Atul Ltd | Annual Report 2016-17

Level 1

: Level 1 hierarchy includes financial instruments measured using quoted prices. This includes listed equity

instruments and mutual fund units that have a quoted price. The fair value of all equity instruments which are traded an

the stock exchanges is valued using the closing price as at the reporting period. The mutual funds units are valued using

the closing net assets value (NAV).

Level 2:

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter

derivatives) is determined using valuation techniques which maximise the use of observable market data and rely as little

as possible on entity-specific estimates. If all significant inputs required to fair value an instrument are observable, the

instrument is included in level 2.

Level 3:

If one or more of the significant inputs is not based on observable market data, the instrument is included in level 3.

This is the case for unlisted equity securities and biological assets which are included in level 3.

b) Valuation technique used to determine fair value

Specific valuation techniques used to value financial instruments include:

i)

the use of quoted market prices or dealer quotes for similar instruments

ii) the fair value of interest rate swaps is calculated as the present value of the estimated future cash flows based on

observable yield curves

iii) the fair value of forward foreign exchange contracts are determined using forward exchange rates at the Balance

Sheet date

iv) the fair value of foreign currency option contracts is determined using the Black Scholes valuation model

v) the fair value of the remaining financial instruments is determined using discounted cash flow analysis.

All of the resulting fair value estimates are included in level 1 and 2.

c) Valuation processes

The finance department of the Group includes a team that performs the valuations of financial assets and liabilities

required for financial reporting purposes, including level 3 fair values.

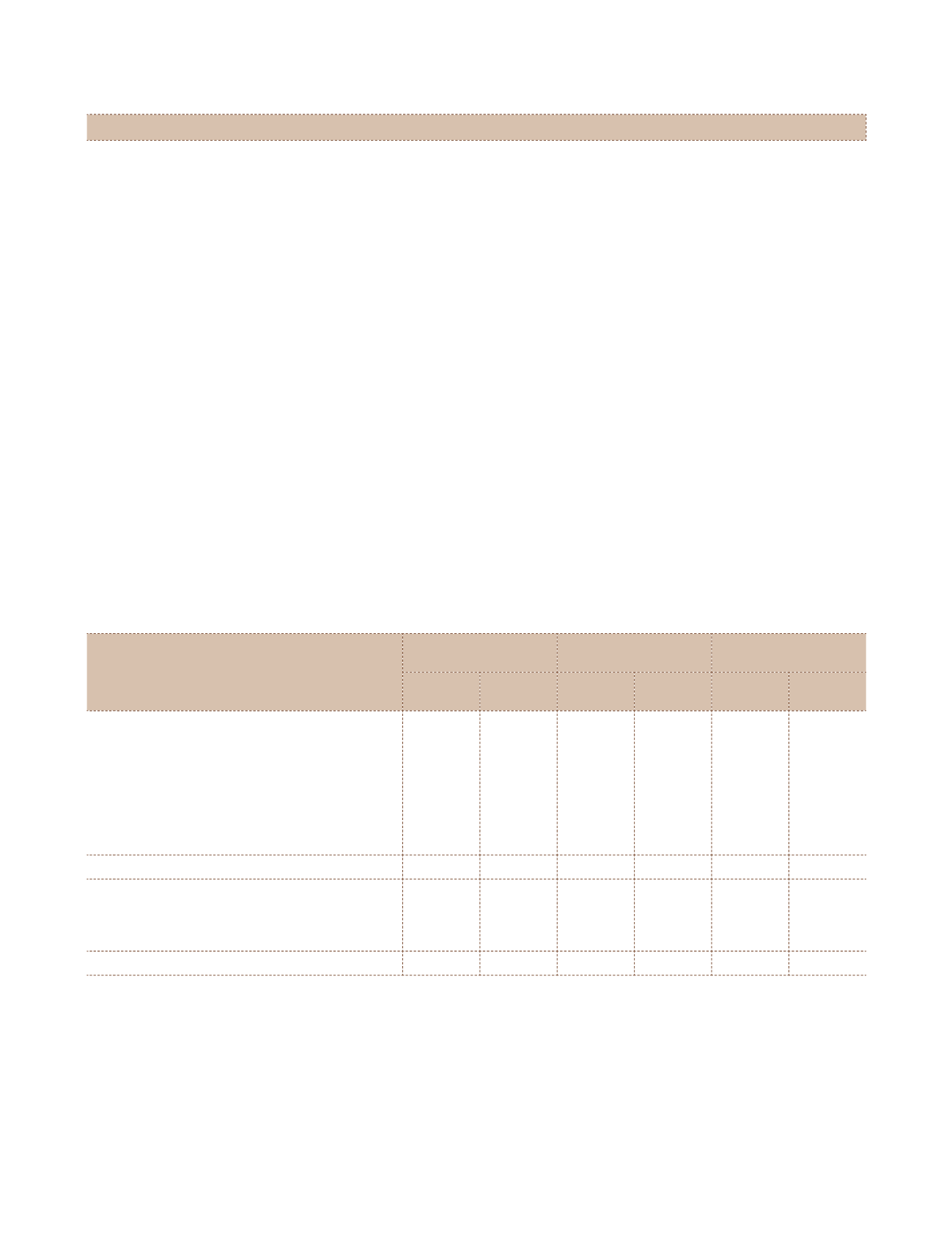

d) Fair value of financial assets and liabilities measured at amortised cost

(

`

cr)

Particulars

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Carrying

amount

Fair value Carrying

amount

Fair value Carrying

amount

Fair value

Financial assets

Investments:

Preference shares

–

–

6.43

7.37

5.81

6.54

Government securities

0.11

0.11

0.01

0.01

0.01

0.01

Loans

–

–

9.40

8.63

7.88

10.94

Security deposits for utilities and premises

1.59

1.59

1.39

1.39

1.49

1.49

Total financial assets

1.70

1.70

17.23

17.40

15.19

18.98

Financial liabilities

Borrowings

167.69

167.26

315.82

314.20

296.60

293.08

Security deposits

21.92

21.92

21.32

21.32

17.74

17.74

Total financial liabilities

189.61

189.18

337.14

335.52

314.34

310.82

The carrying amounts of trade receivables, trade payables, other receivables, short term security deposits, bank deposits with

more than 12 months maturity, capital creditors, dividend receivable, other liabilities (including discount payables) and cash

and cash equivalents including bank balances other than cash and cash equivalents are considered to be the same as their fair

values due to the current and short term nature of such balances.

The fair values for loans and investment in Preference shares were calculated based on cash flows discounted using a current

lending rate.

The fair values of non-current borrowings are based on discounted cash flows using a current borrowing rate. They are

classified as level 3 fair values in the fair value hierarchy due to the use of unobservable inputs, including own credit risk.

For financial assets and liabilities that are measured at fair value, the carrying amounts are equal to the fair values.

Notes

to the Consolidated Financial Statements

Note 29.7 Fair value measurements

(continued)