179

(

`

cr)

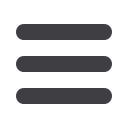

Note 14 Bank balances other than cash and

cash equivalents above

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

a) Unclaimed dividend

1.71

1.44

1.54

b) Unclaimed interest on public deposit

0.02

0.02

0.02

c) Short-term bank deposit with maturity between 3 to 12 months

3.13

2.48

2.06

4.86

3.94

3.62

(

`

cr)

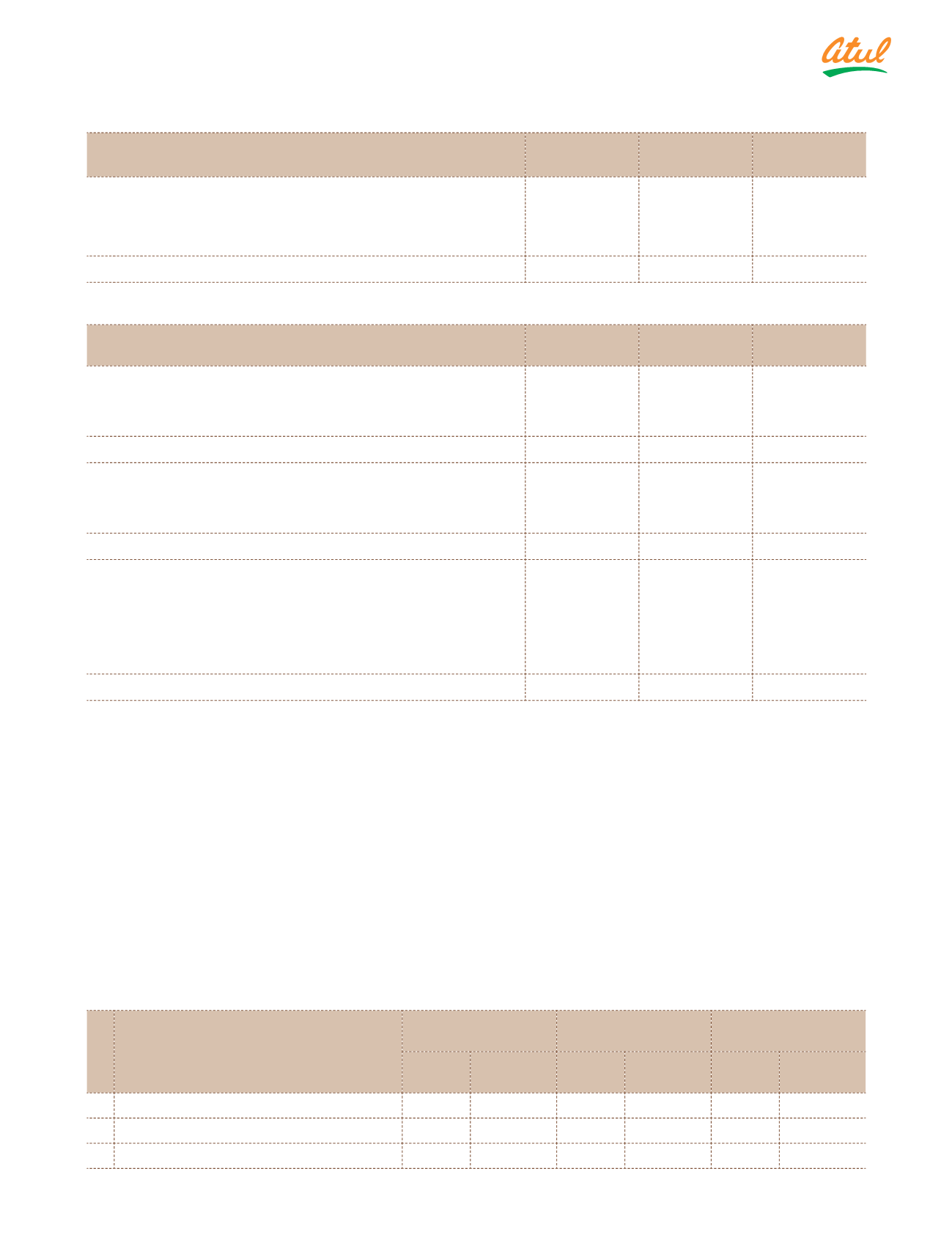

Note 15 Equity share capital

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Authorised

8,00,00,000 (March 31, 2016 and April 01, 2015: 8,00,00,000)

Equity shares of

`

10 each

80.00

80.00

80.00

80.00

80.00

80.00

Issued

2,96,91,780 (March 31, 2016 and April 01, 2015: 2,96,91,780)

Equity shares of

`

10 each

29.69

29.69

29.69

29.69

29.69

29.69

Subscribed

2,96,61,733 (March 31, 2016 and April 01, 2015: 2,96,61,733)

Equity shares of

`

10 each, fully paid

29.66

29.66

29.66

29,991 (March 31, 2016 and April 01, 2015: 29,991)

Add: Forfeited shares (amount paid-up)

0.02

0.02

0.02

29.68

29.68

29.68

a) Rights, preferences and restrictions:

The Group has one class of shares referred to as Equity shares having a par value of

`

10.

i)

Equity shares:

In the event of liquidation of the Group, the holders of Equity shares will be entitled to receive any of the remaining

assets of the Group, after distribution of all preferential amounts and Preference shares. The distribution will be in

proportion to the number of Equity shares held by the Shareholders.

Each holder of Equity shares is entitled to one vote per share.

ii) Dividend:

The Group declares and pays dividend in Indian rupees. The dividend proposed by the Board is subject to the

approval of the Shareholders in the ensuing Annual General Meeting.

b) Shares reserved for allotment at a later date:

56 Equity shares are held in abeyance due to disputes at the time of earlier rights issues.

c) Details of Shareholders holding more than 5% of Equity shares:

No. Name of the Shareholder

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Holding

%

Number of

Shares

Holding

%

Number of

Shares

Holding

%

Number of

Shares

1 Aagam Holdings Pvt Ltd

22.41% 66,50,000

22.92% 67,97,264

22.67% 67,25,501

2 Aeon Investments Pvt Ltd

6.79% 20,14,383

5.95% 17,64,383

5.95% 17,64,383

3 Aura Securities Pvt Ltd

–

–

5.44% 16,14,045

5.44% 16,14,045

Notes

to the Consolidated Financial Statements