Corporate Identity Serving Diverse Industries Purpose and Values Overview by the Chairman Operational Highlights Financial Analysis Research and Technology

Safety, HealthandEnvironment Serving the Society Directors’ Report Management Discussion andAnalysis Report on Corporate Governance

Financial Statements

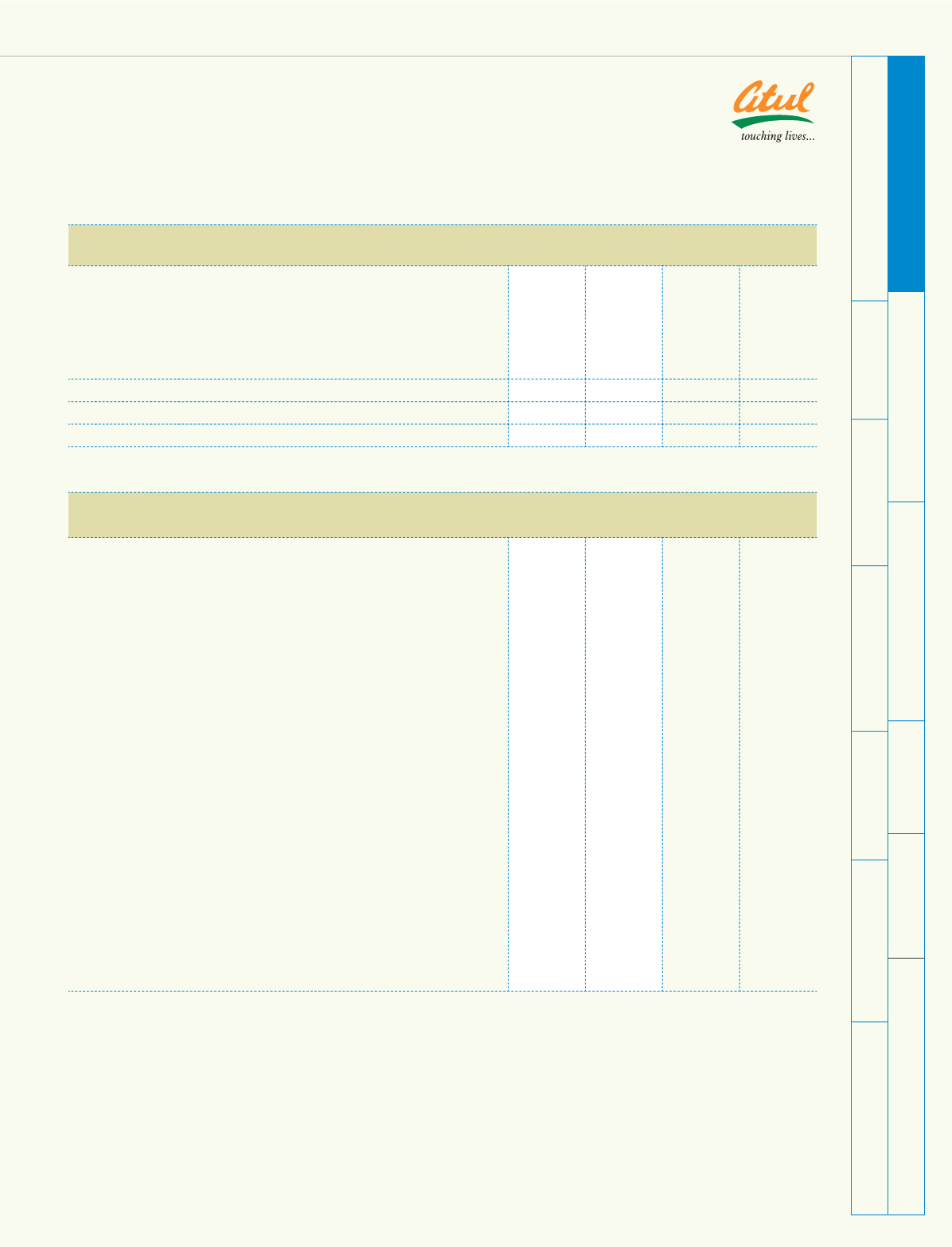

Hedging reserve (see Note 11)

(15.03)

-

General reserve

As per last account

42.71

38.93

Add: Transferred from Central and state subsidy reserve

0.98

-

Add: Set aside this year

5.68

3.79

49.37

42.71

Surplus as per annexed Account

265.21

229.22

458.16

426.95

(Rs crores)

Schedule 3 Secured Loans

As at

March 31, 2010

As at

March 31, 2009

Term loans from Financial Institutions | Banks

Foreign Currency Term loans

State Bank of Travancore - (a)

12.30

20.83

Bank of India - (a)

11.39

21.42

Indian Overseas Bank Ltd - (a)

11.28

19.11

Bank of India, New York - ECB (a)

-

3.19

Bank of India - (a)

-

3.18

Rupee Term Loans

International Finance Corporation - ECB (b)

78.12

78.12

Bank of Rajasthan - (a)

22.49

-

State Bank of Hyderabad - (a)

18.75

25.00

The Karur Vysya Bank Ltd - (a)

17.50

20.20

EXIM Bank - (a)

12.40

18.60

EXIM Bank - (a)

9.97

13.59

State Bank of Hyderabad - (a)

9.36

15.61

State Bank of Indore - (a)

4.98

9.98

Life Insurance Corporation of India - (a)

2.00

6.00

State Bank of India - (b)

0.02

0.03

Indian Overseas Bank - (a)

-

24.98

ICICI Bank Ltd

-

0.14

(Rs crores)

Schedule 2 Reserves and Surplus

(contd)

As at

March 31, 2010

As at

March 31, 2009

Schedule

forming part of Consolidated Balance Sheet As at March 31, 2010