19

Directors’ Report

Dear Members,

The Board of Directors (Board) presents the Annual Report of Atul Ltd together with the audited Financial Statements for the

year ended March 31, 2017.

01.

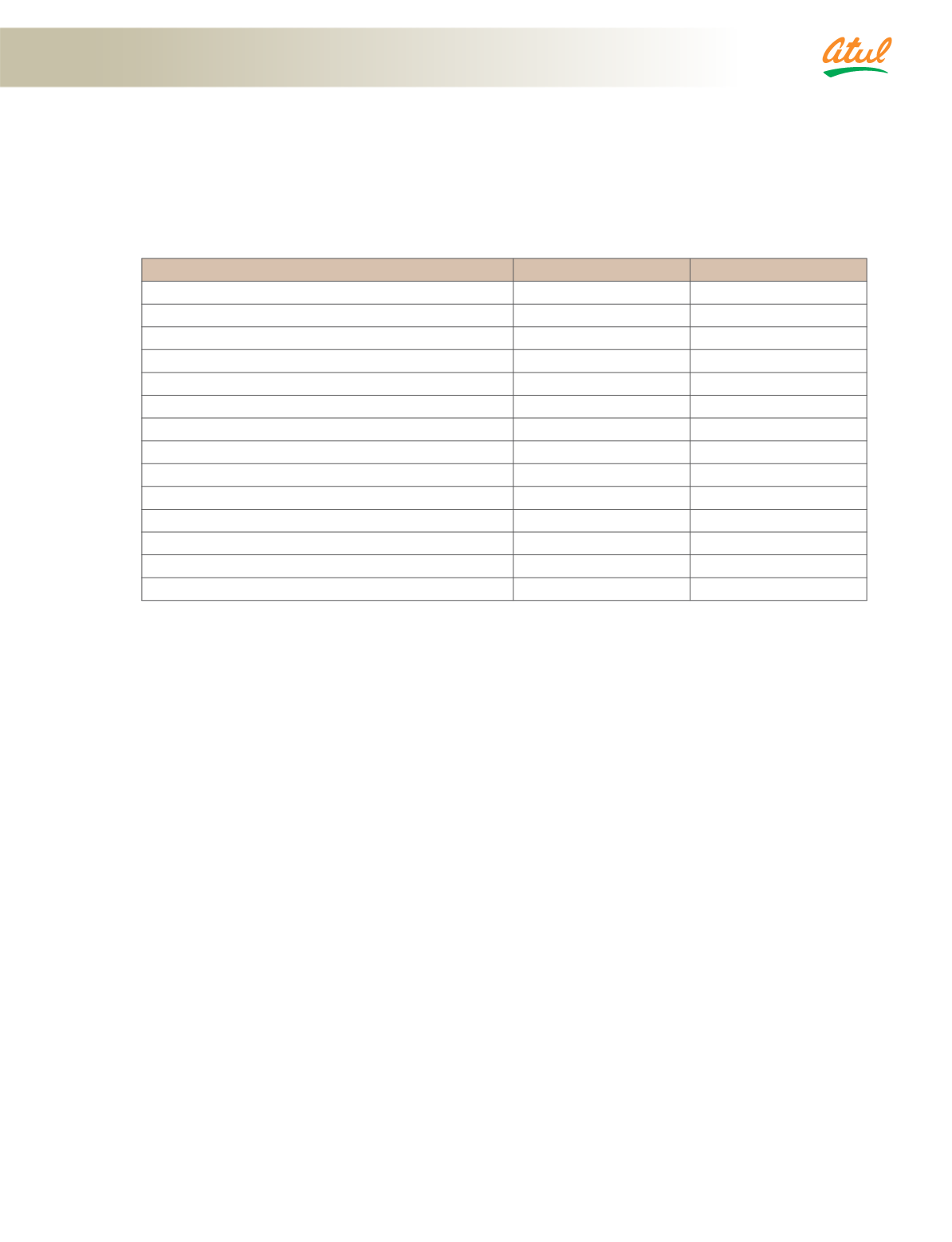

Financial results

(

`

cr

)

2016-17

2015-16

Sales

2,639

2,403

Revenue from operations

2,848

2,609

Other income

43

43

Total revenue

2,891

2,652

Profit before tax

400

400

Provision for tax

115

126

Profit for the year

285

274

Balance brought forward

1,145

900

Transfer from Comprehensive Income

3

(2)

Disposable surplus

1,433

1,172

Less:

Dividend paid

30

25

Dividend distribution tax (net)

6

2

Balance carried forward

1,397

1,145

02.

Performance

Sales increased by 10% from

`

2,403 cr to

`

2,639 cr

mainly due to higher volumes (16%), partly offset

by lower prices (6%). Sales in India increased by 3%

from

`

1,198 cr to

`

1,239 cr. Sales outside India

increased by 16% from

`

1,205 cr to

`

1,400 cr.

The Earning per share increased from

`

92.53 to

`

96.18. While the operating profit before working

capital changes increased by 1% from

`

478 cr to

`

485 cr, the net cash flow from operating activities

decreased by 3% from

`

375 cr to

`

364 cr.

Sales of Life Science Chemicals (LSC) Segment

increased by 10% from

`

737 cr to

`

807 cr, mainly

because of higher sales in Sub-segments Crop

Protection and Aromatics - I; its EBIT decreased by

19% from

`

161 cr to

`

130 cr. Sales of Performance

and Other Chemicals (POC) Segment increased by

10% from

`

1,666 cr to

`

1,832 cr mainly because

of higher sales in Sub-segments Aromatics - II and

Polymers; its EBIT increased by 16% from

`

249 cr to

`

290 cr. More details are given in the Management

Discussion and Analysis (MDA) Report.

The borrowings of the Company decreased

(including current maturities of long-term

borrowings) by 49% from

`

302 cr to

`

155 cr

despite payments towards capital expenditure of

`

176 cr.

Credit Analysis and Research Ltd (CARE) maintained

its credit rating at ‘AA+’ (double A plus) for long-term

borrowings of the Company. Its rating for

short-term borrowings and commercial paper

remained at ‘A1+’ (A1 plus), the highest possible

awarded by CARE.

The Company completed 3 expansion projects with

an investment of

`

117 cr which are expected to

generate sales of

`

220 cr at full capacity utilisation.

03.

Dividend

The Board recommends payment of dividend of

`

10 per share on 2,96,61,733 Equity shares of

`

10 each fully paid up. The dividend will entail

an outflow of

`

35.70 cr {including dividend

distribution tax (net)} on the paid-up Equity share

capital of

`

29.66 cr.

04.

Conservation of energy, technology

absorption, foreign exchange earnings

and outgo

Information required under Section 134 (3) (m)

of the Companies Act, 2013, read with Rule 8 (3) of

the Companies (Accounts) Rules, 2014, as amended

from time to time, forms a part of this Report which

is given at page number 24.

05.

Insurance

The Company has taken adequate insurance to cover

the risks to its employees, property (land and buildings),

plant, equipment, other assets and third parties.

06.

Risk Management

Risk Management is an integral part of the business

practices of the Company. The framework of Risk

Management concentrates on formalising a system

to deal with the most relevant risks, building on

existing management practices, knowledge and

structures. With the help of a reputed international

consultancy firm, the Company has developed and