177

(

`

cr)

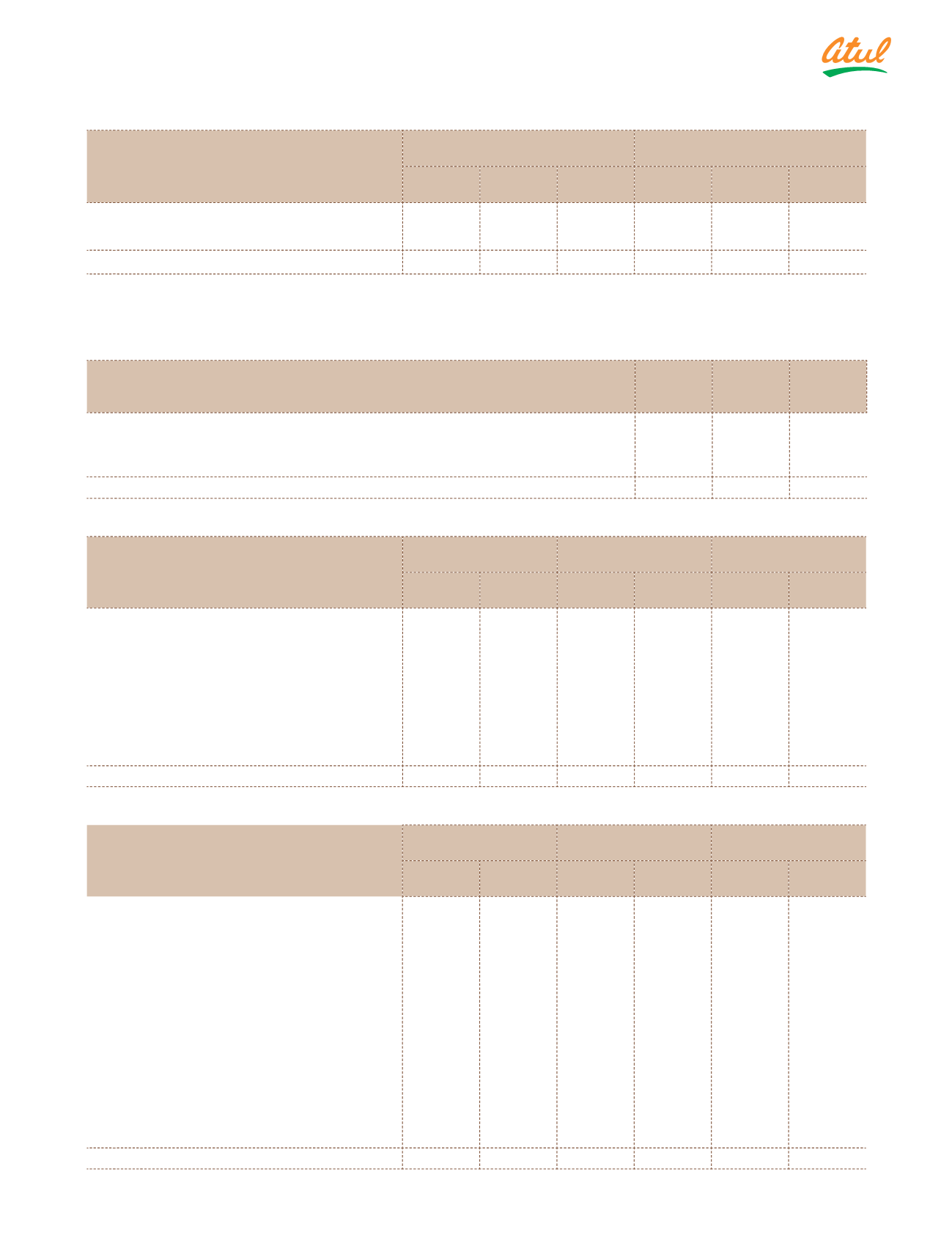

Particulars

Book value

As at

Market value

As at

March 31,

2017

March 31,

2016

April 1,

2015

March 31,

2017

March 31,

2016

April 01,

2015

Quoted

415.10

344.20

382.41

415.10

344.20

382.41

Unquoted

0.11

0.02

0.32

–

–

–

415.21

344.22

382.73

415.10

344.20

382.41

1

Carrying value of

`

12,400 (March 31, 2016:

`

7,720 and April 01, 2015:

`

7,850) |

2

Sales of equity shares under buy back offer |

3

Under liquidation |

4

Associate company up to November 30, 2016 |

5

Includes

`

1 cr due for redemption as on March 31, 2017

(

`

cr)

Note 7 Non-Current loans

As at

March 31,

2017

As at

March 31,

2016

As at

April 01,

2015

a) Loan to associate company (refer Note 29.4)

i)

Secured, considered good

–

6.41

5.41

ii) Unsecured, considered good

–

2.99

2.47

–

9.40

7.88

(

`

cr)

Note 8 Other financial assets

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Current

Non-

current

Current

Non-

current

Current

Non-

current

a) Security deposits for utilities and premises

0.86

0.73

0.66

0.73

0.86

0.63

b) Derivative financial assets - forward

exchange contracts

1.31

–

3.55

2.37

3.34

5.47

c) Balance with banks in fixed deposits, with

maturity beyond 12 months

–

0.41

–

0.04

–

0.02

d) Dividend receivable

9.40

–

–

–

–

–

e) Other receivables (including discount

receivable, insurance receivable, etc.)

8.41

–

9.75

–

10.88

–

19.98

1.14

13.96

3.14

15.08

6.12

(

`

cr)

Note 9

Other assets

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Current

Non-

current

Current

Non-

current

Current

Non-

current

a) Balances with the Government authorities

i) Tax paid under protest

–

16.47

–

19.92

–

16.80

ii) VAT receivable

6.93

34.99

38.13

28.67

26.99

29.85

iii) Balances with the statutory authorities

60.45

–

50.61

–

50.15

–

iv) Deposit paid under protest

–

3.41

–

0.97

–

–

v) Security deposit

–

2.00

–

2.00

–

2.00

b) Export incentive receivable

30.52

–

34.80

–

29.66

–

c) Capital advances

–

17.77

–

20.16

–

22.90

d) Prepayment

i) Related Parties (refer Note 29.4)

–

–

0.17

–

4.13

–

ii) Others

26.40

–

26.03

–

19.53

–

e) Other receivables

1.62

0.02

1.49

0.03

1.14

0.03

125.92

74.66

151.23

71.75

131.60

71.58

Notes

to the Consolidated Financial Statements