Note 29.9 Capital management

Risk Management

¹ĺĚ ƎƑĿŞîƑNj ūċŏĚČƥĿDŽĚ ūlj ČîƎĿƥîŕ ŞîŠîijĚŞĚŠƥ ūlj ƥĺĚ HƑūƭƎ Ŀƙ ƥū ŞîNJĿŞĿƙĚ ƙĺîƑĚĺūŕēĚƑ DŽîŕƭĚȦ ¹ĺĚ HƑūƭƎ ŞūŠĿƥūƑƙ ČîƎĿƥîŕ ƭƙĿŠij

Debt-Equity ratio which is total debt divided by total equity.

For the purpose of capital management, the Group considers the following components of its Balance Sheet to manage capital:

Total equity includes general reserve, retained earnings, share capital, security premium. Total debt includes current debt plus

non-current debt.

(

`

cr)

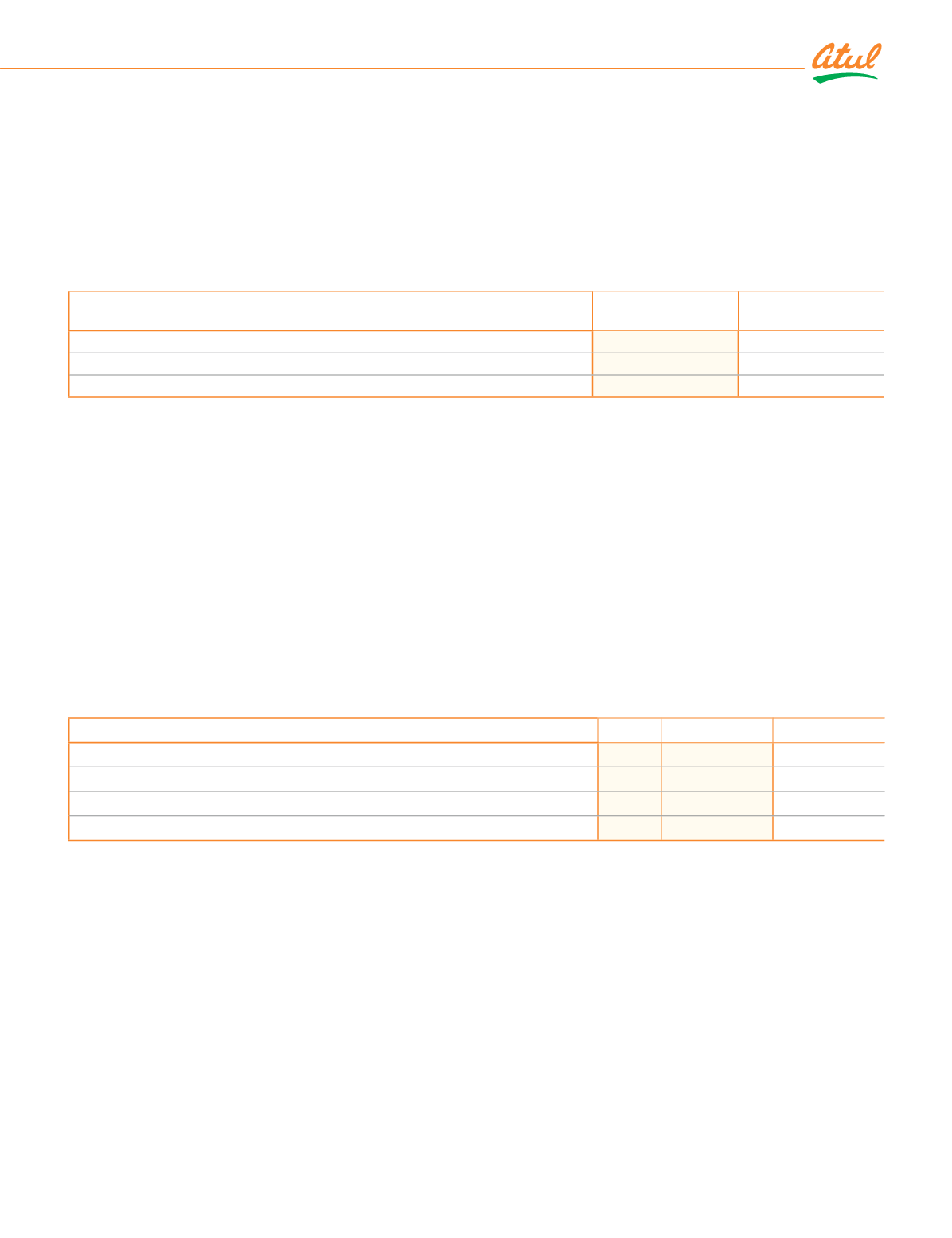

Particulars

As at

March 31, 2019

As at

March 31, 2018

Total debt

ǫǪȦǭǫ

15.91

Total equity

2,705.71

ǨȡǨǪǩȦǯǨ

Debt-Equity ratio

0.02

0.01

sūƥĚ ǨǯȦǧǦ ~ljljƙĚƥƥĿŠij ǛŠîŠČĿîŕ îƙƙĚƥƙ îŠē ŕĿîċĿŕĿƥĿĚƙ

¹ĺĚ ċĚŕūDž sūƥĚ ƎƑĚƙĚŠƥƙ ƥĺĚ ƑĚČūijŠĿƙĚē îƙƙĚƥƙ ƥĺîƥ îƑĚ ūljljƙĚƥ ūƑ ƙƭċŏĚČƥ ƥū ĚŠljūƑČĚîċŕĚ ŞîƙƥĚƑ ŠĚƥƥĿŠij îƑƑîŠijĚŞĚŠƥƙ îŠē

other similar Agreements, but not offset as at March 31, 2019 and March 31, 2018.

