Corporate Identity Serving Diverse Industries Purpose and Values Overview by the Chairman Operational Highlights Financial Analysis Research and Technology

Safety, HealthandEnvironment Serving the Society Directors’ Report Management Discussion andAnalysis Report on Corporate Governance

Financial Statements

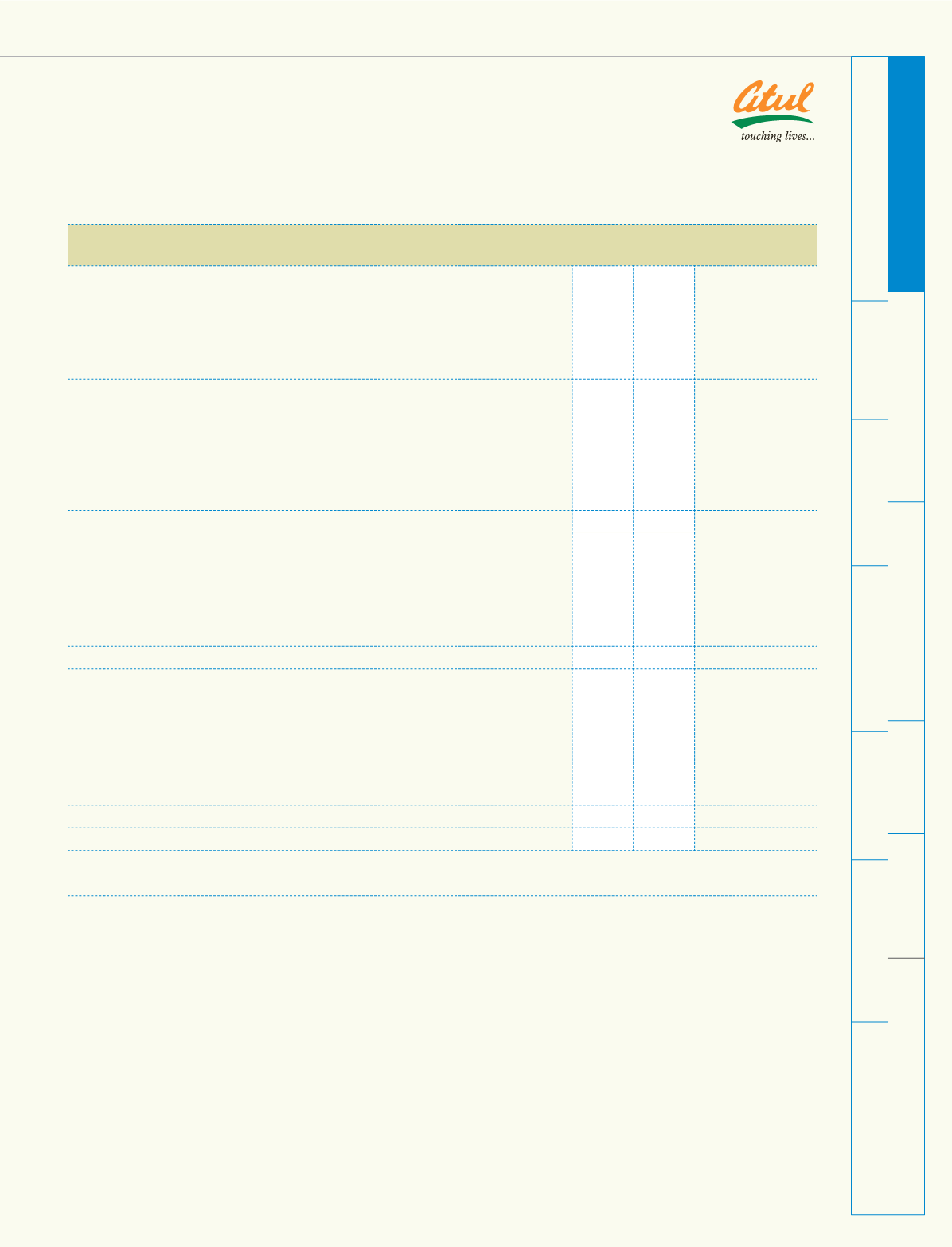

(Rs crores)

Schedule 8 Current Liabilities and Provisions

As at

March 31, 2010

As at

March 31, 2009

(a) Liabilities

Acceptances

12.40

29.80

Sundry creditors

(i) Due to Micro, Small and Medium Enterprise

0.20

0.24

(ii) Due to others

256.47

147.88

256.67

148.12

Investors Education and Protection Fund shall be credited by the

following (see Note below)

Unclaimed dividends

0.77

0.69

Matured fixed deposits Rs Nil (Previous year Rs 10,000)

-

Interest payable on fixed deposits

0.25

0.15

1.02

0.84

Interest accrued but not due on loans

1.40

1.41

Unclaimed amount of sale proceeds of fractional coupons of bonus

shares of erstwhile The Atul Products Ltd

0.10

0.10

Unclaimed amount of sale proceeds of fractional coupons of bonus shares

0.01

0.01

271.60

180.28

(b) Provisions

For contingencies

2.75

2.75

For unencashed leave

13.17

12.22

Provision for Derivatives (see Note 11)

20.18

12.60

For dividend tax

1.97

1.51

Proposed dividend

11.87

8.90

49.94

37.98

321.54

218.26

Note:

There is no amount due and outstanding to be credited to Investor Education and Protection fund as at March 31, 2010.

Schedule

forming part of Consolidated Balance Sheet As at March 31, 2010