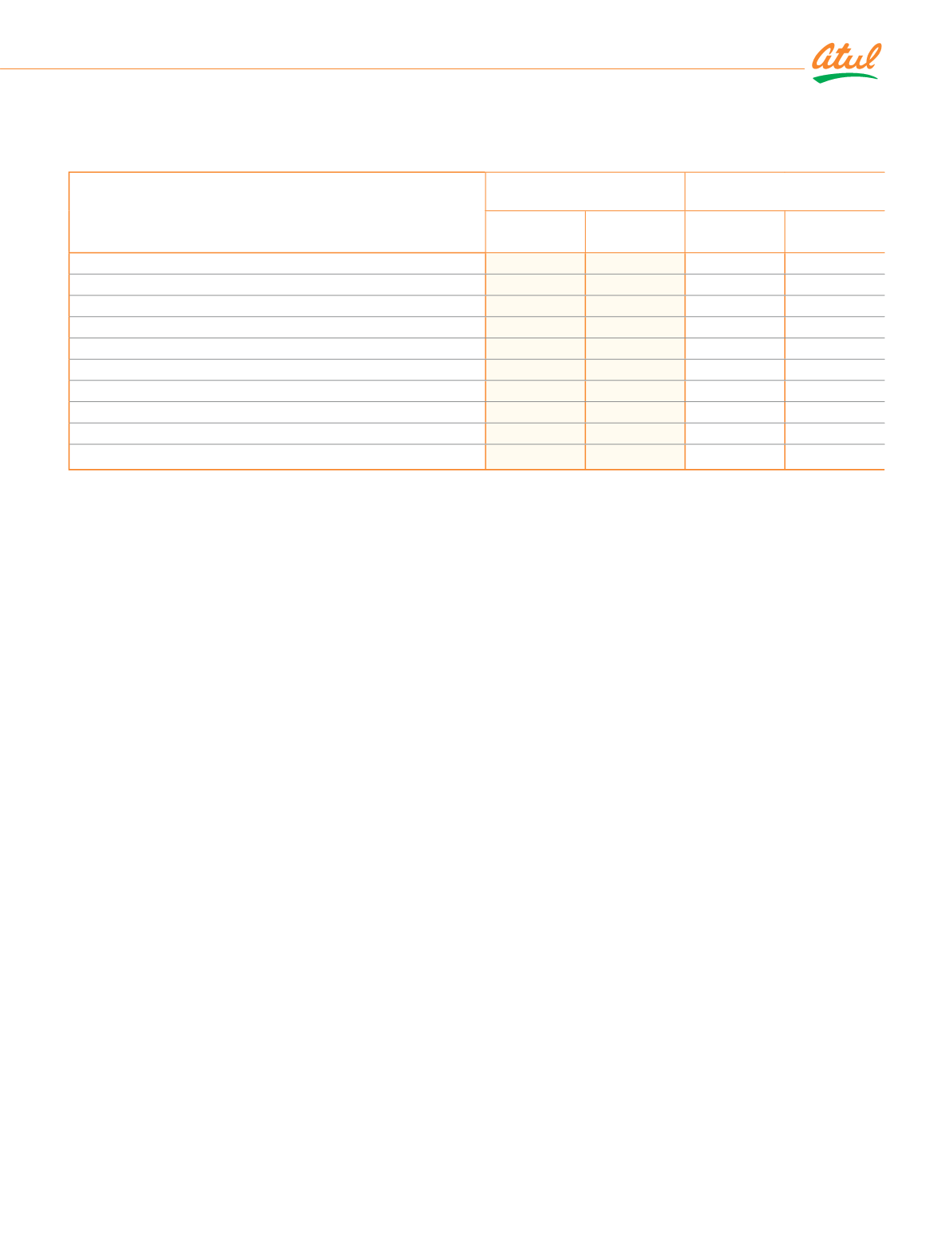

Note 29.7 Fair value measurements (continued)

ēȴ GîĿƑ DŽîŕƭĚ ūlj ǛŠîŠČĿîŕ îƙƙĚƥƙ îŠē ŕĿîċĿŕĿƥĿĚƙ ŞĚîƙƭƑĚē îƥ îŞūƑƥĿƙĚē Čūƙƥ

(

`

cr)

Particulars

As at

March 31, 2019

As at

March 31, 2018

Carrying

amount

Fair value Carrying

amount

Fair value

Financial assets

Investments:

Government securities

0.01

0.01

0.01

0.01

Investment in NHAI bonds

0.10

0.10

0.10

0.10

Security deposits for utilities and premises

ǨȦǪǭ

ǨȦǪǭ

ǧȦǪǮ

ǧȦǪǮ

¹ūƥîŕ ǛŠîŠČĿîŕ îƙƙĚƥƙ

2.58

2.58

1.59

1.59

Financial liabilities

Borrowings

ǫǪȦǭǫ

ǫǪȦǭǫ

15.91

15.91

Security deposits

ǨǫȦǪǨ

ǨǫȦǪǨ

ǨǨȦǪǬ

ǨǨȦǪǬ

¹ūƥîŕ ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙ

80.17

80.17

38.37

38.37

The carrying amounts of trade receivables, cash and cash equivalents, other bank balances, dividend receivables, other

receivables, trade payables, capital creditors, other liabilities are considered to be the same as their fair values due to the

current and short-term nature of such balances.