a) Collateral against borrowings

The Group has hypothecated | mortgaged assets as collateral against a number of its sanctioned line of credit. Refer Note

ǧǬ ljūƑ ljƭƑƥĺĚƑ ĿŠljūƑŞîƥĿūŠ ūŠ ǛŠîŠČĿîŕ îŠē ŠūŠȹǛŠîŠČĿîŕ ČūŕŕîƥĚƑîŕ ĺNjƎūƥĺĚČîƥĚē ʈ ŞūƑƥijîijĚē îƙ ƙĚČƭƑĿƥNjȦ

b) Master netting arrangements – not currently enforceable

ijƑĚĚŞĚŠƥƙ DžĿƥĺ ēĚƑĿDŽîƥĿDŽĚ ČūƭŠƥĚƑƎîƑƥĿĚƙ îƑĚ ċîƙĚē ūŠ îŠ T¬' qîƙƥĚƑ ijƑĚĚŞĚŠƥȦ ÀŠēĚƑ ƥĺĚ ƥĚƑŞƙ ūlj ƥĺĚƙĚ

arrangements, only where certain credit events occur (such as default), the net position owing | receivable to a single

counterparty in the same currency will be taken as owing and all the relevant arrangements terminated. As the Group

does not presently have a legally enforceable right of set-off, these amounts have not been offset in the Balance Sheet.

Note 29.11 Earnings per share

Earning per share (EPS) - The numerators and denominators used to calculate basic and diluted EPS

Particulars

2018-19

2017-18

¡ƑūǛƥ ljūƑ ƥĺĚ NjĚîƑ îƥƥƑĿċƭƥîċŕĚ ƥū ƥĺĚ ĚƐƭĿƥNj ƙĺîƑĚĺūŕēĚƑƙ

`

cr

ǪǩǬȦǦǨ

ǨǮǧȦǨǪ

Basic | weighted average number of equity shares outstanding during the year Number

2,96,61,733

2,96,61,733

Nominal value of equity share

`

10

10

Basic and diluted EPS

`

ǧǪǭȦǦǦ

ǯǪȦǮǨ

Note 29.12 Leases

a) Operating lease

¹ĺĚ HƑūƭƎ ĺîƙ ƥîŒĚŠ DŽîƑĿūƭƙ ƑĚƙĿēĚŠƥĿîŕ îŠē ūljǛČĚ ƎƑĚŞĿƙĚƙ ƭŠēĚƑ ūƎĚƑîƥĿŠij ŕĚîƙĚ ūƑ ŕĚîDŽĚ îŠē ŕĿČĚŠƙĚ îijƑĚĚŞĚŠƥƙȦ

¹ĺĚƙĚ îƑĚ ijĚŠĚƑîŕŕNj ČîŠČĚŕŕîċŕĚȡ ĺîDŽĚ î ƥĚƑŞ ċĚƥDžĚĚŠ ǧǧ ŞūŠƥĺƙ îŠē ǩ NjĚîƑƙ îŠē ĺîDŽĚ Šū ƙƎĚČĿǛČ ūċŕĿijîƥĿūŠ ljūƑ ƑĚŠĚDžîŕȦ

¡îNjŞĚŠƥƙ îƑĚ ƑĚČūijŠĿƙĚē ĿŠ ƥĺĚ ¬ƥîƥĚŞĚŠƥ ūlj ¡ƑūǛƥ îŠē gūƙƙ ƭŠēĚƑ Ƀ¤ĚŠƥɄ ĿŠ sūƥĚ ǨǮȦ

b) Finance lease

¹ĺĚ HƑūƭƎ ĺîƙ ƥîŒĚŠ ūŠ ŕĚîƙĚ î ƎîƑČĚŕ ūlj ŕîŠē ljƑūŞ HƭŏîƑîƥ TŠēƭƙƥƑĿîŕ 'ĚDŽĚŕūƎŞĚŠƥ ūƑƎūƑîƥĿūŠ ljūƑ î ƎĚƑĿūē ūlj ǯǯ NjĚîƑƙ

DžĿƥĺ îŠ ūƎƥĿūŠ ƥū ĚNJƥĚŠē ƥĺĚ ŕĚîƙĚ ċNj îŠūƥĺĚƑ ǯǯ NjĚîƑƙ ūŠ ĚNJƎĿƑNj ūlj ŕĚîƙĚ îƥ î ƑĚŠƥîŕ ƥĺîƥ Ŀƙ ǧǦǦɼ ĺĿijĺĚƑ ƥĺîŠ ƥĺĚ ČƭƑƑĚŠƥ

rental. The Group has considered that such a lease of land transfers substantially all of the risks and rewards incidental to

ūDžŠĚƑƙĺĿƎ ūlj ŕîŠēȡ îŠē ĺîƙ ƥĺƭƙ îČČūƭŠƥĚē ljūƑ ƥĺĚ ƙîŞĚ îƙ ǛŠîŠČĚ ŕĚîƙĚȦ

Note 29.13 Rounding off

Figures less than

`

50,000 have been shown at actual in brackets.

Consolidated

|

Notes to the Financial Statements

237