14.31

10.55

6.13

Add: Group share of profit and (loss)

(4.31)

3.76

4.42

10.00

14.31

10.55

b) Quoted investment in associate

company:

Amal Ltd

1

–

–

0.24

Add: Group share of profit | (loss)

India

37%

–

–

(0.24)

–

–

–

c) Equity component compounded financial instruments in Amal Ltd

1

From 0% Redeemable Preference shares

–

6.17

6.17

From 0% Loans

–

11.95

11.95

–

18.12

18.12

Total equity accounted investments

10.00

32.43

28.67

Notes

to the Consolidated Financial Statements