Note 28.7 Fair value measurements (continued)

(

`

cr)

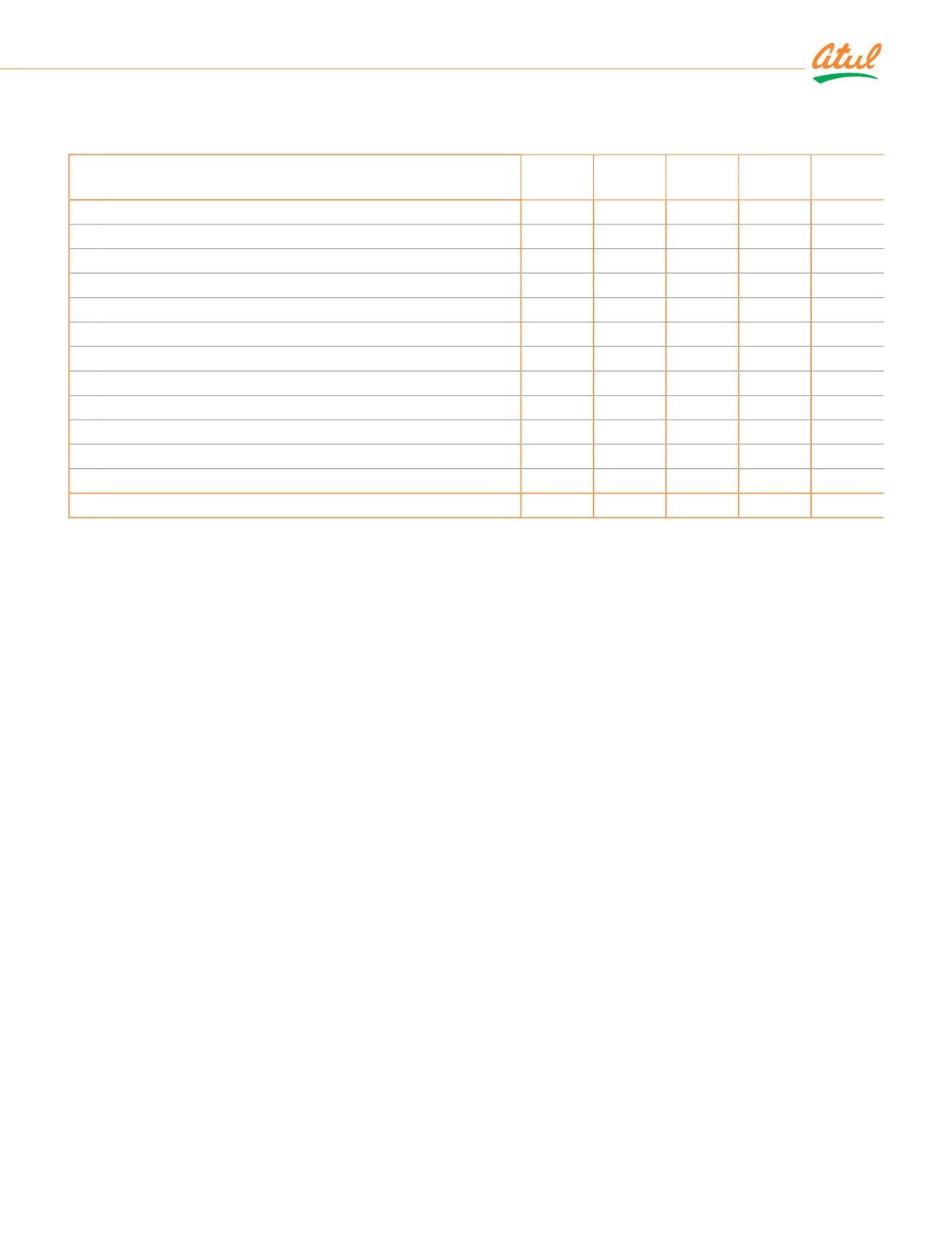

iv) Assets and liabilities for which fair values are disclosed at

March 31, 2018

Note Level 1 Level 2 Level 3 Total

Financial assets

Investments:

Preference shares

5.1

-

-

5.72

5.72

Government securities

5.2

0.01

-

-

0.01

Loans

6

-

-

7.07

7.07

Security deposits for utilities and premises

7

-

-

1.10

1.10

Finance lease receivable

7

-

-

1.25

1.25

¹ūƥîŕ ǛŠîŠČĿîŕ îƙƙĚƥƙ

0.01

-

15.14

15.15

Financial liabilities

Borrowings

15

-

-

0.01

0.01

Security deposits

16

-

-

19.80

19.80

¹ūƥîŕ ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙ

-

-

19.81

19.81

Investment properties

3

-

- 141.00

141.00

¹Includes investments in Bharuch Enviro Infrastructure Ltd (70,000 equity shares), in Narmada Clean Tech Ltd (7,15,272 equity

shares) and in OPGS Power Gujarat Pvt Ltd (5,03,000 equity shares) which are for operation purposes and the Company

expects its refund on exit. The Company estimates that the fair value of these investments are not materially different as

compared to its cost.

