Note 29.8 Financial risk management (continued)

c) Management of credit risk

ƑĚēĿƥ ƑĿƙŒ Ŀƙ ƥĺĚ ƑĿƙŒ ūlj ǛŠîŠČĿîŕ ŕūƙƙ ƥū ƥĺĚ HƑūƭƎ Ŀlj î ČƭƙƥūŞĚƑ ūƑ ČūƭŠƥĚƑƎîƑƥNj ljîĿŕƙ ƥū ŞĚĚƥ Ŀƥƙ ČūŠƥƑîČƥƭîŕ ūċŕĿijîƥĿūŠƙȦ

Trade receivables

Concentrations of credit risk with respect to trade receivables are limited, due to the customer base being large, diverse and

îČƑūƙƙ ƙĚČƥūƑƙ îŠē ČūƭŠƥƑĿĚƙȦ ¬ĿijŠĿǛČîŠƥ ƎūƑƥĿūŠ ūlj ƥƑîēĚ ƑĚČĚĿDŽîċŕĚ îƑĚ ƙĚČƭƑĚē ċNj ĿŠƙƭƑîŠČĚ ƎūŕĿČĿĚƙ ūƑ /¡ H ƙČĺĚŞĚƙȦ

All trade receivables are reviewed and assessed for default on a quarterly basis.