¹ĺĚ ljîĿƑ DŽîŕƭĚƙ ūlj ŠūŠȹČƭƑƑĚŠƥ ċūƑƑūDžĿŠijƙ îƑĚ ċîƙĚē ūŠ ēĿƙČūƭŠƥĚē Čîƙĺ ǜūDžƙ ƭƙĿŠij î ČƭƑƑĚŠƥ ċūƑƑūDžĿŠij ƑîƥĚȦ ¹ĺĚNj îƑĚ

ČŕîƙƙĿǛĚē îƙ ŕĚDŽĚŕ ǩ ljîĿƑ DŽîŕƭĚƙ ĿŠ ƥĺĚ ljîĿƑ DŽîŕƭĚ ĺĿĚƑîƑČĺNj ēƭĚ ƥū ƥĺĚ ƭƙĚ ūlj ƭŠūċƙĚƑDŽîċŕĚ ĿŠƎƭƥƙȡ ĿŠČŕƭēĿŠij ūDžŠ ČƑĚēĿƥ ƑĿƙŒȦ

GūƑ ǛŠîŠČĿîŕ îƙƙĚƥƙ îŠē ŕĿîċĿŕĿƥĿĚƙ ƥĺîƥ îƑĚ ŞĚîƙƭƑĚē îƥ ljîĿƑ DŽîŕƭĚȡ ƥĺĚ ČîƑƑNjĿŠij îŞūƭŠƥƙ îƑĚ ĚƐƭîŕ ƥū ƥĺĚ ljîĿƑ DŽîŕƭĚƙȦ

Note 29.8 Financial risk management

Risk management is an integral part of the business practices of the Group. The framework of risk management concentrates on

ljūƑŞîŕĿƙĿŠij î ƙNjƙƥĚŞ ƥū ēĚîŕ DžĿƥĺ ƥĺĚ Şūƙƥ ƑĚŕĚDŽîŠƥ ƑĿƙŒƙȡ ċƭĿŕēĿŠij ūŠ ĚNJĿƙƥĿŠij ŞîŠîijĚŞĚŠƥ ƎƑîČƥĿČĚƙȡ ŒŠūDžŕĚēijĚ îŠē ƙƥƑƭČƥƭƑĚƙȦ

ØĿƥĺ ƥĺĚ ĺĚŕƎ ūlj î ƑĚƎƭƥĚē ĿŠƥĚƑŠîƥĿūŠîŕ ČūŠƙƭŕƥîŠČNj ǛƑŞȡ ƥĺĚ HƑūƭƎ ĺîƙ ēĚDŽĚŕūƎĚē îŠē ĿŞƎŕĚŞĚŠƥĚē î ČūŞƎƑĚĺĚŠƙĿDŽĚ ƑĿƙŒ

ŞîŠîijĚŞĚŠƥ ƙNjƙƥĚŞ ƥū ĚŠƙƭƑĚ ƥĺîƥ ƑĿƙŒƙ ƥū ƥĺĚ ČūŠƥĿŠƭĚē ĚNJĿƙƥĚŠČĚ ūlj ƥĺĚ HƑūƭƎ îƙ î ijūĿŠij ČūŠČĚƑŠ îŠē ƥū Ŀƥƙ ijƑūDžƥĺ îƑĚ

ĿēĚŠƥĿǛĚē îŠē ƑĚŞĚēĿĚē ūŠ î ƥĿŞĚŕNj ċîƙĿƙȦ ØĺĿŕĚ ēĚǛŠĿŠij îŠē ēĚDŽĚŕūƎĿŠij ƥĺĚ ljūƑŞîŕĿƙĚē ƑĿƙŒ ŞîŠîijĚŞĚŠƥ ƙNjƙƥĚŞȡ ŕĚîēĿŠij

standards and practices have been considered. The risk management system is relevant to business reality, pragmatic and

simple and involves the following:

Ŀȴ

¤ĿƙŒ ĿēĚŠƥĿǛČîƥĿūŠ îŠē ēĚǛŠĿƥĿūŠȠ GūČƭƙĚē ūŠ ĿēĚŠƥĿljNjĿŠij ƑĚŕĚDŽîŠƥ ƑĿƙŒƙȡ ČƑĚîƥĿŠij ʈ ƭƎēîƥĿŠij ČŕĚîƑ ēĚǛŠĿƥĿūŠƙ ƥū ĚŠƙƭƑĚ

undisputed understanding along with details of the underlying root causes | contributing factors.

