Atul Ltd | Annual Report 2016-17

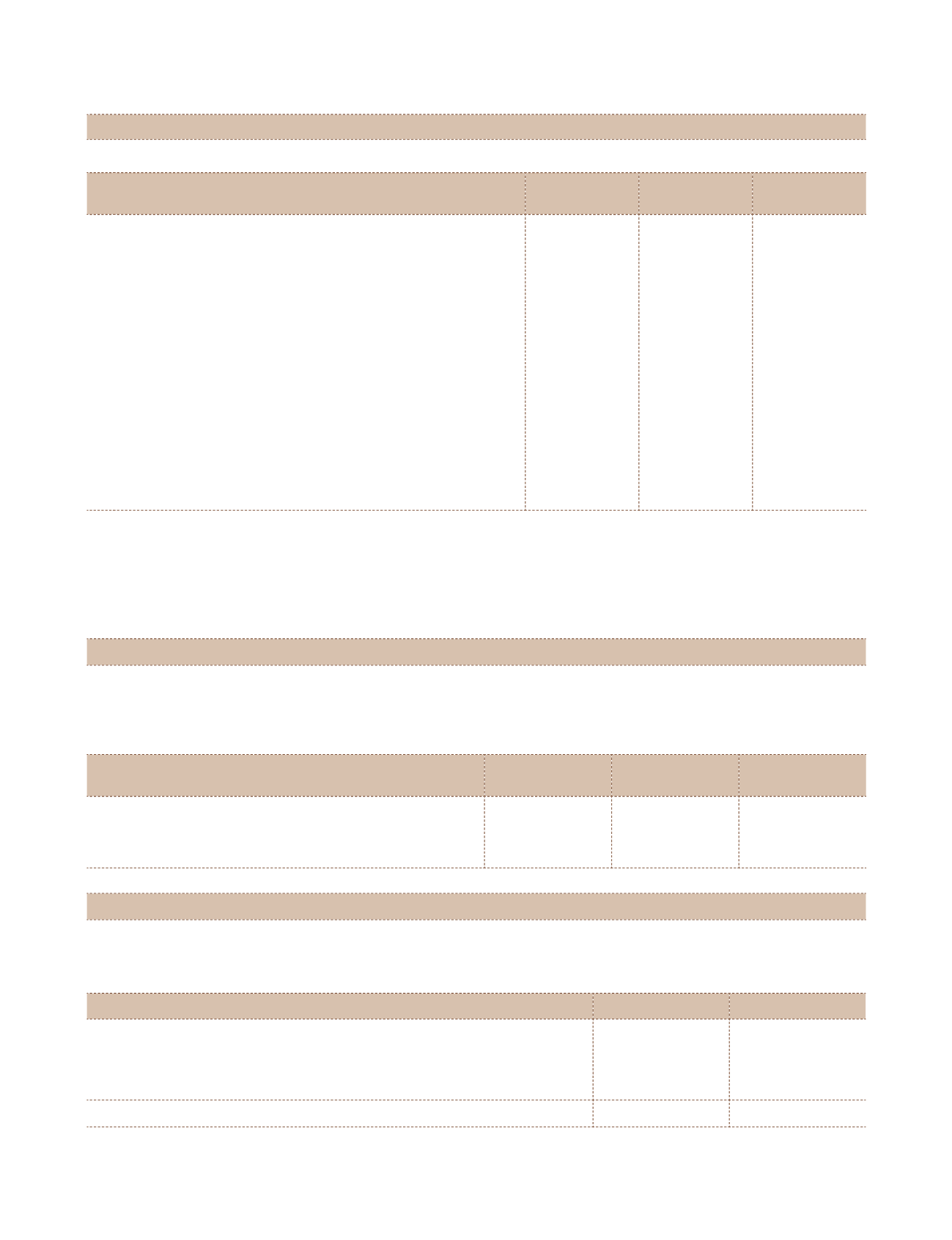

Note 29.1 Contingent liabilities

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Claims against the Group not acknowledged as debts in

respects of:

i) Excise duty

8.00

7.70

7.25

ii) Income tax

8.23

9.10

8.56

iii) Sales tax

0.68

0.67

0.67

iv) Service tax

0.01

0.01

0.01

v) Custom duty

–

0.18

0.18

vi) Water charges

89.28

89.65

79.84

vii) Others

6.02

14.42

14.93

viii) In respect of a customer claim amounting to

`

32.35 cr, the

Company, based on legal opinion, believes that the claim will not

sustain.

The above matters are currently being considered by the tax authorities | various forums and the Group expects the judgements

will be in its favour and has therefore, not recognised the provision in relation to these claims. Future cash outflow in respect of

above will be determined only on receipt of judgement | decision pending with tax authorities | various forums. The potential

undiscounted amount of total payments for taxes that the Group may be required to make if there was an adverse decision

related to these disputed demands of regulators as of the date reporting period ends are as stated above.

Note 29.2 Commitments

Capital commitments

Capital expenditure contracted for at the end of the reporting period but not recognised as liabilities is as follows:

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Estimated amount of contracts remaining to be executed and

not provided for (net of advances):

Property, plant and equipment

35.73

47.13

121.86

Note 29.3 Research and Development

Details of expenditure incurred on approved in-house Research and Development facilities.

(

`

cr)

Particulars

2016-17

2015-16

Capital expenditure

12.86

1.32

Recurring expenditure

19.00

18.16

Capital expenditure on building

6.07

–

37.93

19.48

Notes

to the Consolidated Financial Statements