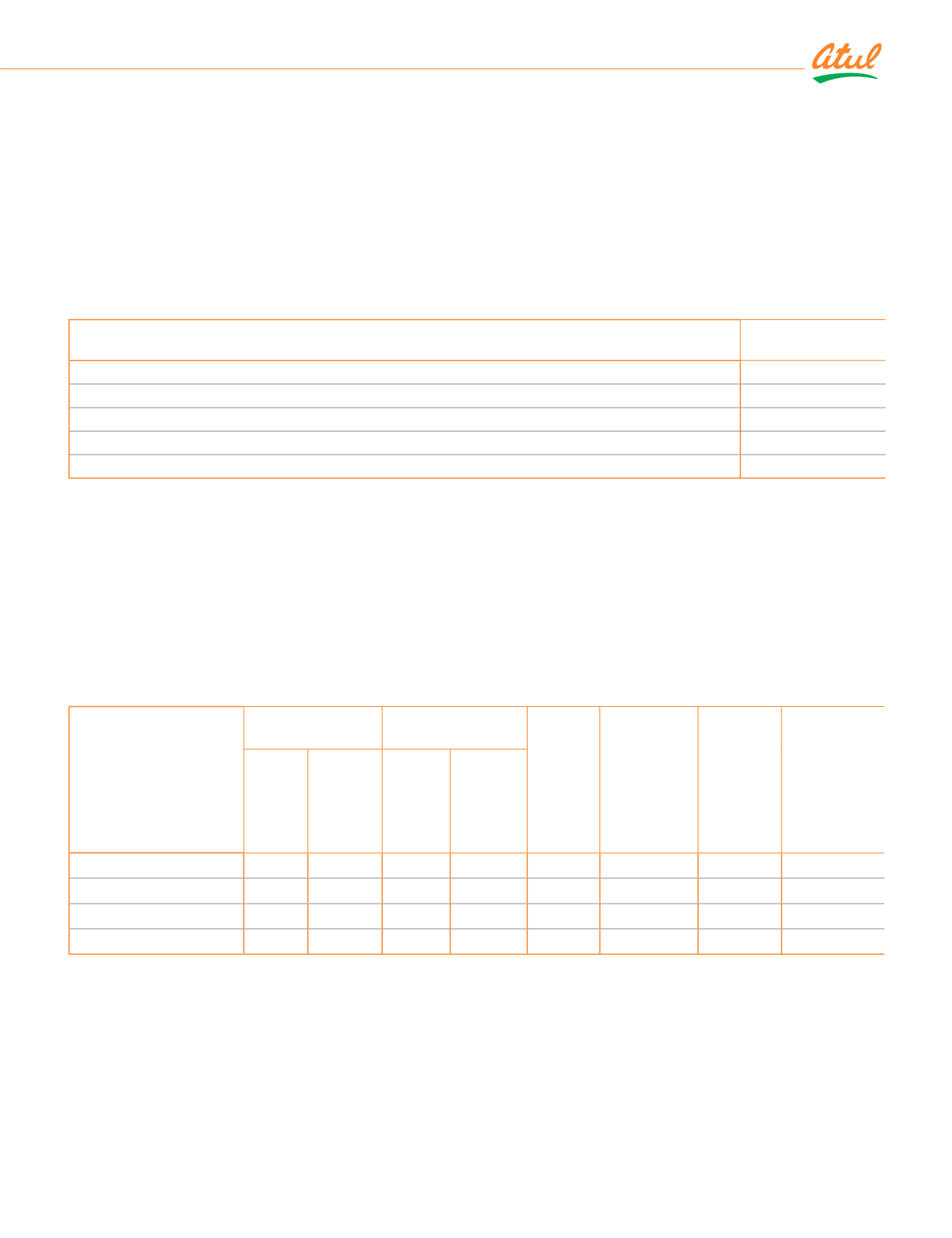

Reconciliation of loss allowance provision – trade receivables

(

`

cr)

Particulars

Loss allowance on

trade receivables

Loss allowance as on March 31, 2017

3.16

Changes in loss allowance

(0.56)

Loss allowance as on March 31, 2018

2.60

Changes in loss allowance

5.01

Loss allowance as on March 31, 2019

7.61

~ƥĺĚƑ ǛŠîŠČĿîŕ îƙƙĚƥƙ

¹ĺĚ HƑūƭƎ ŞîĿŠƥîĿŠƙ ĚNJƎūƙƭƑĚ ĿŠ Čîƙĺ îŠē Čîƙĺ ĚƐƭĿDŽîŕĚŠƥƙȡ ƥĚƑŞ ēĚƎūƙĿƥƙ DžĿƥĺ ċƙȡ ĿŠDŽĚƙƥŞĚŠƥƙ ĿŠ ijūDŽĚƑŠŞĚŠƥ ƙĚČƭƑĿƥĿĚƙȡ

ƎƑĚljĚƑĚŠČĚ ƙĺîƑĚƙ îŠē ŕūîŠƙ ƥū ƙƭċƙĿēĿîƑNj ČūŞƎîŠĿĚƙȦ ¹ĺĚ HƑūƭƎ ĺîƙ ēĿDŽĚƑƙĿǛĚē ƎūƑƥljūŕĿū ūlj ĿŠDŽĚƙƥŞĚŠƥ DžĿƥĺ DŽîƑĿūƭƙ ŠƭŞċĚƑ

of counterparties which have secure credit ratings hence the risk is reduced. Individual risk limits are set for each counter-

ƎîƑƥNj ċîƙĚē ūŠ ǛŠîŠČĿîŕ ƎūƙĿƥĿūŠȡ ČƑĚēĿƥ ƑîƥĿŠij îŠē Ǝîƙƥ ĚNJƎĚƑĿĚŠČĚȦ ƑĚēĿƥ ŕĿŞĿƥƙ îŠē ČūŠČĚŠƥƑîƥĿūŠ ūlj ĚNJƎūƙƭƑĚƙ îƑĚ îČƥĿDŽĚŕNj

monitored by the treasury department of the Group.

Impact of hedging activities

îȴ 'ĿƙČŕūƙƭƑĚ ūlj ĚljljĚČƥƙ ūlj ĺĚēijĚ îČČūƭŠƥĿŠij ūŠ ǛŠîŠČĿîŕ ƎūƙĿƥĿūŠȠ

As at March 31, 2019

(

`

cr)

Type of hedge and risks Notional value Carrying amount of

hedging instrument

Maturity

(months)

Weighted

average

strike price |

interest rate

Changes

in fair

value of

hedging

instrument

Change in

the value of

hedged item

used as the

basis for

recognising

hedge

effectiveness

Assets Liabilities Assets Liabilities

îƙĺ ǜūDž ĺĚēijĚ

`

Ƞ À¬ɐ

Foreign exchange risk

Currency range options

87.09

-

1.22

-

1-12

ǬǯȦǬǪȹǭǫȦǮǪ

1.22

(1.22)

Consolidated

|

Notes to the Financial Statements

235