191

Note 29.5 Current and Deferred tax

(continued)

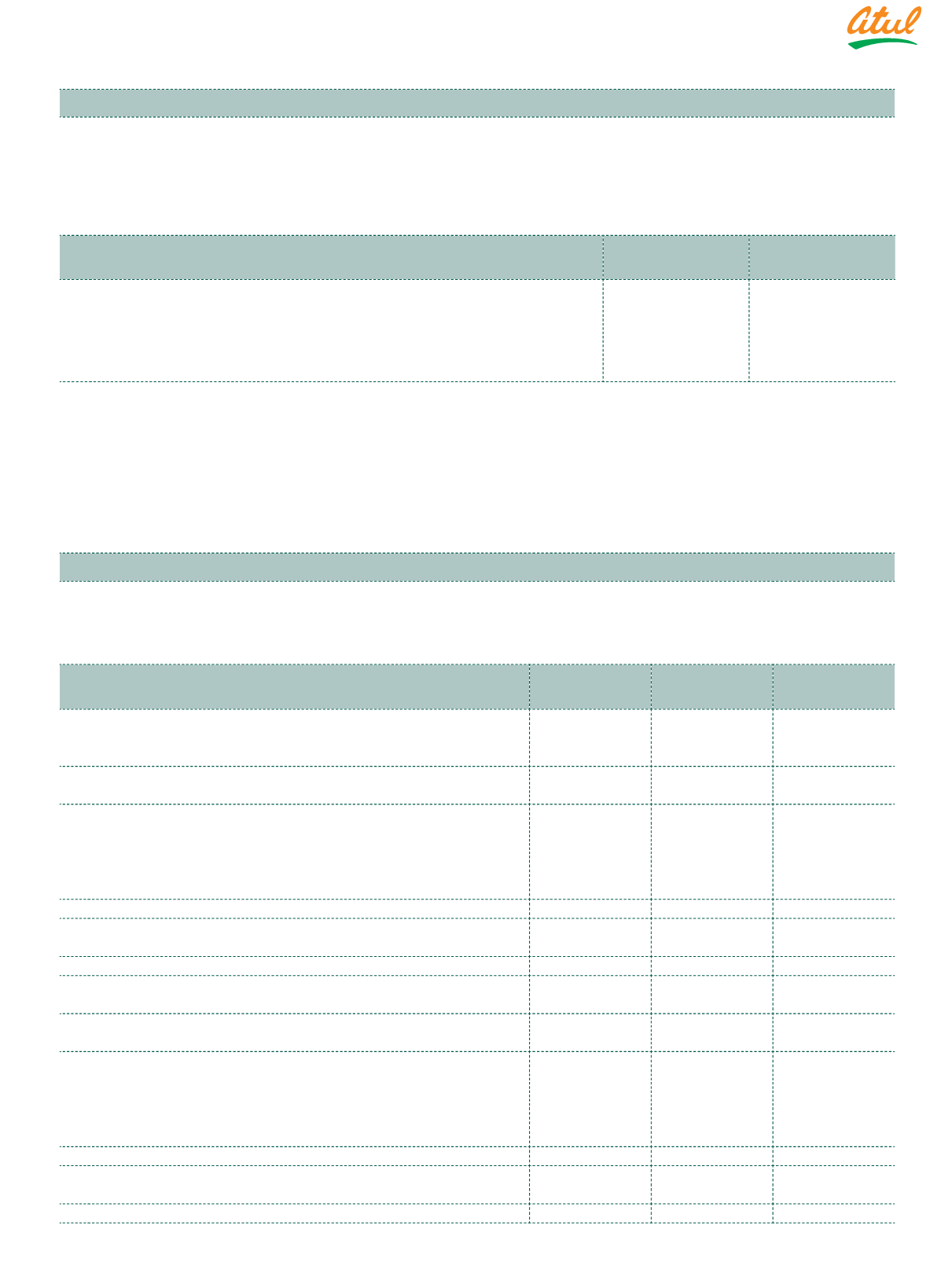

h) Unrecognised temporary differences

The Group has not recognised deferred tax liability associated with undistributed earnings of its subsidiary companies as it

can control the timing of the reversal of these temporary differences and it is probable that such differences will not reverse

in the foreseeable future.

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

Temporary difference relating to investments in subsidiary companies for

which deferred tax liabilities have not been recognised:

Undistributed earnings

7.08

19.35

Unrecogniseddeferredtaxliabilitiesrelatingtotheabovetemporarydifferences

@ 17.30%

1.23

3.35

The Group has not recognised deferred tax liability | asset associated with fair value gain | (loss) on equity share measured

at OCI as based on the Management projection of future taxable income and existing plan, it is not probable that such

difference will reverse in the foreseeable future.

i) Effective income tax rate

The effective income tax rate up to March 31, 2018 is 34.61%. The increase in effective income tax rate to 34.94% was

announced in Union Budget 2018 which was substantively enacted on March 29, 2018 and will be effective from April 01,

2018. As a result, the relevant deferred tax balances has been remeasured using revised effective income tax rate.

Note 29.6 Employee benefit obligations

a) Defined benefit plans:

Balance Sheet amount (Gratuity)

(

`

cr)

Particulars

Present value of

obligation

Fair value of

plan assets

Net amount

As at March 31, 2016

48.02

(47.96)

0.06

Current service cost

2.67

–

2.67

Interest expense | (income)

3.73

(3.73)

–

Total amount recognised in the Consolidated Statement

of Profit and Loss

6.40

(3.73)

2.67

Remeasurement

Return on plan assets, excluding amount included in interest

expense | (income)

0.02

(1.98)

(1.96)

(Gain) | Loss from change in financial assumptions

1.14

–

1.14

Experience (gain) | loss

(1.64)

–

(1.64)

Total amount recognised in Other Comprehensive Income

(0.48)

(1.98)

(2.46)

Employer contributions

–

(0.18)

(0.18)

Benefit payments

(5.85)

5.85

–

As at March 31, 2017

48.09

(48.00)

0.09

Current service cost

2.96

–

2.96

Interest expense | (income)

3.46

(3.46)

–

Total amount recognised in the Consolidated Statement

of Profit and Loss

6.42

(3.46)

2.96

Remeasurement

Return on plan assets, excluding amount included in interest

expense | (income)

–

0.07

0.07

(Gain) | Loss from change in financial assumptions

(1.13)

–

(1.13)

Experience (gain) | loss

(1.66)

–

(1.66)

Total amount recognised in Other Comprehensive Income

(2.79)

0.07

(2.72)

Employer contributions

–

(0.28)

(0.28)

Benefit payments

(5.22)

5.18

(0.04)

As at March 31, 2018

46.50

(46.49)

0.01

Notes

to the Consolidated Financial Statements