Atul Ltd | Annual Report 2016-17

h) Deferred tax assets have not been recognised in respect of these losses as they may not be used to offset

taxable profits elsewhere in the Group, they have arisen in subsidiary companies that have been loss-

making for some time, and there are no other tax planning opportunities or other evidence of recoverability

in the near future.

(

`

cr)

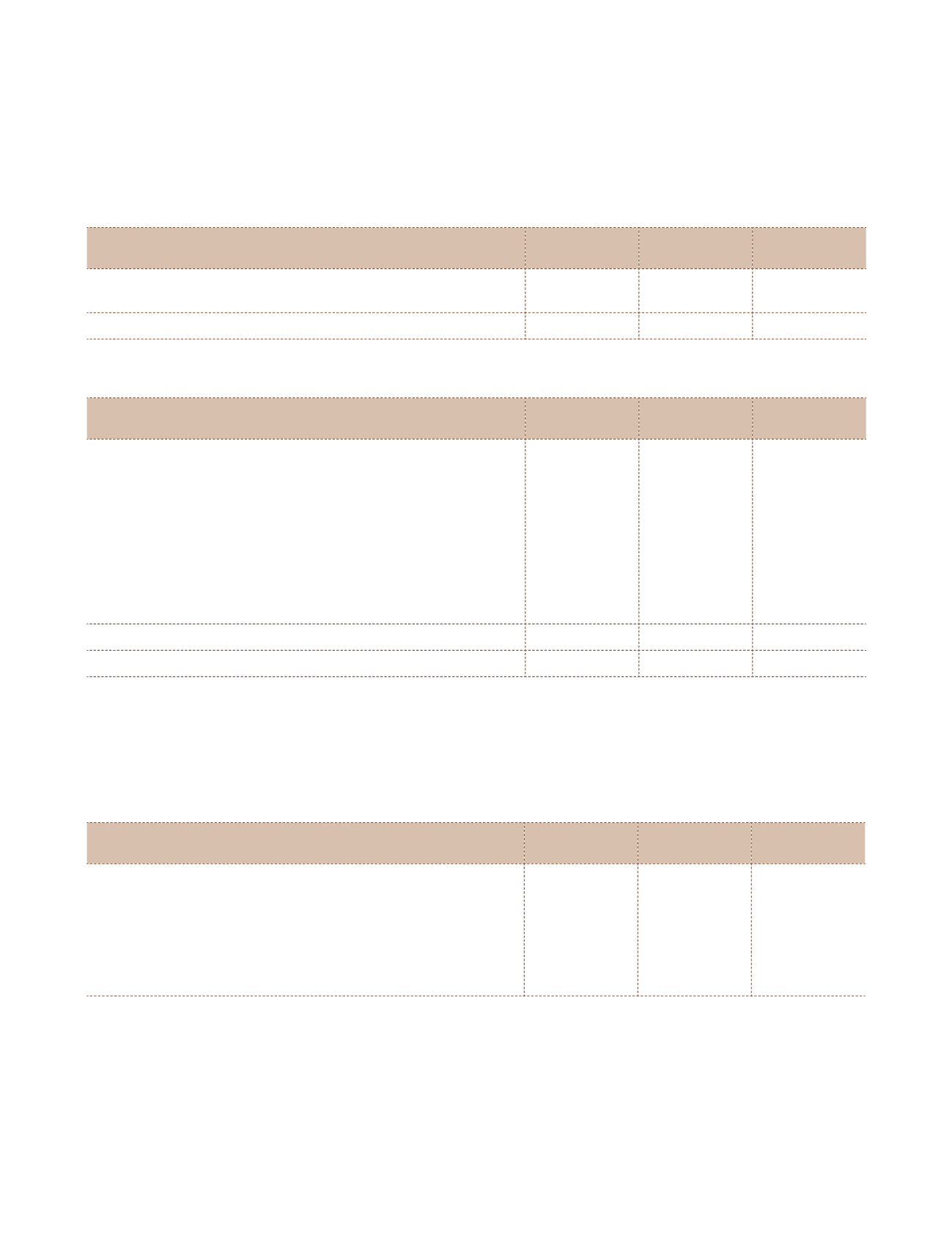

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Unused tax losses for which no deferred tax asset has been

recognised

23.71

30.67

30.22

Potential tax benefit @ 34.61%

8.21

10.61

10.46

As on March 31, 2017 the Group has net operating losses and carry forwards that shall expire as follows:

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Net operating losses

2018-19

–

0.04

0.39

2019-20

0.80

0.93

0.93

2020-21

0.31

0.31

0.31

2021-22

0.24

0.24

0.24

2022-23

0.14

0.14

0.14

2023-24

–

–

–

Unabsorbed depreciation

Indefinitely

22.22

29.01

28.21

i) Unrecognised temporary differences

The Group has not recognised deferred tax liability associated with undistributed earnings of its subsidiary companies as it

can control the timing of the reversal of these temporary differences and it is probable that such differences will not reverse

in the foreseeable future.

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Temporary difference relating to investments in subsidiary

companies for which deferred tax liabilities have not been

recognised:

Undistributed earnings

19.35

13.94

15.50

Unrecognised deferred tax liabilities relating to the above

temporary differences @ 17.304%

3.35

2.41

2.68

The Group has not recognised deferred tax liability associated with fair value gains on Equity share measured in Other

Comprehensive Income, as based on the Management projection of future taxable income and existing plan, it is not

probable that such difference will reverse in the foreseeable future.

Notes

to the Consolidated Financial Statements