Atul Ltd | Annual Report 2013-14

ii)

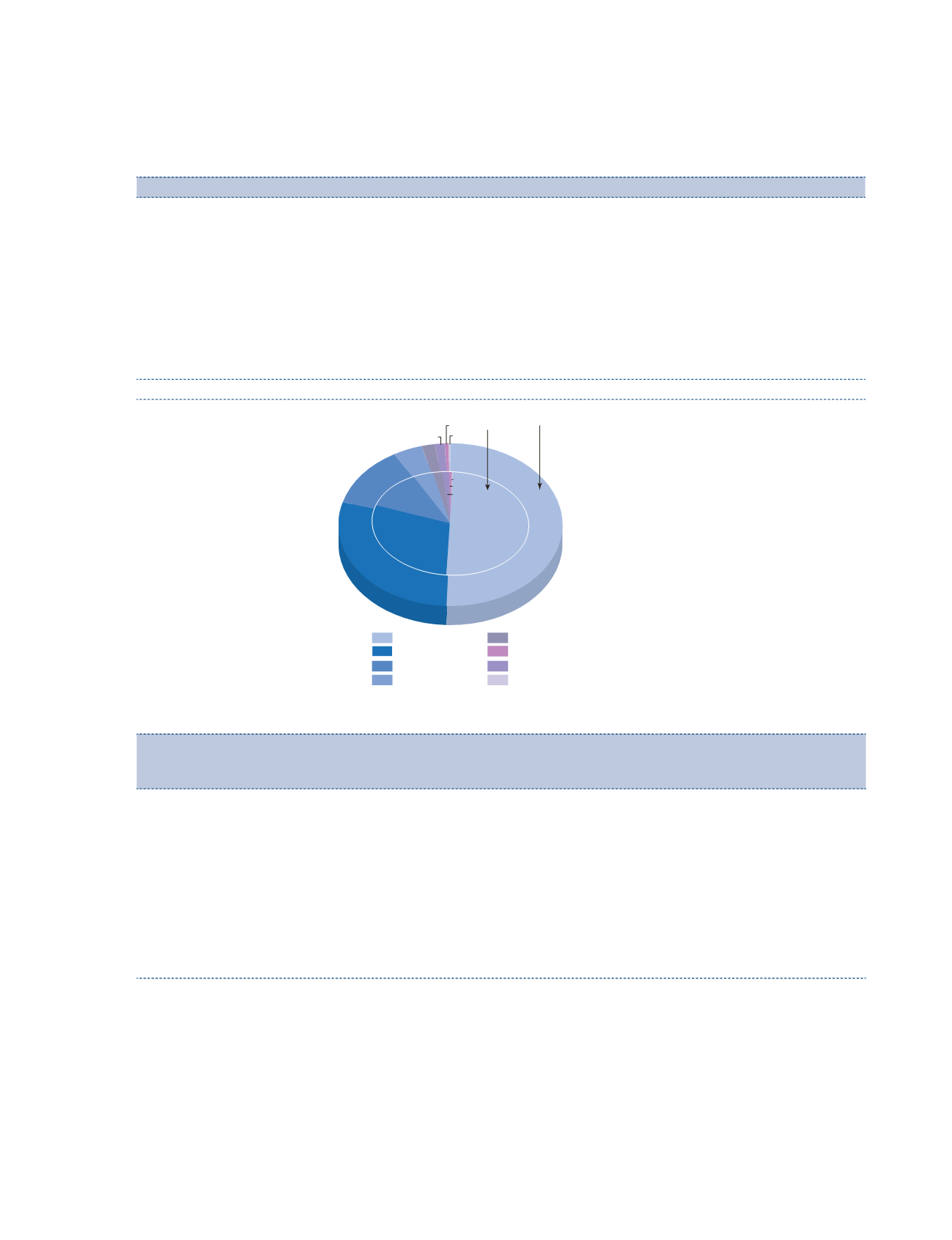

Category-wise:

Category

Shares (Numbers) Shareholding (%)

Promoter group

1,50,13,610

50.62

Indian public

86,24,644

29.07

Corporate bodies

35,91,871

12.11

Mutual funds

12,40,338

4.18

Insurance companies

5,54,115

1.87

Foreign institutional investors

4,29,445

1.45

Non-resident Indians | Overseas corporate bodies

1,49,320

0.50

Banks

58,054

0.20

State Government

336

0.00

Total

2,96,61,733

100.00%

Insurance companies

FIIs

NRIs | OCBs

Banks

2012-13

50.36 50.62

29.07

12.11

4.18

1.87

1.45 0.20

0.50

28.87

13.60

4.32

1.87

0.45

0.33

2013-14

Promoter group

Indian public

Corporate bodies

Mutual funds

0.20

7.12 Details of Equity Shares in unclaimed suspense account

Particulars

Shareholders

(Numbers)

Unclaimed

Shares

(Numbers)

1. Opening balance of Equity Shares in unclaimed suspense account as on

April 01, 2013

1,106

41,498

2. Unclaimed Equity Shares transferred to unclaimed suspense account during

the year

Nil

Nil

Total

1,106

41,498

3. Transferred to Shareholders from unclaimed suspense account

Nil

Nil

4. Balance of Equity Shares in unclaimed suspense account as on March 31, 2014

(1+2-3)

1,106

41,498

Number of Shareholders who approached the Company for transfer of Equity Shares

from unclaimed suspense account

Nil

Nil

7.13 Dematerialisation of shares and liquidity

Electronic holding by the Members comprising 96.35% of the paid-up equity share capital of the Company and 3.65%

were in physical form as on March 31, 2014.

7.14 Outstanding GDRs | ADRs | warrants or any convertible instruments, conversion date and likely

impact on equity

Paid-up share capital of the Company comprises Equity Shares. It does not have any Preference Shares, outstanding

ADRs, GDRs, warrants or any convertible instruments.