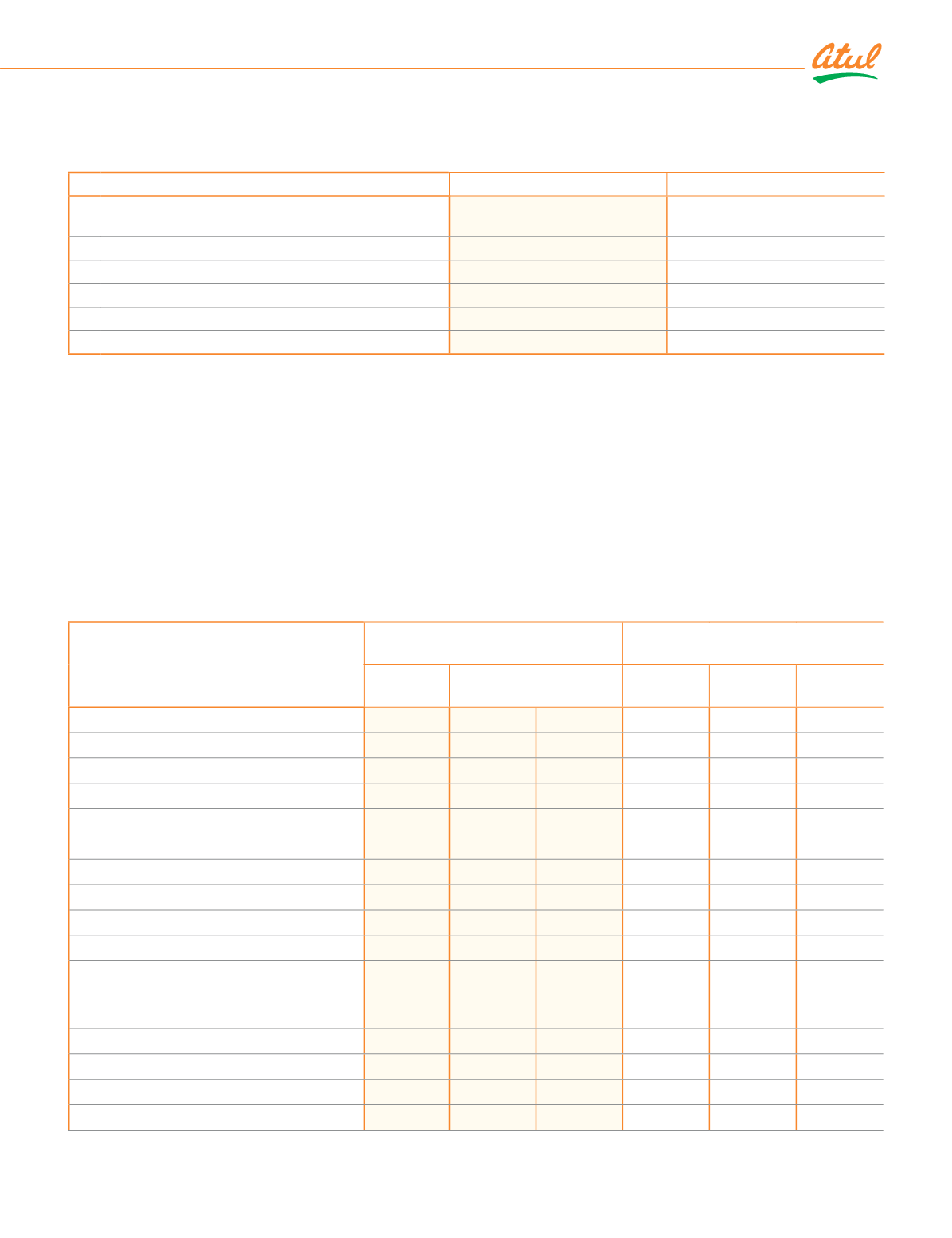

sūƥĚ ǨǯȦǬ /ŞƎŕūNjĚĚ ċĚŠĚǛƥ ūċŕĿijîƥĿūŠƙ ȳČūŠƥĿŠƭĚēȴ

The assumptions used in determining the present value of obligation of the interest rate guarantee under deterministic

approach are:

