Atul Ltd | Annual Report 2016-17

(

`

cr)

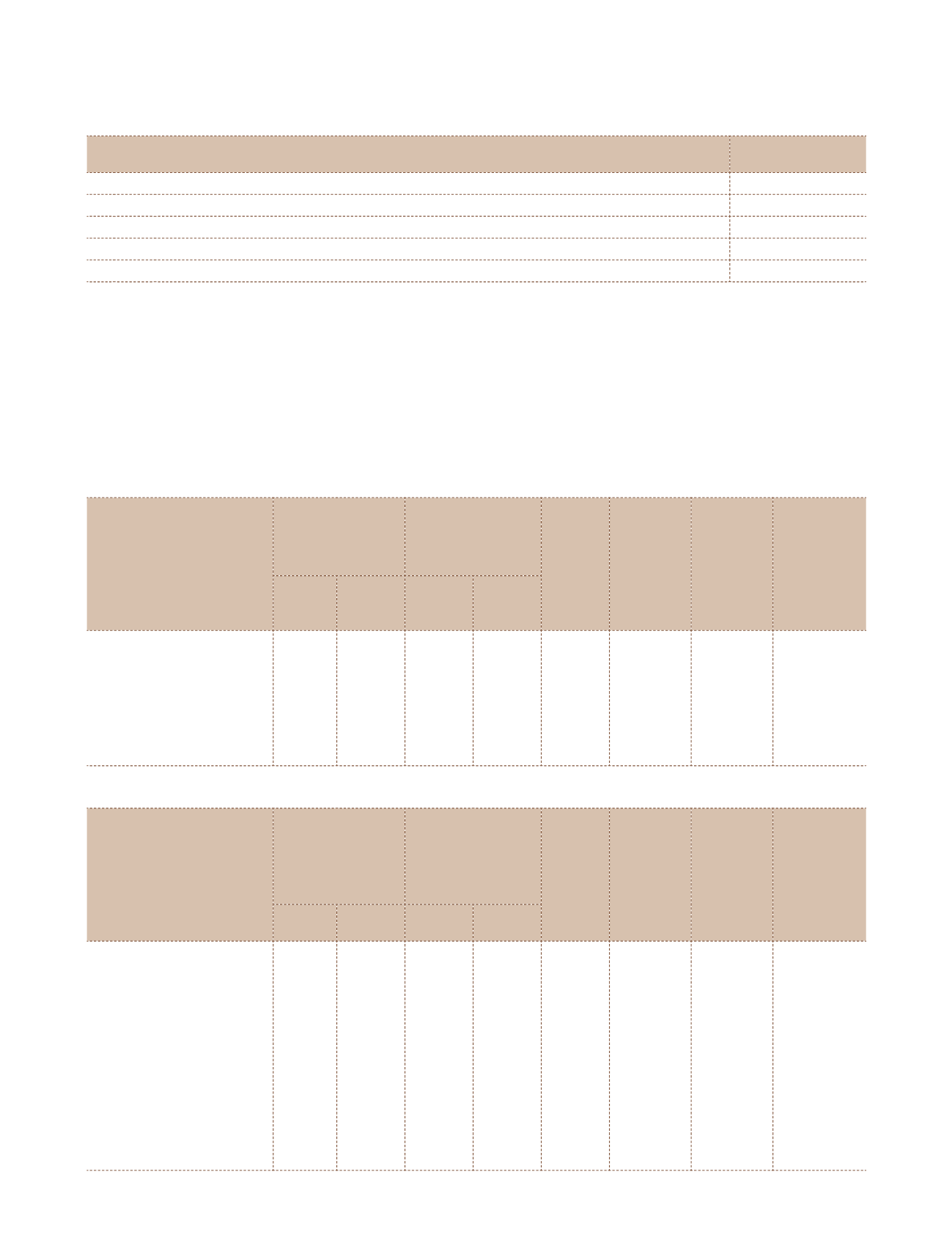

Particulars

As at

March 31, 2017

Loss allowance on April 01, 2015

2.73

Changes in loss allowance

1.07

Loss allowance on March 31, 2016

3.80

Changes in loss allowance

(0.64)

Loss allowance on March 31, 2017

3.16

Other financial assets

The Group maintains exposure in cash and cash equivalents, term deposits with banks, investments in Government securities,

Preference shares and loans to subsidiary companies. The Group has diversified portfolio of investment with various number

of counterparties which have secure credit ratings hence the risk is reduced. Individual risk limits are set for each counter-

party based on financial position, credit rating and past experience. Credit limits and concentration of exposures are actively

monitored by the treasury department of the Group.

Impact of hedging activities

a) Disclosure of effects of hedge accounting on financial position:

As at March 31, 2017

(

`

cr)

Type of hedge and risks

Notional value Carrying amount of

hedging instrument

Maturity Weighted

average

strike price|

interest rate

Changes in

fair value

of hedging

instrument

Change in

the value

of hedged

item used as

the basis for

recognising

hedge

effectiveness

Assets Liabilities Assets Liabilities

Cash flow hedge

` :

USD $

Foreign exchange risk

Foreign exchange forward

contracts

–

58.35

–

(2.43)

1-12

months

68.06

(2.43)

(2.43)

Currency range options

49.60

–

1.70

–

1-12

months

67.98-

73.20

1.70

1.70

As at March 31, 2016

(

`

cr)

Type of hedge and risks

Notional value Carrying amount of

hedging instrument

Maturity Weighted

average

strike price|

interest rate

Changes in

fair value

of hedging

instrument

Change in

the value

of hedged

item used as

the basis for

recognising

hedge

effectiveness

Assets Liabilities Assets Liabilities

Cash flow hedge

` :

USD $

Foreign exchange risk

Foreign exchange forward

contracts

–

53.07

–

(1.33)

1-12

months

68.69

(1.33)

(1.33)

Currency range options

83.25

–

0.14

–

1-12

months

65.96-

73.86

0.14

0.14

Currency vanilla options

44.00

–

0.30

–

1-12

months

66.41

0.30

0.30

Interest rate risk

Interest rate swaps

–

2.07

–

(0.01)

1-15

months

3.70

(0.01)

(0.01)

Notes

to the Consolidated Financial Statements