Note 28.8 Financial risk management (continued)

b) Management of market risk

¹ĺĚ ƙĿǕĚ îŠē ūƎĚƑîƥĿūŠƙ ūlj ƥĺĚ ūŞƎîŠNj ĚNJƎūƙĚƙ Ŀƥ ƥū ƥĺĚ ljūŕŕūDžĿŠij ŞîƑŒĚƥ ƑĿƙŒƙ ƥĺîƥ îƑĿƙĚ ljƑūŞ Ŀƥƙ ƭƙĚ ūlj ǛŠîŠČĿîŕ

instruments:

i) price risk

ii) foreign exchange risk

¹ĺĚ îċūDŽĚ ƑĿƙŒƙ ŞîNj îljljĚČƥ ĿŠČūŞĚ îŠē ĚNJƎĚŠƙĚƙȡ ūƑ ƥĺĚ DŽîŕƭĚ ūlj Ŀƥƙ ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙ ūlj ƥĺĚ ūŞƎîŠNjȦ ¹ĺĚ ūċŏĚČƥĿDŽĚ

of the Management of the Company for market risk is to maintain this risk within acceptable parameters, while optimising

returns. The Company exposure to, and the Management of these risks is explained below:

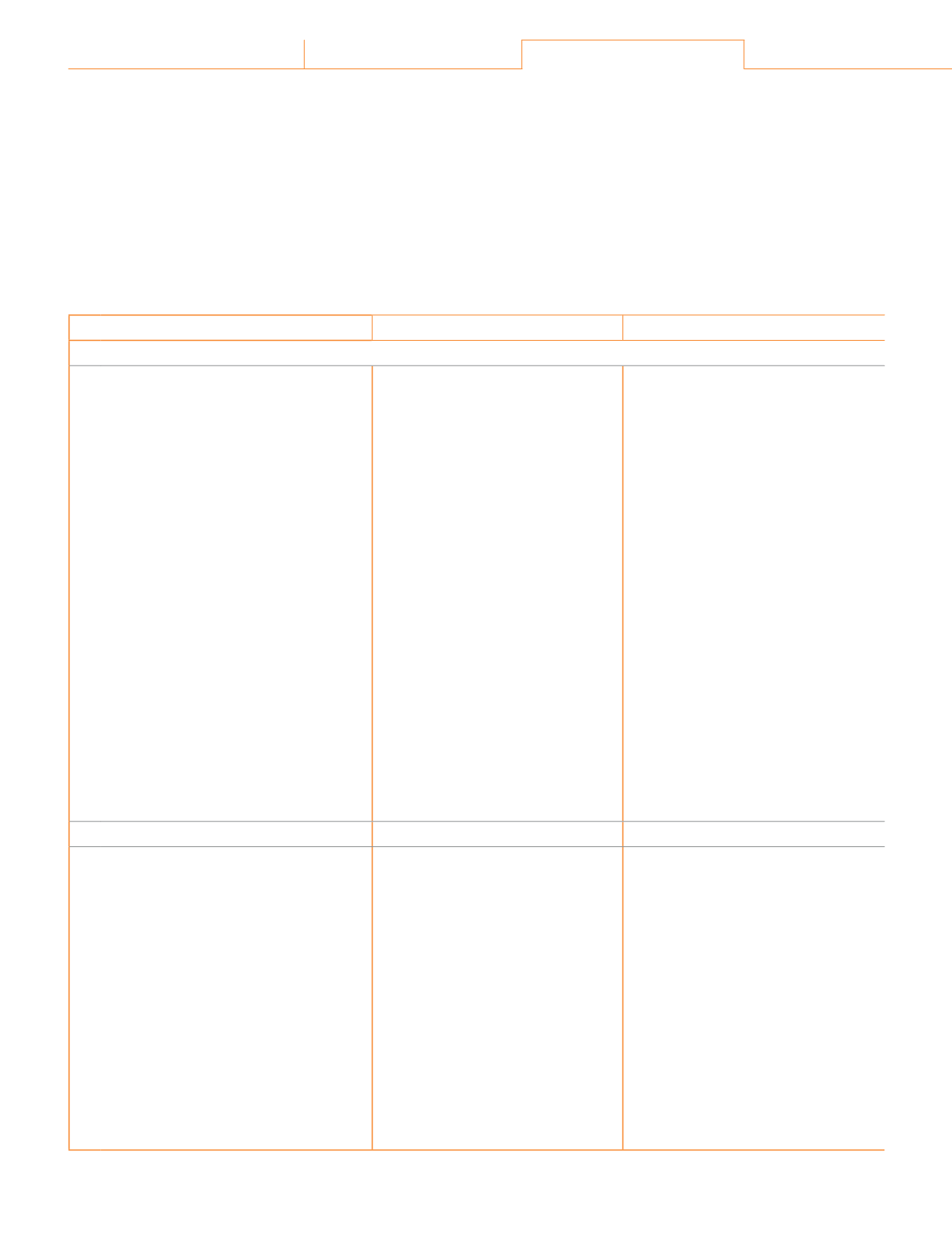

Potential impact of risk

Management policy

Sensitivity to risk

i) Price risk

The Company is mainly exposed to

the price risk due to its investments in

equity instruments and mutual funds.

