Atul Ltd | Annual Report 2016-17

17.

Key Managerial Personnel and other

employees

17.1 Appointments and cessations of the Key Managerial

Personnel

There were no appointments | cessations of the Key

Managerial Personnel during 2016-17.

17.2 Remuneration

The Remuneration Policy of the KeyManagerial Personnel

and other employees consists of the following:

17.2.1 Components

i) Fixed pay

a.

Basic salary

b.

Allowances

c.

Perquisites

d.

Retirals

ii) Variable pay

17.2.2 Factors for determining and changing fixed pay

i) Existing compensation

ii) Education

iii) Experience

iv) Salary bands

v) Performance

vi) Market benchmark

17.2.3 Factors for determining and changing variable pay

i) Business performance

ii) Individual performance

iii) Grade

18.

Analysis of remuneration

The information required pursuant to Sections 134

(3)(q) and 197 (12) of the Companies Act, 2013

read with Rule 5 of the Companies (Appointment

and Remuneration of Managerial Personnel) Rules,

2014 in respect of employees of the Company, forms

part of this Report. However, as per the provisions

of Sections 134 and 136 of the Act, the Report

and the Accounts are being sent to the Members

and others entitled thereto excluding the information

on employees’ particulars which are available

for inspection by the Members at the registered

office of the Company during business hours on

working days of the Company up to the date of

ensuing AGM.

Any Member interested in obtaining a copy of such

statement may write to the Company Secretary at the

Registered office of the Company.

19.

Management Discussion and Analysis

The Management Discussion and Analysis Report

covering performance of the 2 reporting Segments,

namely, LSC and POC, is given at page number 46.

20.

Corporate Governance Report

20.1 Statement of declaration given by the Independent

Directors.

The Independent Directors have given declarations

under Section 149 (6) of the Companies Act, 2013.

20.2 Report

The Corporate Governance Report along with the

certificate from the Statutory Auditors regarding

compliance of the conditions of Corporate

Governance pursuant to Regulation 34 (3) read

with Schedule V of the Securities and Exchange

Board of India (Listing Obligations and Disclosure

Requirements) Regulations, 2015 is given at page

number 53. Details about the number of meetings

of the Board held during 2016-17 are given at page

number 56. The composition of the Audit Committee

is given at page number 59.

All the recommendations given by the Audit

Committee were accepted by the Board.

20.3 Whistle-blowing Policy

The Board, on the recommendation of the

Audit Committee, had approved a vigil mechanism

(Whistle-blowing Policy). The policy provides an

independent mechanism for reporting and resolving

complaints pertaining to unethical behaviour, actual

or suspected fraud and violation of the Code of

Conduct of the Company and is displayed on the

website (of the Company) at

http://www.atul.co.in/investors/pdf/Whistle_Blowing_Policy.pdf

No personnel has been denied access to the Audit

Committee.

21.

Business Responsibility Report

As per Regulation 34 of the Securities and Exchange

Board of India (Listing Obligations and Disclosure

Requirements) Regulations, 2015, the Business

Responsibility Report is given at page number 68.

22.

Dividend Distribution Policy

As per Regulation 43A of the Securities and Exchange

Board of India (Listing Obligations and Disclosure

Requirements) Regulations, 2015, the Dividend

Distribution Policy is given at page number 74.

23.

Acknowledgements

The Board expresses its sincere thanks to all the

employees, customers, suppliers, lenders, regulatory

and Government authorities, Stock Exchanges,

investors for their support.

For and on behalf of the Board of Directors

Mumbai

(Sunil Siddharth Lalbhai)

