110 /

Atul Ltd

|

Annual Report 2009-10

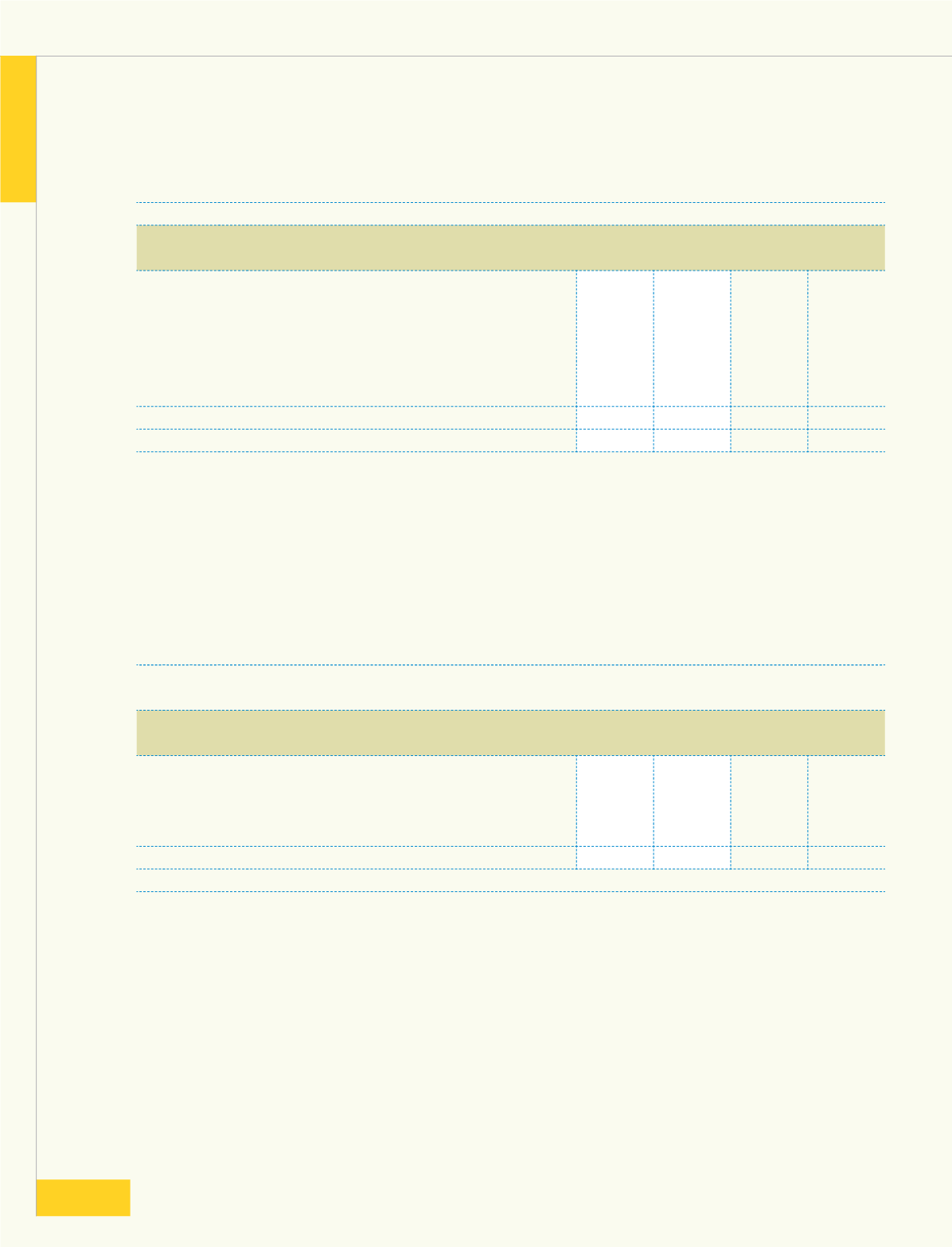

(Rs crores)

Schedule 3 Secured Loans

(contd)

As at

March 31, 2010

As at

March 31, 2009

Working capital loans from Banks (c)

Cash credit

8.42

17.89

Working capital demand loan

10.00

-

Packing credit

-

23.61

Bills discounting

0.10

7.03

Buyer's credit

29.93

7.50

48.45

56.03

259.01

336.01

Notes:

(a) Secured by first pari passu charge on the fixed assets of the Company as a whole, both present and future,

excluding specific assets with specific charge.

(b) Secured by first pari passu charge by way of hypothecation of all the movable fixed assets and mortgage of the

immovable properties of the Company, present and future, excluding specific assets with exclusive charge and

second charge on the entire current assets of the Company, present and future.

(c) Secured by hypothecation of tangible current assets (other than movable machinery), namely raw materials,

finished and semi finished goods, inventories and book-debts of the Company as a whole and also secured by

second and subservient charge on immovable assets of the Company to the extent of individual bank's limit

as mentioned in joint consortium documents. This also extends to guarantee given by the bankers. Amount of

guarantee outstanding at the end of the year Rs 24.75 crores (Previous year Rs 31.49 crores).

(Rs crores)

Schedule 4 Unsecured Loans

As at

March 31, 2010

As at

March 31, 2009

Fixed deposits *

16.87

10.75

Interest accrued on cumulative deposits

0.90

0.66

From companies

-

0.17

From banks

18.30

21.92

36.07

33.50

* Including from Chairman and Managing Director Rs 0.40 crore (Previous year Rs Nil)

Schedule

forming part of Consolidated Balance Sheet As at March 31, 2010

111