There were no transfers between any levels during the year.

Level 1:

gĚDŽĚŕ ǧ ĺĿĚƑîƑČĺNj ĿŠČŕƭēĚƙ ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙ ŞĚîƙƭƑĚē ƭƙĿŠij ƐƭūƥĚē ƎƑĿČĚƙȦ ¹ĺĚ ljîĿƑ DŽîŕƭĚ ūlj îŕŕ ĚƐƭĿƥNj ĿŠƙƥƑƭŞĚŠƥƙ

which are traded on the Stock Exchanges is valued using the closing price as at the reporting period.

Level 2:

¹ĺĚ ljîĿƑ DŽîŕƭĚ ūlj ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙ ƥĺîƥ îƑĚ Šūƥ ƥƑîēĚē ĿŠ îŠ îČƥĿDŽĚŞîƑŒĚƥ ȳljūƑ ĚNJîŞƎŕĚȡ ūDŽĚƑȹƥĺĚȹČūƭŠƥĚƑ ēĚƑĿDŽîƥĿDŽĚƙȴ

is determined using valuation techniques which maximise the use of observable market data and rely as little as possible on

ĚŠƥĿƥNjȹƙƎĚČĿǛČ ĚƙƥĿŞîƥĚƙȦ ¹ĺĚ Şƭƥƭîŕ ljƭŠē ƭŠĿƥƙ îƑĚ DŽîŕƭĚē ƭƙĿŠij ƥĺĚ ČŕūƙĿŠij ŠĚƥ îƙƙĚƥƙ DŽîŕƭĚȦ Tlj îŕŕ ƙĿijŠĿǛČîŠƥ ĿŠƎƭƥƙ ƑĚƐƭĿƑĚē

to fair value an instrument are observable, the instrument is included in levels 1 and 2.

Level 3:

Tlj ūŠĚ ūƑ ŞūƑĚ ūlj ƥĺĚ ƙĿijŠĿǛČîŠƥ ĿŠƎƭƥƙ Ŀƙ Šūƥ ċîƙĚē ūŠ ūċƙĚƑDŽîċŕĚ ŞîƑŒĚƥ ēîƥîȡ ƥĺĚ ĿŠƙƥƑƭŞĚŠƥ Ŀƙ ĿŠČŕƭēĚē ĿŠ ŕĚDŽĚŕ ǩȦ

b) Valuation technique used to determine fair value

¬ƎĚČĿǛČ DŽîŕƭîƥĿūŠ ƥĚČĺŠĿƐƭĚƙ ƭƙĚē ƥū DŽîŕƭĚ ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙ ĿŠČŕƭēĚȠ

i)

the use of quoted market prices or dealer quotes for similar instruments

ii) the fair value of forward foreign exchange contracts are determined using forward exchange rates at the Balance

Sheet date

iii) the fair value of foreign currency option contracts is determined using the Black Scholes valuation model

ĿDŽȴ ƥĺĚ ljîĿƑ DŽîŕƭĚ ūlj ƥĺĚ ƑĚŞîĿŠĿŠij ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙ Ŀƙ ēĚƥĚƑŞĿŠĚē ƭƙĿŠij ēĿƙČūƭŠƥĚē Čîƙĺ ǜūDž îŠîŕNjƙĿƙ

All of the resulting fair value estimates are included in levels 1 and 2.

c) Valuation processes

¹ĺĚ GĿŠîŠČĚ ēĚƎîƑƥŞĚŠƥ ūlj ƥĺĚ ūŞƎîŠNj ĿŠČŕƭēĚƙ î ƥĚîŞ ƥĺîƥ ƎĚƑljūƑŞƙ ƥĺĚ DŽîŕƭîƥĿūŠƙ ūlj ǛŠîŠČĿîŕ îƙƙĚƥƙ îŠē ŕĿîċĿŕĿƥĿĚƙ

ƑĚƐƭĿƑĚē ljūƑ ǛŠîŠČĿîŕ ƑĚƎūƑƥĿŠij ƎƭƑƎūƙĚƙȡ ĿŠČŕƭēĿŠij ŕĚDŽĚŕ ǩ ljîĿƑ DŽîŕƭĚƙȦ

163

Standalone

|

Notes to the Financial Statements