Note 29.8 Financial risk management (continued)

¹ĺĚ îċūDŽĚ ƑĿƙŒƙ ŞîNj îljljĚČƥ ĿŠČūŞĚ îŠē ĚNJƎĚŠƙĚƙȡ ūƑ ƥĺĚ DŽîŕƭĚ ūlj Ŀƥƙ ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙ ūlj ƥĺĚ HƑūƭƎȦ ¹ĺĚ ūċŏĚČƥĿDŽĚ ūlj ƥĺĚ

Management of the Group for market risk is to maintain this risk within acceptable parameters, while optimising returns.

¹ĺĚ ĚNJƎūƙƭƑĚ ūlj ƥĺĚ HƑūƭƎ ƥū ƥĺĚƙĚ ƑĿƙŒƙ îŠē ƥĺĚ ŞîŠîijĚŞĚŠƥ ūlj ƥĺĚƙĚ ƑĿƙŒƙ îƑĚ ĚNJƎŕîĿŠĚē ċĚŕūDžȠ

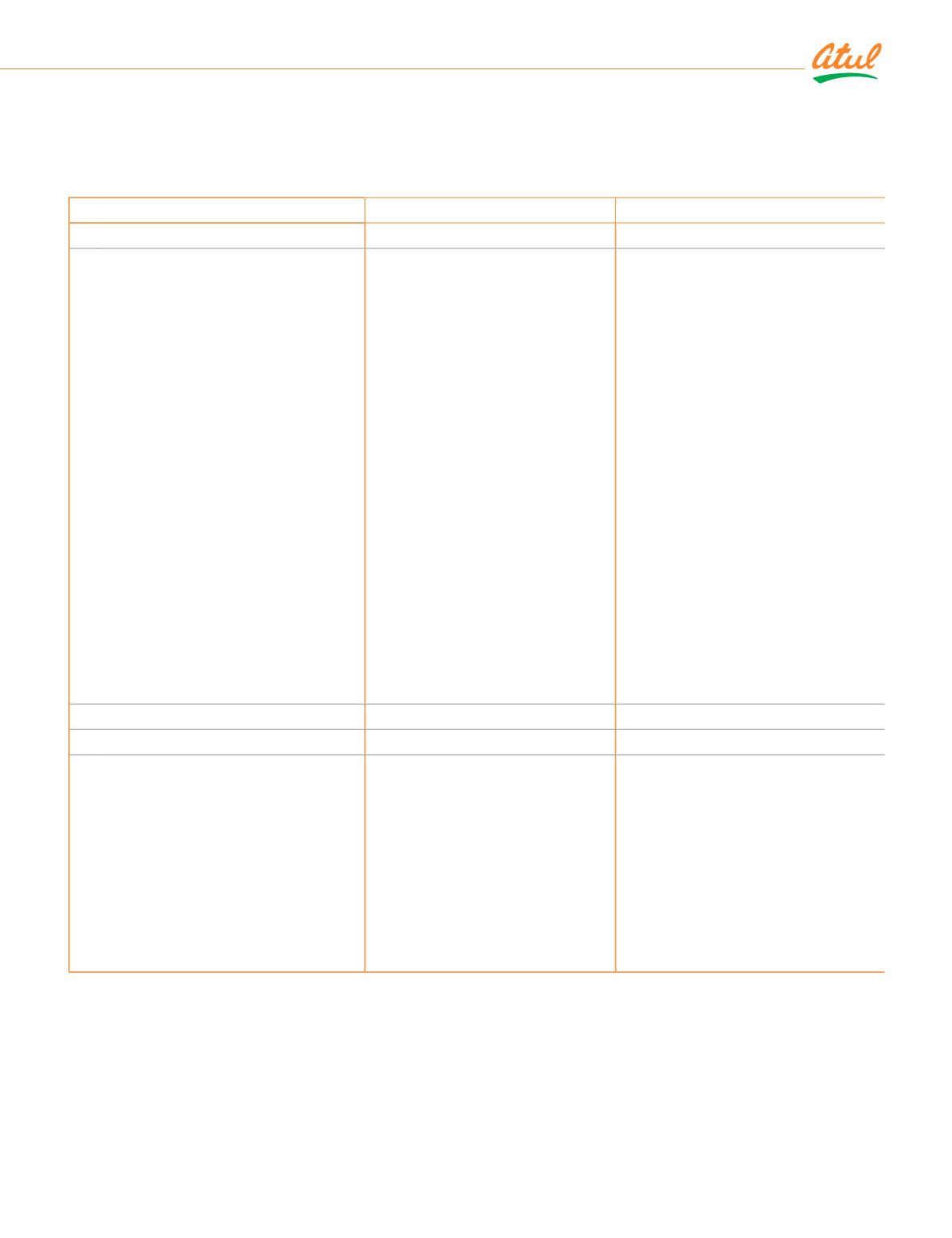

Potential impact of risk

Management policy

Sensitivity to risk

i) Price risk

¹ĺĚ HƑūƭƎ Ŀƙ ŞîĿŠŕNj ĚNJƎūƙĚē ƥū ƥĺĚ

price risk due to its investments in

equity instruments and mutual funds.

