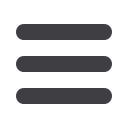

205

As at April 01, 2015

(

`

cr)

Type of hedge and risks

Notional value Carrying amount of

hedging instrument

Maturity Weighted

average

strike price|

interest rate

Changes in

fair value

of hedging

instrument

Change in

the value

of hedged

item used as

the basis for

recognising

hedge

effectiveness

Assets Liabilities Assets Liabilities

Cash flow hedge

`

: USD $

Foreign exchange risk

Foreign exchange forward

contracts

4.38

12.55

0.01

(0.45)

1-12

months

65.02

(0.44)

(0.44)

Currency range options

162.74

–

0.27

–

1-12

months

63.26-

68.47

0.27

0.27

Interest rate risk

Interest rate swaps

–

15.62

–

(0.11)

1-15

months

3.91

(0.11)

(0.11)

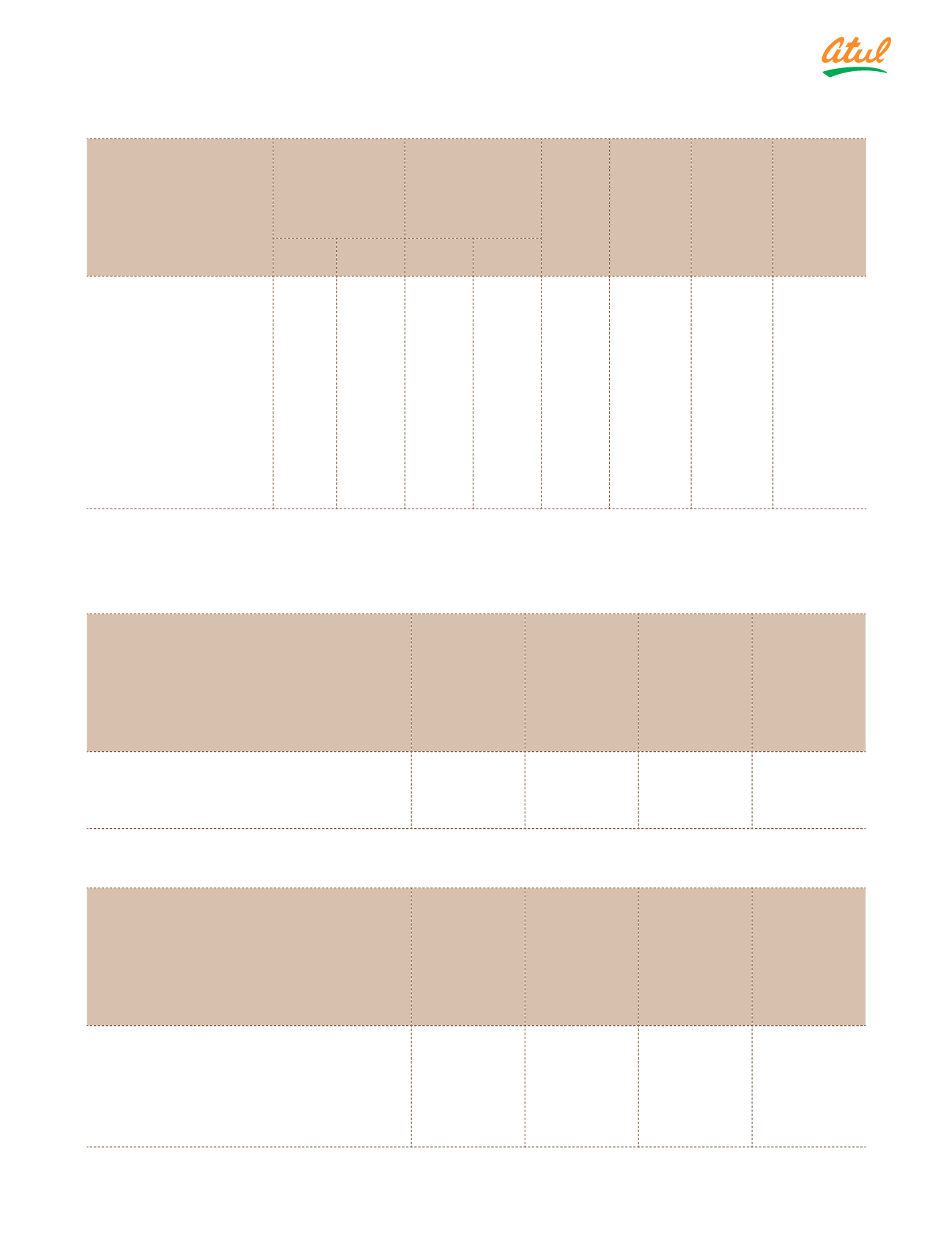

b) Disclosure of effects of hedge accounting on financial performance

As at March 31, 2017

(

`

cr)

Type of hedge

Change in

the value of

the hedging

instrument

recognised

in Other

Comprehensive

Income

Hedge

ineffectiveness

recognised in

profit or loss

Amount

reclassified

from cash flow

hedging reserve

to profit or loss

Financial

Statement line

item affected

Cash flow hedge

i)

Foreign exchange risk

(0.73)

–

(0.89) Revenue and

finance cost

As at March 31, 2016

(

`

cr)

Type of hedge

Change in

the value of

the hedging

instrument

recognised

in Other

Comprehensive

Income

Hedge

ineffectiveness

recognised in

profit or loss

Amount

reclassified

from cash flow

hedging reserve

to profit or loss

Financial

Statement line

item affected

Cash flow hedge

i)

Foreign exchange risk

(0.89)

–

(0.17)

Revenue and

finance cost

ii) Interest rate risk

(0.01)

–

(0.11)

Revenue and

finance cost

Notes

to the Consolidated Financial Statements