203

Note 29.8 Financial Risk Management

(continued)

ii)

Foreign exchange risk

The Group has international

operations and is exposed to

foreign exchange risk arising from

foreign

currency

transactions.

Foreign exchange risk arises from

future commercial transactions

and recognised Financial assets

and liabilities denominated in a

currency that is not the functional

currency (INR) of the Group. The

risk also includes highly probable

foreign currency cash flows. The

objective of the cash flows hedges is

to minimise the volatility of the cash

flows of highly probable forecast

transactions.

The Group has exposure arising

out of export, import, loans and

other transactions other than

functional risk. The Group hedges its

foreign exchange risk using foreign

exchange forward contracts and

currency options after considering

the natural hedge. The same is

within the guidelines laid down

by Risk Management Policy of the

Group.

As an estimation of the approximate

impact of the foreign exchange

rate risk, with respect to Financial

Statements, the Group has calculated

the follows:

For derivative and non-derivative

financial instruments, a 2% increase

in the spot price as on the reporting

date would have led to an increase

in additional

`

2.05 cr gain in Other

Comprehensive Income (2015-16:

gain of

`

1.16 cr). A 2% decrease

would have led to an increase in

additional

`

0.65 cr loss in Other

Comprehensive Income (2015-16:

gain of

`

0.17 cr).

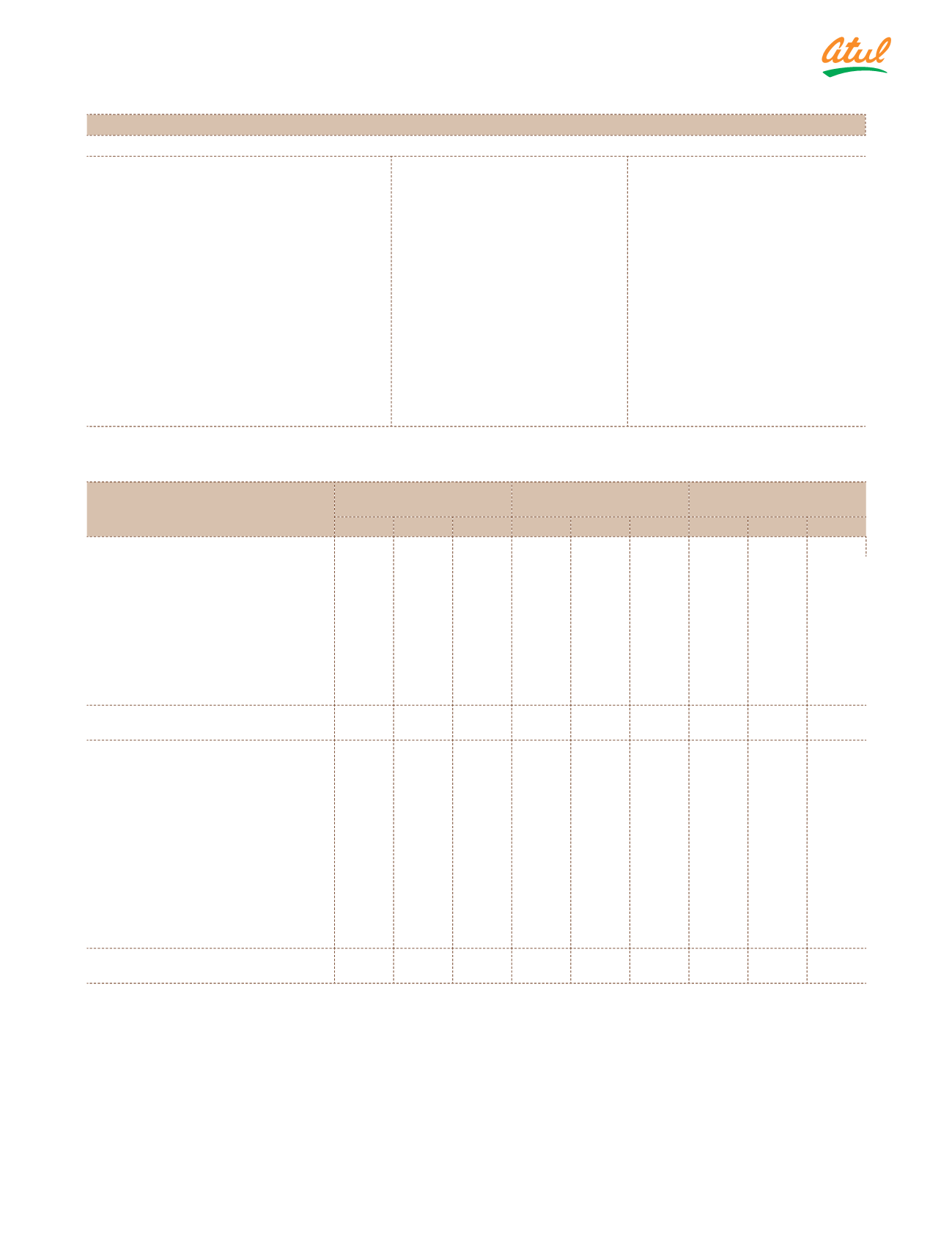

Foreign currency risk exposure:

The exposure to foreign currency risk of the Group at the end of the reporting period expressed in

`

cr, are as follows:

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

USD EUR GBP USD EUR GBP USD EUR GBP

Financial assets

Trade receivables

175.07

5.89

– 154.31

3.94

0.01 108.56

6.75

0.53

Less:

Hedged

through

derivatives

(Includes hedges for highly probable

transactions up to next 12 months)

Foreign exchange forward contracts

–

–

–

–

–

– 4.38

–

–

Currency range options

49.60

–

– 83.25

–

– 162.74

–

–

Currency vanilla options

–

–

–

44.00

–

–

–

–

–

Net exposure to foreign currency risk

(assets)

125.47

5.89

– 27.06

3.94

0.01 (58.56)

6.75

0.53

Financial liabilities

Borrowings

69.15

–

– 95.21

–

– 97.93

–

–

Trade payables

51.06

1.50

– 35.26

0.73

0.77

37.07

0.01

0.03

Capital creditors

0.16

–

–

–

–

–

–

–

–

Less:

Hedged

through

derivatives

(Includes hedges for highly probable

transactions up to next 12 months)

Foreign exchange forward contracts

58.35

–

– 59.98

–

– 12.52

–

–

Interest rate swaps

–

–

– 2.07

–

– 12.39

–

–

Currency swaps

10.80

–

– 33.17

–

– 52.16

–

–

Net exposure to foreign currency risk

(liabilities)

51.22

1.50

–

35.25

0.73

0.77 57.93

0.01

0.03

iii) Management of credit risk

Credit risk is the risk of financial loss to the Group if a customer or counterparty fails to meet its contractual

obligations.

Trade receivables

Concentrations of credit risk with respect to trade receivables are limited, due to the customer base being large,

diverse and across sectors and countries. All trade receivables are reviewed and assessed for default on a quarterly

basis.

historical experience of collecting receivables of the Group is supported by low level of past default and hence the

credit risk is perceived to be low.

Notes

to the Consolidated Financial Statements