Particulars

2018-19

2017-18

i)

Mortality rate

Indian Assured Lives Mortality

ȳǨǦǦǬȹǦǮȴ ÀŕƥĿŞîƥĚ

Indian Assured Lives

qūƑƥîŕĿƥNj ȳǨǦǦǬȹǦǮȴ ÀŕƥĿŞîƥĚ

ii) Withdrawal rates

5% p.a. for all age groups

5% p.a. for all age groups

iii) Rate of discount

7.22%

7.68%

iv)

/NJƎĚČƥĚē ƑîƥĚ ūlj ĿŠƥĚƑĚƙƥ

8.65%

8.65%

v) Retirement age

60 years

60 years

vi) Guaranteed rate of interest

8.65%

8.65%

ċȴ 'ĚǛŠĚē ČūŠƥƑĿċƭƥĿūŠ ƎŕîŠƙȠ

¡ƑūDŽĿēĚŠƥ îŠē ūƥĺĚƑ ljƭŠēƙȠ

Amount of

`

15.78 cr (March 31, 2018:

`

10.33 cr) {net of

`

ǦȦǨǧ ČƑ ljƑūŞ ƥĺĚ ¡ƑîēĺîŠ qîŠƥƑĿ ¤ūŏijîƑ ¡ƑūƥƙîĺîŠ ÞūŏîŠî

ȳ¡q¤¡ÞȴȰ Ŀƙ ƑĚČūijŠĿƙĚē îƙ ĚNJƎĚŠƙĚ îŠē ĿŠČŕƭēĚē ĿŠ sūƥĚ ǨǬ Ƀ ūŠƥƑĿċƭƥĿūŠ ƥū ¡ƑūDŽĿēĚŠƥ îŠē ūƥĺĚƑ ljƭŠēƙɄȦ

ūŞƎĚŠƙîƥĚē îċƙĚŠČĚƙȠ

Amount of

`

3.57 cr (March 31, 2018 :

`

ǧȦǧǧ ČƑȴ Ŀƙ ƑĚČūijŠĿƙĚē îƙ ĚNJƎĚŠƙĚ îŠē ĿŠČŕƭēĚē ĿŠ sūƥĚ ǨǬ Ƀ¬îŕîƑĿĚƙȡ DžîijĚƙ îŠē

bonus’.

Note 29.7 Fair value measurements

Financial instruments by category

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

FVPL

FVOCI

Amortised

cost

FVPL

FVOCI

Amortised

cost

Financial assets

Investments:

Equity instruments

-

527.35

-

-

ǪǫǩȦǩǦ

-

Mutual funds

208.81

-

-

5.70

-

-

Government securities

-

-

0.01

-

-

0.01

Investment in NHAI bonds

-

-

0.10

-

-

0.10

Share application money

-

-

-

-

0.01

-

Trade receivables

-

-

ǬǯǮȦǪǭ

-

-

ǭǨǩȦǪǦ

Loans

-

-

0.22

-

-

0.20

Security deposits for utilities and premises

-

-

ǨȦǪǭ

-

-

ǧȦǪǮ

Dividend receivable

-

-

0.01

-

-

3.51

'ĚƑĿDŽîƥĿDŽĚ ǛŠîŠČĿîŕ îƙƙĚƥƙ ēĚƙĿijŠîƥĚē îƙ

hedges (net)

-

1.22

-

-

0.05

-

Cash and bank balances

-

-

ǫǪȦǫǦ

-

-

ǪǯȦǩǯ

Other receivables

-

-

18.92

-

-

17.38

¹ūƥîŕ ǛŠîŠČĿîŕ îƙƙĚƥƙ

208.81

528.57

774.70

5.70

453.36

795.47

Financial liabilities

Consolidated

|

Notes to the Financial Statements

227