May 05, 2017

Chairman and Managing Director

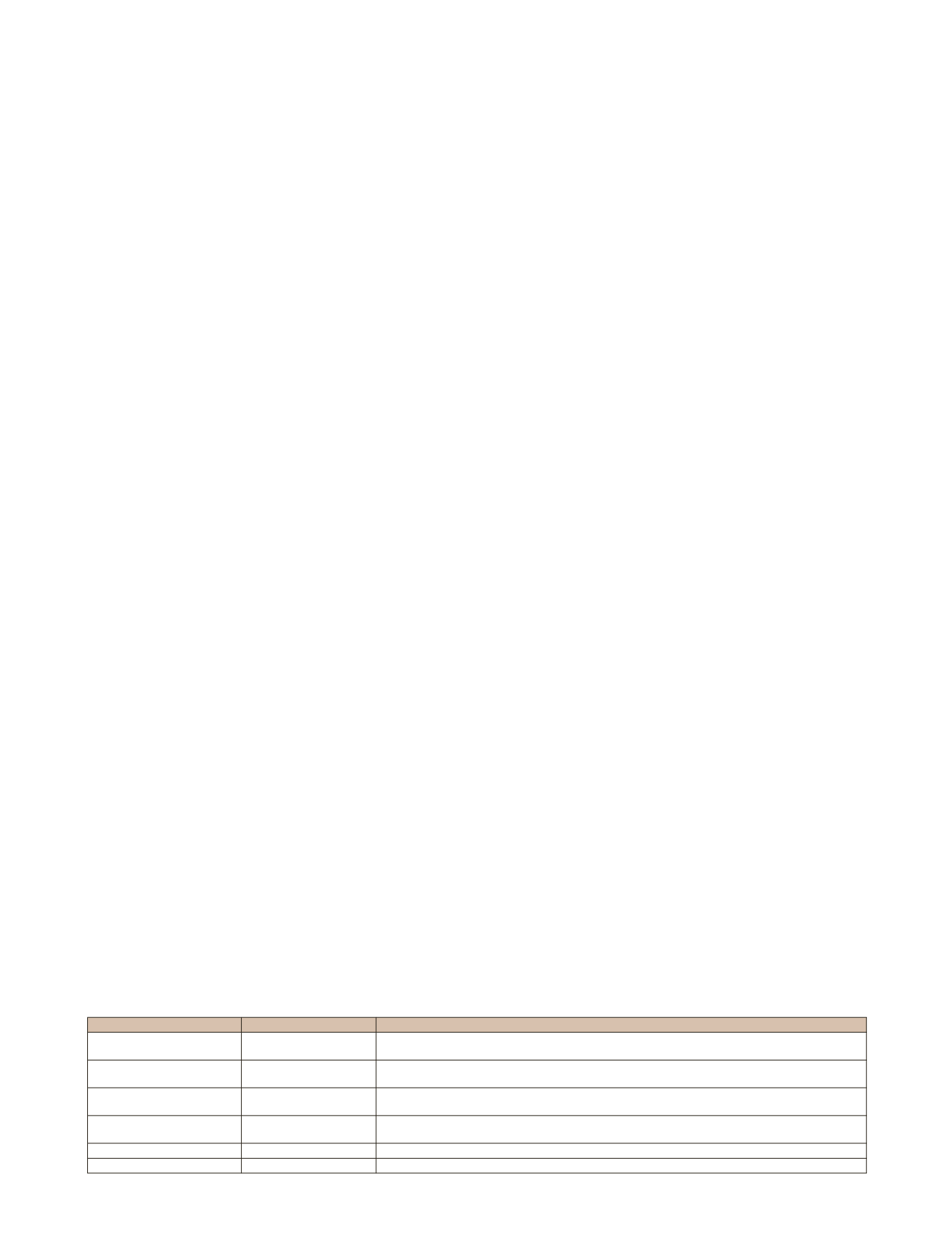

Table

Evaluation of

Evaluation by

Criteria

Non-independent Director

(Executive)

Independent Directors

Qualification, Experience, Availability and attendance, Integrity, Commitment, Governance,

Transparency, Communication, Business leadership, People leadership, Investor relations

Non-independent Director

(Non-executive)

Independent Directors

Qualification, Experience, Availability and attendance, Integrity, Commitment, Governance,

Independence, Communication, Preparedness, Participation and Value addition

Independent Director

All other Board Members Qualification, Experience, Availability and attendance, Integrity, Commitment, Governance,

Independence, Communication, Preparedness, Participation and Value addition

Chairman

Independent Directors

Qualification, Experience, Availability and attendance, Integrity, Commitment, Governance,

Impartiality, Communication, Business leadership, People leadership and Meeting conduct

Committees

Board Members

Composition, Process and Dynamics

Board as a whole

Independent Directors

Composition, Process and Dynamics