The price risk arises due to uncertainties

about the future market values of these

investments.

Equity price risk is related to the

change in market reference price of the

investments in equity securities.

In general, equity securities are not

held for trading purposes. These

investments are subject to changes in

the market price of securities. The fair

value of quoted equity instruments

ČŕîƙƙĿǛĚē îƙ ljîĿƑ DŽîŕƭĚ ƥĺƑūƭijĺ ūƥĺĚƑ

comprehensive income as at March 31,

2019 is

`

525.32 cr (March 31, 2018:

`

ǪǫǧȦǫǩ ČƑȴȦ

The fair value of mutual funds

ČŕîƙƙĿǛĚē îƥ ljîĿƑ DŽîŕƭĚ ƥĺƑūƭijĺ ƎƑūǛƥ

and loss as at March 31, 2019 is

`

197.65 cr (March 31, 2018: Nil).

In order to manage its price risk

arising from investments in equity

instruments, the Company maintains

its portfolio in accordance with

the framework set by the Risk

Management Policy.

Any new investment or divestment

must be approved by the Board,

ĺĿĚlj GĿŠîŠČĿîŕ ~ljǛČĚƑ îŠē ¤ĿƙŒ

Management Committee.

As an estimation of the approximate

impact of price risk, with respect to

investments in equity instruments, the

Company has calculated the impact as

follows.

GūƑ ĚƐƭĿƥNj ĿŠƙƥƑƭŞĚŠƥƙȡ

î ǯȦǧǪɼ

increase in Nifty 50 prices may have

led to approximately an additional

`

25.53 cr gain in other comprehensive

income (2017-18:

`

ǪǦȦǮǩ ČƑȴȦ

ǯȦǧǪɼ

decrease in Nifty 50 prices may have

led to an equal but opposite effect.

For mutual funds, a 1% increase in

prices may have led to approximately

an additional

`

1.98 cr gain in the

¬ƥîƥĚŞĚŠƥ ūlj ¡ƑūǛƥ îŠē gūƙƙ ȳǨǦǧǭȹ

18:

`

Nil). A 1% decrease in prices may

have led to an equal but opposite effect.

ii) Foreign exchange risk

The Company has international

operations and is exposed to foreign

exchange risk arising from foreign

currency transactions. Foreign exchange

risk arises from future commercial

ƥƑîŠƙîČƥĿūŠƙ îŠē ƑĚČūijŠĿƙĚē ǛŠîŠČĿîŕ

assets and liabilities denominated in

a currency that is not the functional

currency (

`

) of the Company. The risk

also includes highly probable foreign

ČƭƑƑĚŠČNj Čîƙĺ ǜūDžƙȦ ¹ĺĚ ūċŏĚČƥĿDŽĚ ūlj

ƥĺĚ Čîƙĺ ǜūDž ĺĚēijĚƙ Ŀƙ ƥū ŞĿŠĿŞĿƙĚ ƥĺĚ

volatility of the

`

Čîƙĺ ǜūDžƙ ūlj ĺĿijĺŕNj

probable forecast transactions.

The Company has exposure arising

out of export, import, and other

transactions other than functional

risks. The Company hedges its

foreign exchange risk using foreign

exchange forward contracts and

currency options after considering

the natural hedge. The same is within

the guidelines laid down by Risk

Management Policy of the Company.

As an estimation of the approximate

impact of the foreign exchange rate

risk, with respect to the Financial

Statements,

the

Company

has

calculated the impact as follows:

For derivative and non-derivative

ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙȡ î Ǩɼ ĿŠČƑĚîƙĚ

in the spot price as on the reporting

date may have led to an increase

in additional

`

5.93 cr gain in other

comprehensive

income

(2017-18:

gain of

`

ǫȦǪǮ ČƑȴȦ

Ǩɼ ēĚČƑĚîƙĚ ŞîNj

have led to an increase in additional

`

5.17 cr loss in other comprehensive

income (2017-18: loss of

`

5.01 cr).

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250

166

Atul Ltd | Annual Report 2018-19