191

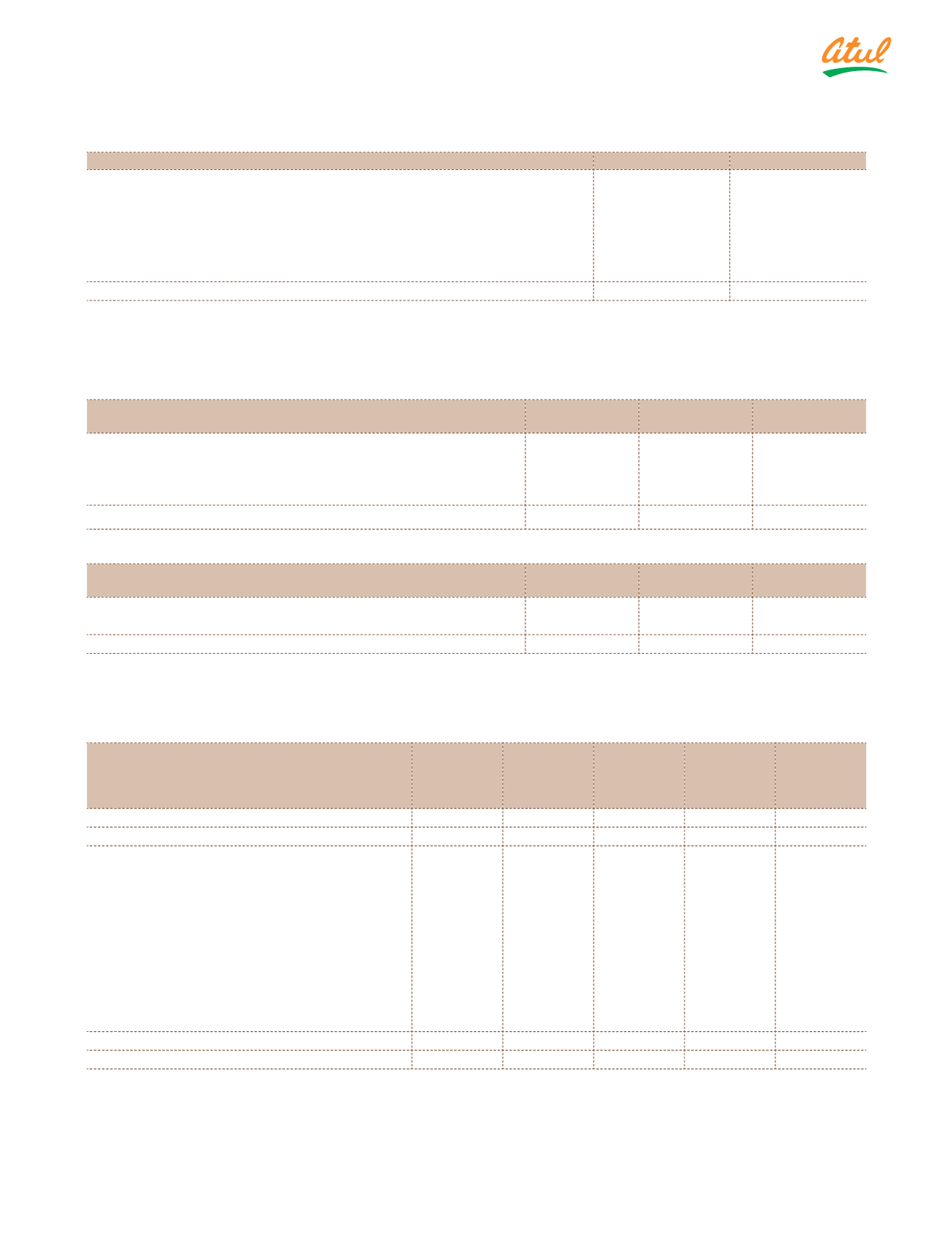

c) The reconciliation between the Statutory income tax rate applicable to the Group and the effective income

tax rate of the Group is as follows:

Particulars

2016-17

2015-16

a) Statutory income tax rate

34.61%

34.61%

b) Differences due to:

i)

Expenses not deductible for tax purposes

0.76%

1.29%

ii)

Income exempt from income tax

(2.33%)

(1.02%)

iii)

Income tax incentives

(3.37%)

(2.89%)

iv)

Others

(0.04%)

0.50%

Effective income tax rate

29.63%

32.49%

d) No aggregate amounts of current and deferred tax have arisen in the reporting periods which have not

been recognised in the Consolidated Statement of Profit and Loss or Other Comprehensive Income but

directly debited | (credited) to equity.

e) Current tax liabilities (net)

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Opening balance

0.59

5.94

–

Add: Current tax payable for the year

87.11

108.03

84.01

Less: Taxes paid

(84.31)

(113.38)

(78.07)

Closing balance

3.39

0.59

5.94

f) Current tax assets (net)

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Opening balance

4.36

1.57

–

Add: Tax paid in advance, net of provisions during the year

(3.15)

2.79

1.57

Closing balance

1.21

4.36

1.57

g) Deferred tax liabilities (net)

The balance comprises temporary differences attributable to the below items and corresponding movement in deferred

tax liabilities | (assets):

(

`

cr)

Particulars

As at

March 31,

2017

(Charged) |

Credited to

profit or loss

| OCI

As at

March 31,

2016

(Charged) |

Credited to

profit or loss

| OCI

As at

April 01,

2015

Property, plant and equipment

143.08

63.73

79.35

22.60

56.75

Total deferred tax liabilities

143.08

63.73

79.35

22.60

56.75

Provision for leave encashment

(9.24)

(1.24)

(8.00)

(0.42)

(7.58)

Provision for doubtful debts

(1.10)

0.22

(1.32)

0.18

(1.50)

Provision for doubtful advances

–

0.07

(0.07)

–

(0.07)

Unabsorbed depreciation *

(2.35)

(2.35)

–

–

–

Investment properties

(3.95)

(0.18)

(3.77)

(0.25)

(3.52)

Voluntary Retirement Scheme

–

–

–

0.16

(0.16)

Unrealised MTM losses on derivatives (CIRS)

(1.75)

(1.75)

–

–

–

Effective portion of gains and loss on cash flow

hedges

(0.25)

0.06

(0.31)

(0.31)

–

MAT credit entitlement

(23.02)

(22.95)

(0.07)

(0.07)

–

Total deferred tax assets

(41.66)

(28.12)

(13.54)

(0.71)

(12.83)

Net deferred tax (asset) | liabilities

101.42

35.61

65.81

21.89

43.92

* The Group has recognised deferred tax assets on carried forward tax losses and unabsorbed depreciation of

Amal Ltd. The subsidiary company has incurred the losses over the last few financial years. The Group has recognised

deferred tax assets to the extend deductible temporary difference. The subsidiary company is currently generating and

expected to generate taxable income from 2018 onwards. The losses can be carried forward for a period of 8 years as

per local tax regulations and the Group expects to recover the losses.

Notes

to the Consolidated Financial Statements