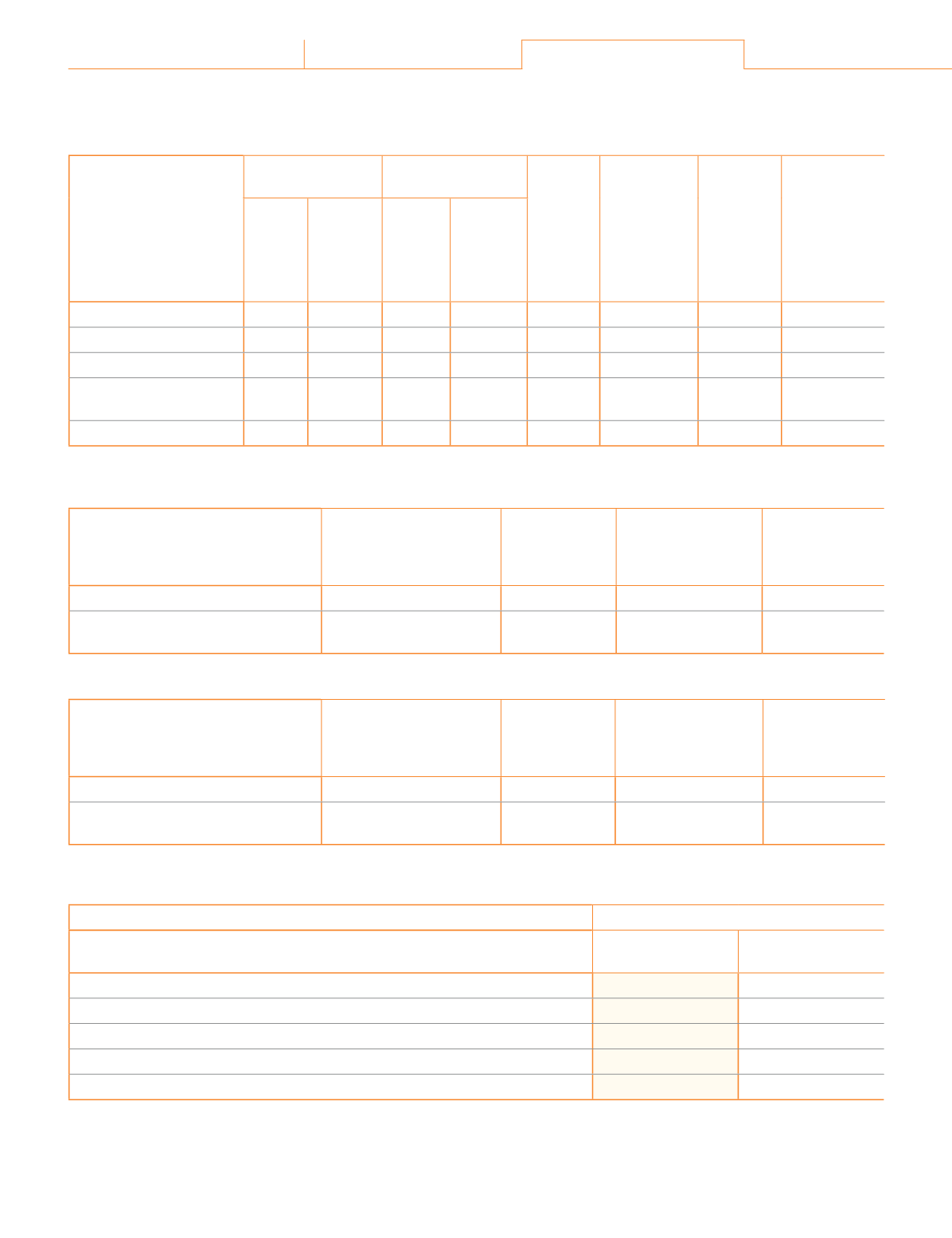

Note 29.8 Financial risk management (continued)

As at March 31, 2018

(

`

cr)

Type of hedge and risks Notional value Carrying amount of

hedging instrument

Maturity

(months)

Weighted

average

strike price |

interest rate

Changes

in fair

value of

hedging

instrument

Change in

the value of

hedged item

used as the

basis for

recognising

hedge

effectiveness

Assets Liabilities Assets Liabilities

îƙĺ ǜūDž ĺĚēijĚ

`

Ƞ À¬ɐ

Foreign exchange risk

GūƑĚĿijŠ ĚNJČĺîŠijĚ

forward contracts

6.01

-

0.07

-

1-12

66.18

0.07

(0.07)

Currency range options

-

ǨǪȦǨǨ

-

(0.02)

1-12

ǬǪȦǯǦȹǬǮȦǯǦ

(0.02)

0.02

ċȴ 'ĿƙČŕūƙƭƑĚ ūlj ĚljljĚČƥƙ ūlj ĺĚēijĚ îČČūƭŠƥĿŠij ūŠ ǛŠîŠČĿîŕ ƎĚƑljūƑŞîŠČĚ

As at March 31, 2019

(

`

cr)

Type of hedge

Change in the value of

the hedging instrument

recognised in other

comprehensive income

Hedge

ineffectiveness

recognised in

ƎƑūǛƥ ūƑ ŕūƙƙ

ŞūƭŠƥ ƑĚČŕîƙƙĿǛĚē

ljƑūŞ Čîƙĺ ǜūDž

hedging reserve to

ƎƑūǛƥ ūƑ ŕūƙƙ

Financial

Statement line

item affected

îƙĺ ǜūDž ĺĚēijĚ

GūƑĚĿijŠ ĚNJČĺîŠijĚ ƑĿƙŒ

1.22

-

0.05

Trade receivable

and payable

As at March 31, 2018

(

`

cr)

Type of hedge

Change in the value of

the hedging instrument

recognised in other

comprehensive income

Hedge

ineffectiveness

recognised in

ƎƑūǛƥ ūƑ ŕūƙƙ

ŞūƭŠƥ ƑĚČŕîƙƙĿǛĚē

ljƑūŞ Čîƙĺ ǜūDž

hedging reserve to

ƎƑūǛƥ ūƑ ŕūƙƙ

Financial

Statement line

item affected

îƙĺ ǜūDž ĺĚēijĚ

GūƑĚĿijŠ ĚNJČĺîŠijĚ ƑĿƙŒ

0.05

-

(0.73)

Revenue and

inventories

qūDŽĚŞĚŠƥƙ ĿŠ Čîƙĺ ǜūDž ĺĚēijĿŠij ƑĚƙĚƑDŽĚ

(

`

cr)

Risk category

Foreign currency risk

Derivative instruments

As at

March 31, 2019

As at

March 31, 2018

Balance at the beginning of the year

0.03

(0.48)

Gain | (Loss) recognised in other comprehensive income during the year

1.22

0.05

ŞūƭŠƥ ƑĚČŕîƙƙĿǛĚē ƥū ƑĚDŽĚŠƭĚ ēƭƑĿŠij ƥĺĚ NjĚîƑ

(0.03)

ǦȦǪǮ

¹îNJ ĿŞƎîČƥ ūŠ îċūDŽĚ

ȳǦȦǪǩȴ

(0.02)

Balance at the end of the year

0.79

0.03

236

Atul Ltd | Annual Report 2018-19

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250