25

Dear Members,

The Board of Directors (Board) presents the Annual Report of Atul Ltd together with the audited statement of accounts for the

year ended March 31, 2014.

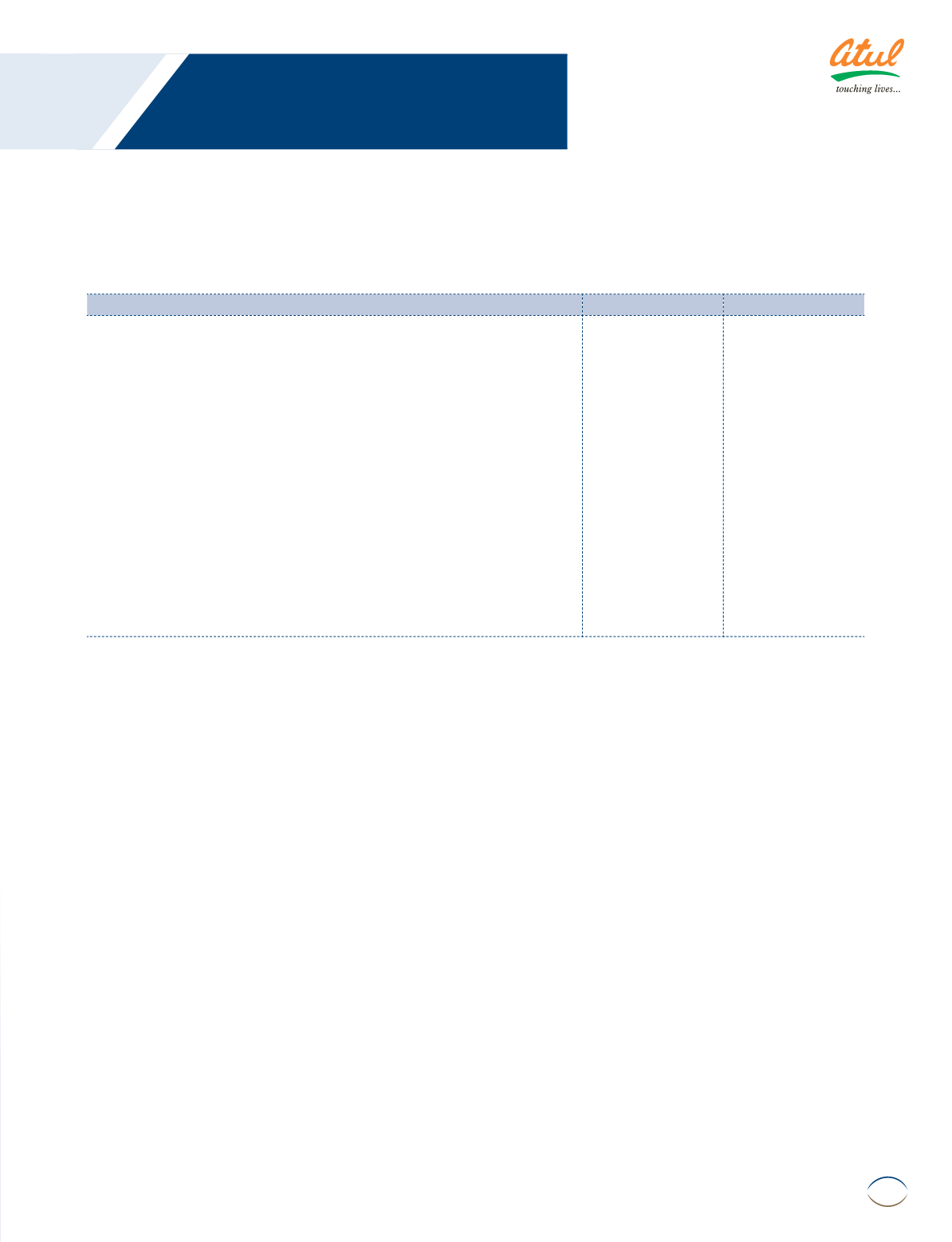

Financial Results

(

`

cr)

2013-14

2012-13

Sales

2,307

1,964

Revenue from operations

2,365

2,001

Other income

40

21

Total revenue

2,405

2,022

Profit before tax

297

192

Provision for tax

84

56

Profit for the year

213

136

Tax adjustments for the earlier years

-

-

Profit available for appropriation

213

136

Balance brought forward

498

397

Disposable surplus

711

533

Appropriations

General reserve

21

14

Proposed dividend

22

18

Dividend distribution tax

4

3

Balance carried forward

664

498

Performance

Sales increased by 17% from

`

1,964 cr to

`

2,307cr aided

by both higher volumes (8%) and prices (9%). Sales in India

increased by 22% from

`

986 cr to

`

1,199 cr. Sales outside of

India increased by 13% from

`

978 cr to

`

1,108 cr. Revenue

from operations increased by 18% from

`

2,001 cr to

`

2,365

cr. PBT for the year includes about

`

20 cr of one-time special

dividend income received; including such special income, the

earnings per share increased from

`

45.69 to

`

71.74. While the

operating profit before working capital changes increased by

38% from

`

260 cr to

`

360 cr, the net cash flow from operating

activities declined by 16% from

`

167 cr to

`

141 cr mainly on

account of the growth in working capital consequent to the

higher level of sales achieved.

Both the Segments of the Company, namely, Life Science

Chemicals Segment (LSC) and Performance and Other Chemicals

Segment (POC) showed improvement in performance. The

sales of LSC increased by 6% from

`

699 cr to

`

738 cr, aided

by higher sales of Crop Protection and Pharmaceuticals and

Intermediates and its EBIT increased by 8% from

`

139 cr to

`

150 cr. The sales of POC increased by 24% from to

`

1,265 cr

`

1,569 cr, supported by growth in Colors and Polymers and its

EBIT increased from

`

90 cr to

`

173 cr. More details are given in

the ‘Management Discussion and Analysis’ Report.

The Company reduced its borrowings (including current

maturities on long-term borrowings) by 1% from

`

355 cr to

`

351 cr despite the growth in working capital to support higher

sales and payments towards capital expenditure of about

`

100 cr.

The Company improved its credit rating from ‘AA-‘ (double A

minus) to ‘AA’ (double A) for its long-term borrowings, awarded

by CARE. Its rating for short-term borrowings and commercial

paper remained at A1+, the highest possible, awarded by CARE.

The Company is in the process of implementing 33 projects with

a total outlay of about

`

480 cr; these projects are expected to

be commissioned in during 2014-15 and 2015-16. It completed

14 projects related to environment protection during 2013-14

and is expected to complete 8 more projects for reducing and

treating pollutants.

Dividend

The Board recommends payment of dividend of

`

7.50 per

share on 2,96,61,733 Equity Shares of

`

10 each fully paid-

up. The dividend will entail an outflow of

`

26 cr (including

dividend distribution tax) on the paid-up Equity Share capital

of

`

29.66 cr.

Management Discussion and Analysis

Management Discussion and Analysis covering performance of

the two Reporting Segments, namely, Life Science Chemicals

and Performance and Other Chemicals, is given at page no 27

to 33.

Directors’ Report