ĿĿȴ ¤ĿƙŒ ČŕîƙƙĿǛČîƥĿūŠȠ GūČƭƙĚē ūŠ ƭŠēĚƑƙƥîŠēĿŠij ƥĺĚ DŽîƑĿūƭƙ ĿŞƎîČƥƙ ūlj ƑĿƙŒƙ îŠē ƥĺĚ ŕĚDŽĚŕ ūlj ĿŠǜƭĚŠČĚ ūŠ Ŀƥƙ Ƒūūƥ ČîƭƙĚƙȦ ¹ĺĿƙ

involves identifying various processes generating the root causes and clear understanding of risk inter-relationships.

iii) Risk assessment and prioritisation: Focused on determining risk priority and risk ownership for critical risks. This involves

îƙƙĚƙƙŞĚŠƥ ūlj ƥĺĚ DŽîƑĿūƭƙ ĿŞƎîČƥƙ ƥîŒĿŠij ĿŠƥū ČūŠƙĿēĚƑîƥĿūŠ ƑĿƙŒ îƎƎĚƥĿƥĚ îŠē ĚNJĿƙƥĿŠij ŞĿƥĿijîƥĿūŠ ČūŠƥƑūŕƙȦ

ĿDŽȴ ¤ĿƙŒ ŞĿƥĿijîƥĿūŠȠ GūČƭƙĚē ūŠ îēēƑĚƙƙĿŠij ČƑĿƥĿČîŕ ƑĿƙŒƙ ƥū ƑĚƙƥƑĿČƥ ƥĺĚĿƑ ĿŞƎîČƥȳƙȴ ƥū îŠ îČČĚƎƥîċŕĚ ŕĚDŽĚŕ ȳDžĿƥĺĿŠ ƥĺĚ ēĚǛŠĚē ƑĿƙŒ

îƎƎĚƥĿƥĚȴȦ ¹ĺĿƙ ĿŠDŽūŕDŽĚƙ î ČŕĚîƑ ēĚǛŠĿƥĿūŠ ūlj îČƥĿūŠƙȡ ƑĚƙƎūŠƙĿċĿŕĿƥĿĚƙ îŠē ŞĿŕĚƙƥūŠĚƙȦ

v) Risk reporting and monitoring: Focused on providing to the Board and the Audit Committee periodic information on risk

ƎƑūǛŕĚ ĚDŽūŕƭƥĿūŠ îŠē ŞĿƥĿijîƥĿūŠ ƎŕîŠƙȦ

a) Management of liquidity risk

¹ĺĚ ƎƑĿŠČĿƎîŕ ƙūƭƑČĚƙ ūlj ŕĿƐƭĿēĿƥNj ūlj ƥĺĚ HƑūƭƎ îƑĚ Čîƙĺ îŠē Čîƙĺ ĚƐƭĿDŽîŕĚŠƥƙȡ ċūƑƑūDžĿŠijƙ îŠē ƥĺĚ Čîƙĺ ǜūDž ƥĺîƥ Ŀƙ

generated from operations. The Group believes that current cash and cash equivalents, tied up borrowing lines and cash

ǜūDž ƥĺîƥ Ŀƙ ijĚŠĚƑîƥĚē ljƑūŞ ūƎĚƑîƥĿūŠƙ Ŀƙ ƙƭljǛČĿĚŠƥ ƥū ŞĚĚƥ ƑĚƐƭĿƑĚŞĚŠƥƙȦ ČČūƑēĿŠijŕNjȡ ŕĿƐƭĿēĿƥNj ƑĿƙŒ Ŀƙ ƎĚƑČĚĿDŽĚē ƥū ċĚ ŕūDžȦ

¹ĺĚ ljūŕŕūDžĿŠij ƥîċŕĚ ƙĺūDžƙ ƥĺĚ ŞîƥƭƑĿƥNj îŠîŕNjƙĿƙ ūlj ǛŠîŠČĿîŕ ŕĿîċĿŕĿƥĿĚƙ ūlj ƥĺĚ HƑūƭƎ ċîƙĚē ūŠ ČūŠƥƑîČƥƭîŕŕNj îijƑĚĚē

ƭŠēĿƙČūƭŠƥĚē Čîƙĺ ǜūDžƙ îƙ îƥ ƥĺĚ ūŠƙūŕĿēîƥĚē îŕîŠČĚ ¬ĺĚĚƥ ēîƥĚȠ

Consolidated

|

Notes to the Financial Statements

231