The price risk arises due to uncertainties

about the future market values of these

investments.

Equity price risk is related to the

change in market reference price of the

investments in equity securities.

In general, these securities are not

held for trading purposes. These

ĿŠDŽĚƙƥŞĚŠƥƙ îƑĚ ƙƭċŏĚČƥ ƥū ČĺîŠijĚƙ ĿŠ

the market price of securities. The fair

value of quoted equity instruments

ČŕîƙƙĿǛĚē îƥ ljîĿƑ DŽîŕƭĚ ƥĺƑūƭijĺ ~ƥĺĚƑ

Comprehensive Income as at March 31,

2019 is

`

ǫǨǭȦǪǬ ČƑ ȳqîƑČĺ ǩǧȡ ǨǦǧǮȠ

`

ǪǫǨȦǫǦ ČƑȴȦ

The fair value of mutual fund

ČŕîƙƙĿǛĚē îƥ ljîĿƑ DŽîŕƭĚ ƥĺƑūƭijĺ ƎƑūǛƥ

and loss as at March 31, 2019 is

`

212.31 cr (March 31, 2018:

`

5.70 cr).

In order to manage its price risk

arising from investments in equity

instruments, the Group maintains

its portfolio in accordance with

the framework set by the Risk

Management policies.

Any new investment or divestment

must be approved by the Board of

'ĿƑĚČƥūƑƙȡ ĺĿĚlj GĿŠîŠČĿîŕ ~ljǛČĚƑ îŠē

Risk Management Committee.

ƙ îŠ ĚƙƥĿŞîƥĿūŠ ūlj ƥĺĚ îƎƎƑūNJĿŞîƥĚ

impact of price risk, with respect to

investments in equity instruments, the

Group has calculated the impact as

follows:

GūƑ ĚƐƭĿƥNj ĿŠƙƥƑƭŞĚŠƥƙȡ

î ǯȦǧǪɼ

increase in Nifty 50 prices would have

ŕĚē ƥū îƎƎƑūNJĿŞîƥĚŕNj îŠ îēēĿƥĿūŠîŕ

`

25.67

cr

gain

in

other

comprehensive

income

(2017-18:

`

ǪǦȦǮǯ ČƑȴȦ

ǯȦǧǪɼ ēĚČƑĚîƙĚ ĿŠ sĿljƥNj

50 prices would have led to an equal but

opposite effect.

ii) Interest rate risk

Financial liabilities:

¹ĺĚ HƑūƭƎ Ŀƙ ŞîĿŠŕNj ĚNJƎūƙĚē ƥū ĿŠƥĚƑĚƙƥ

rate risk due to its variable interest

rate borrowings. The interest rate risk

arises due to uncertainties about the

future market interest rate of these

borrowings.

ƙ îƥ qîƑČĺ ǩǧȡ ǨǦǧǯȡ ƥĺĚ ĚNJƎūƙƭƑĚ ƥū

interest rate risk due to variable interest

rate borrowings amounted to

`

ǮȦǪǯ ČƑ

(March 31, 2018:

`

Nil)

In order to manage its interest rate

risk arising from variable interest

rate borrowings, the Group uses

interest rate swaps to hedge its

ĚNJƎūƙƭƑĚ ƥū ljƭƥƭƑĚ ŞîƑŒĚƥ ĿŠƥĚƑĚƙƥ

rates whenever appropriate. The

hedging activity is undertaken in

accordance with the framework set

by the Risk Management Committee

and supported by the treasury

department.

ƙ îŠ ĚƙƥĿŞîƥĿūŠ ūlj ƥĺĚ îƎƎƑūNJĿŞîƥĚ

impact of the interest rate risk, with

ƑĚƙƎĚČƥ ƥū ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙȡ ƥĺĚ

Group has calculated the impact of a

25 bps change in interest rates. A 25

bps increase in interest rates would

ĺîDŽĚ ŕĚē ƥū îƎƎƑūNJĿŞîƥĚŕNj îŠ îēēĿƥĿūŠîŕ

`

0.02 cr (2017-18:

`

Nil) gain in other

comprehensive income. A 25 bps

decrease in interest rates would have led

to an equal but opposite effect.

Consolidated

|

Notes to the Financial Statements

233