Atul Ltd | Annual Report 2017-18

Note 29.5 Current and Deferred tax

(continued)

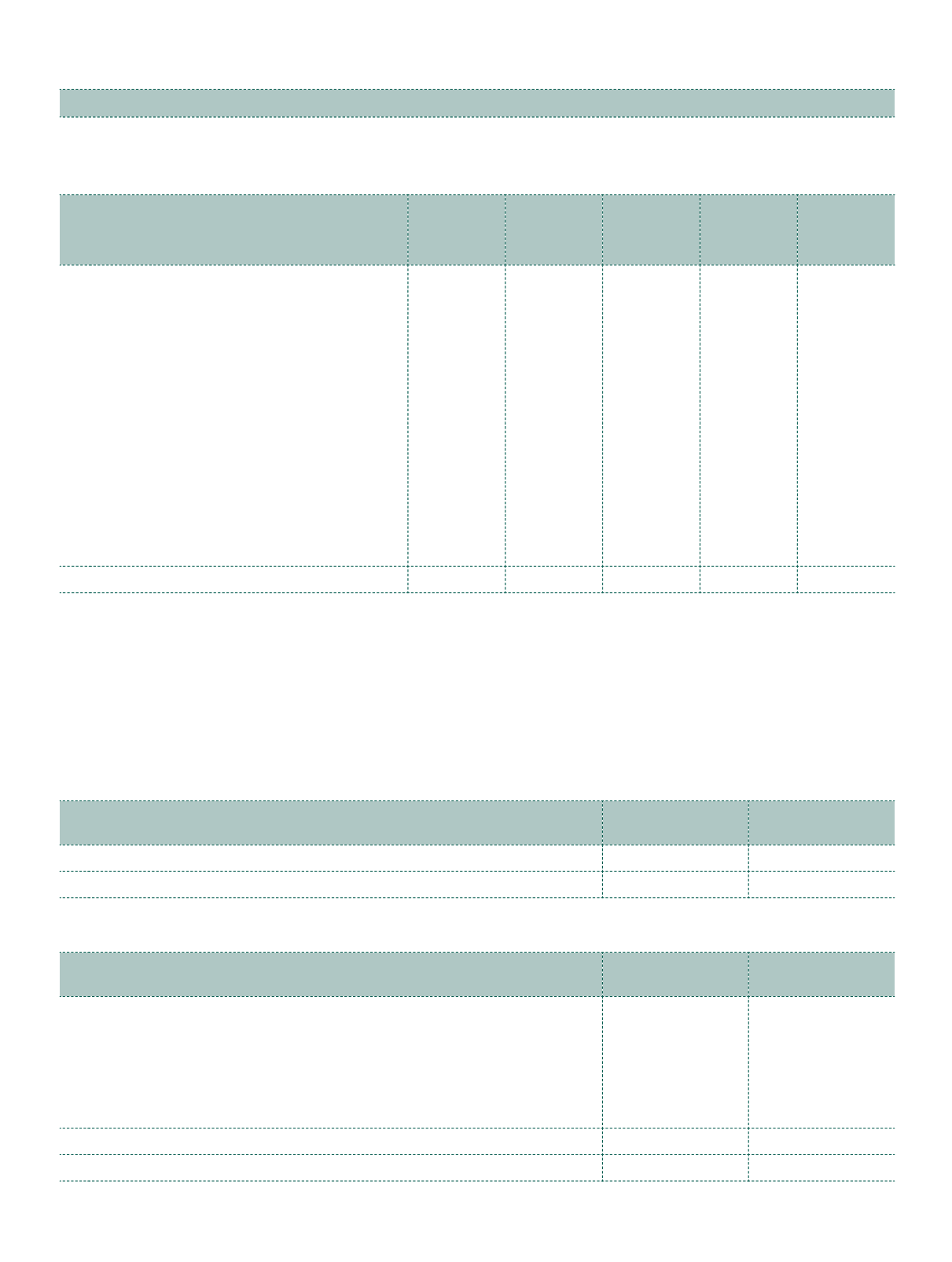

The balance comprises temporary differences attributable to the below items and corresponding movement in deferred tax

liabilities | (assets):

(

`

cr)

Particulars

As at

March 31,

2018

(Charged) |

Credited to

profit or loss

| OCI | equity

As at

March 31,

2017

(Charged) |

Credited to

profit or loss

| OCI | equity

As at

March 31,

2016

Property, plant and equipment

145.23

2.15

143.08

63.73

79.35

Provision for leave encashment

(8.09)

1.15

(9.24)

(1.24)

(8.00)

Provision for doubtful debts

(1.65)

(0.55)

(1.10)

0.22

(1.32)

Provision for doubtful advances

–

–

–

0.07

(0.07)

Unabsorbed depreciation*

(2.35)

–

(2.35)

(2.35)

–

Investment properties

(6.21)

(2.26)

(3.95)

(0.18)

(3.77)

Unrealised MTM losses on derivatives (CIRS)

–

1.75

(1.75)

(1.75)

–

Effective portion of gain | (loss) on cash flow

hedges

0.02

0.27

(0.25)

0.06

(0.31)

Elimination of profits resulting from intra-group

transactions

(2.30)

(2.30)

–

–

–

MAT credit entitlement

(0.11)

22.91

(23.02)

(22.95)

(0.07)

Net deferred tax (assets) | liabilities

124.54

23.12

101.42

35.61

65.81

* The Group has recognised deferred tax assets on carried forward tax losses and unabsorbed depreciation of Amal Ltd. The subsidiary

company has incurred the losses over the last few financial years. The Group has recognised deferred tax assets to the extent of deductible

temporary difference. The subsidiary company is currently generating and expected to generate taxable income from 2018 onwards. The

losses can be carried forward for a period of 8 years as per local tax regulations and the Group expects to recover the losses.

g)

Deferred tax assets have not been recognised in respect of these losses as they may not be used to offset taxable profits

elsewhere in the Group, they have arisen in subsidiary companies that were loss-making for sometime, and there are no

other tax planning opportunities or other evidence of recoverability in the near future.

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Unused tax losses for which no deferred tax asset has been recognised

23.72

23.71

Potential tax benefit @ 34.61%

8.21

8.21

As at March 31, 2018 the Group has net operating losses and carry forwards that will expire as follows:

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Net operating losses

2019-20

0.81

0.80

2020-21

0.31

0.31

2021-22

0.24

0.24

2022-23

0.14

0.14

Unabsorbed depreciation

Indefinitely

22.22

22.22

Notes

to the Consolidated Financial Statements