189

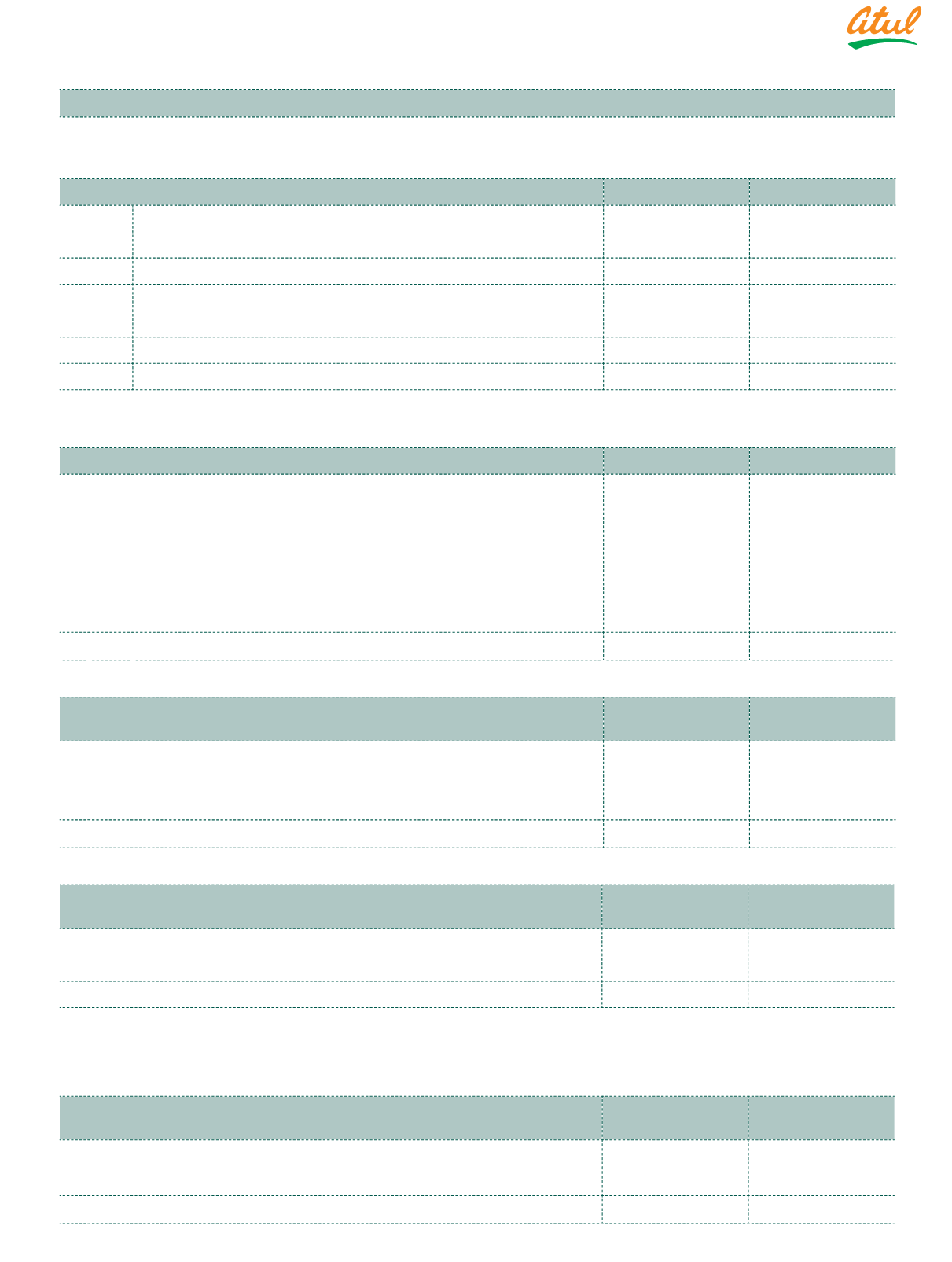

Note 29.5 Current and Deferred tax

(continued)

b) Income tax expense recognised in Statement of Other Comprehensive Income:

(

`

cr)

Particulars

2017-18

2016-17

i)

Current tax

Remeasurement gain | (loss) on defined benefit plans

0.95

0.85

Total current tax expense

0.95

0.85

ii)

Deferred tax

Effective portion of gain | (loss) on cash flow hedges

0.02

(0.25)

Total deferred tax expense | (benefit)

0.02

(0.25)

Income tax expense

0.97

0.60

c) The reconciliation between the Statutory income tax rate applicable to the Group and the effective income

tax rate of the Group is as follows:

Particulars

2017-18

2016-17

a) Statutory income tax rate

34.61%

34.61%

b) Differences due to:

i)

Expenses not deductible for tax purposes

1.05%

0.76%

ii)

Income exempt from income tax

(1.63%)

(2.33%)

iii)

Income tax incentives

(0.50%)

(3.37%)

iv)

Others

(1.69%)

(0.04%)

Effective income tax rate

31.84%

29.63%

d) Current tax liabilities (net)

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Opening balance

3.39

0.59

Add: Current tax payable for the year

108.16

87.11

Less: Taxes paid

(103.42)

(84.31)

Closing balance

8.13

3.39

e) Current tax assets (net)

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Opening balance

1.21

4.36

Add: Tax paid in advance, net of provisions during the year

1.37

(3.15)

Closing balance

2.58

1.21

f) Deferred tax liabilities | (assets)

The following is the analysis of deferred tax liabilities | (assets) balances presented in the Consolidated Balance Sheet:

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Deferred tax liabilities

129.55

104.09

Deferred tax assets

(5.01)

(2.67)

124.54

101.42

Notes

to the Consolidated Financial Statements