Directors’ Report

Dear Members,

The Board of Directors (Board) presents the Annual Report of Atul Ltd together with the audited Financial Statements for the

year ended March 31, 2019.

01.

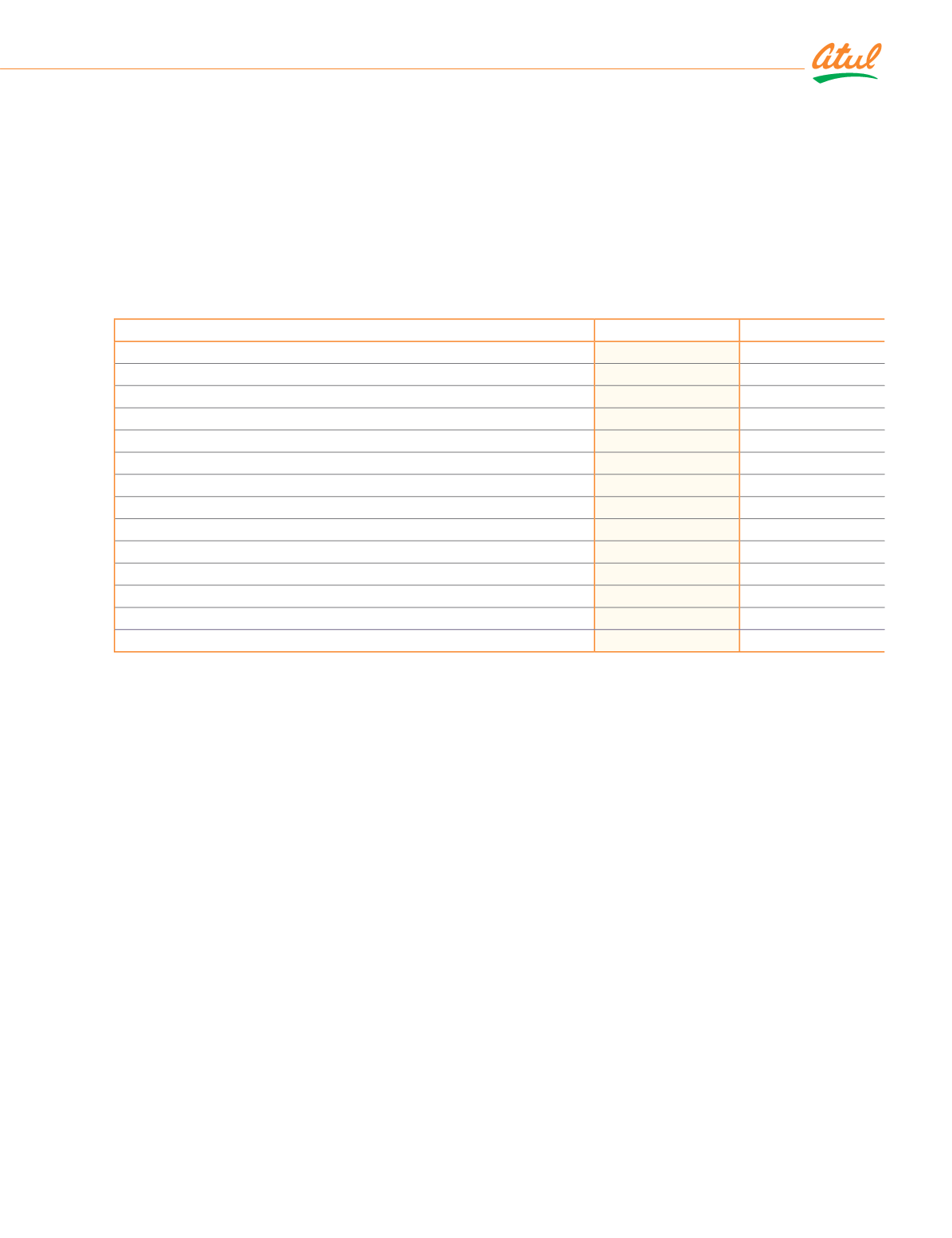

Financial results

(

`

cr

)

2018-19

2017-18

Sales

3,845

3,052

Revenue from operations

3,916

3,148

Other income

31

38

Total revenue

3,947

3,186

¡ƑūǛƥ ċĚljūƑĚ ƥîNJ

652

397

¡ƑūDŽĿƙĿūŠ ljūƑ ƥîNJ

223

127

¡ƑūǛƥ ljūƑ ƥĺĚ NjĚîƑ

429

270

Balance brought forward

1,637

1,397

Transfer from comprehensive income

-

3

Disposable surplus

2,066

1,670

Less:

Dividend paid

36

30

'ĿDŽĿēĚŠē ēĿƙƥƑĿċƭƥĿūŠ ƥîNJ ȳŠĚƥȴ

4

3

Balance carried forward

2,026

1,637

02.

Performance

Sales increased by 26% from

`

3,052 cr to

`

3,845 cr

mainly due to better price realisation. Sales in

India increased by 26% from

`

1,538 cr to

`

1,937 cr.

Sales outside India increased by 26% from

`

1,514

cr to

`

1,908 cr. The earnings per share increased

from

`

91.16 to

`

ǧǪǪȦǫǧȦ îƙĺ ǜūDž ljƑūŞ ūƎĚƑîƥĿŠij

activities before working capital changes increased

by 60% from

`

480 cr to

`

770 cr and the net cash

ǜūDž ljƑūŞ ūƎĚƑîƥĿŠij îČƥĿDŽĿƥĿĚƙ ĿŠČƑĚîƙĚē ċNj ǨǨɼ

from

`

325 cr to

`

397 cr.

Sales of Life Science Chemicals (LSC) segment

increased by 26% from

`

1,027 cr to

`

1,289 cr,

mainly because of higher sales in sub-segments

Aromatics-I, Crop Protection and Pharmaceuticals;

its EBIT increased by 81% from

`

120 cr to

`

217 cr. Sales of Performance and Other Chemicals

(POC) segment increased by 26% from

`

2,025 cr

to

`

2,556 cr mainly because of higher sales in

sub-segments Aromatics - II and Polymers; its EBIT

increased by 61% from

`

281 cr to

`

453 cr. More

details are given in the Management Discussion

and Analysis (MDA) Report.

03.

Dividend

The Board recommends payment of dividend of

`

15

per share on 2,96,61,733 equity shares of

`

10 each

ljƭŕŕNj ƎîĿēȹƭƎȦ ¹ĺĚ ēĿDŽĿēĚŠē DžĿŕŕ ĚŠƥîĿŕ îŠ ūƭƥǜūDž ūlj

`

ǫǩȦǬǪ ČƑ ȯĿŠČŕƭēĿŠij ēĿDŽĿēĚŠē ēĿƙƥƑĿċƭƥĿūŠ ƥîNJ ȳŠĚƥȴȰ

on the paid-up equity share capital of

`

29.66 cr.

04.

Conservation of energy, technology absorption,

foreign exchange earnings and outgo

Information required under Section 134 (3)(m) of

the Companies Act, 2013, (the Act) read with Rule

8(3) of the Companies (Accounts) Rules, 2014, as

amended from time to time, forms a part of this

Report which is given at page number 29.

05.

Insurance

The Company has taken adequate insurance to

cover the risks to its employees, property (land and

buildings), plant, equipment, other assets and third

parties.

06.

Risk management

The Board has constituted Risk Management

Committee effective April 01, 2019.

23