92 /

Atul Ltd

|

Annual Report 2009-10

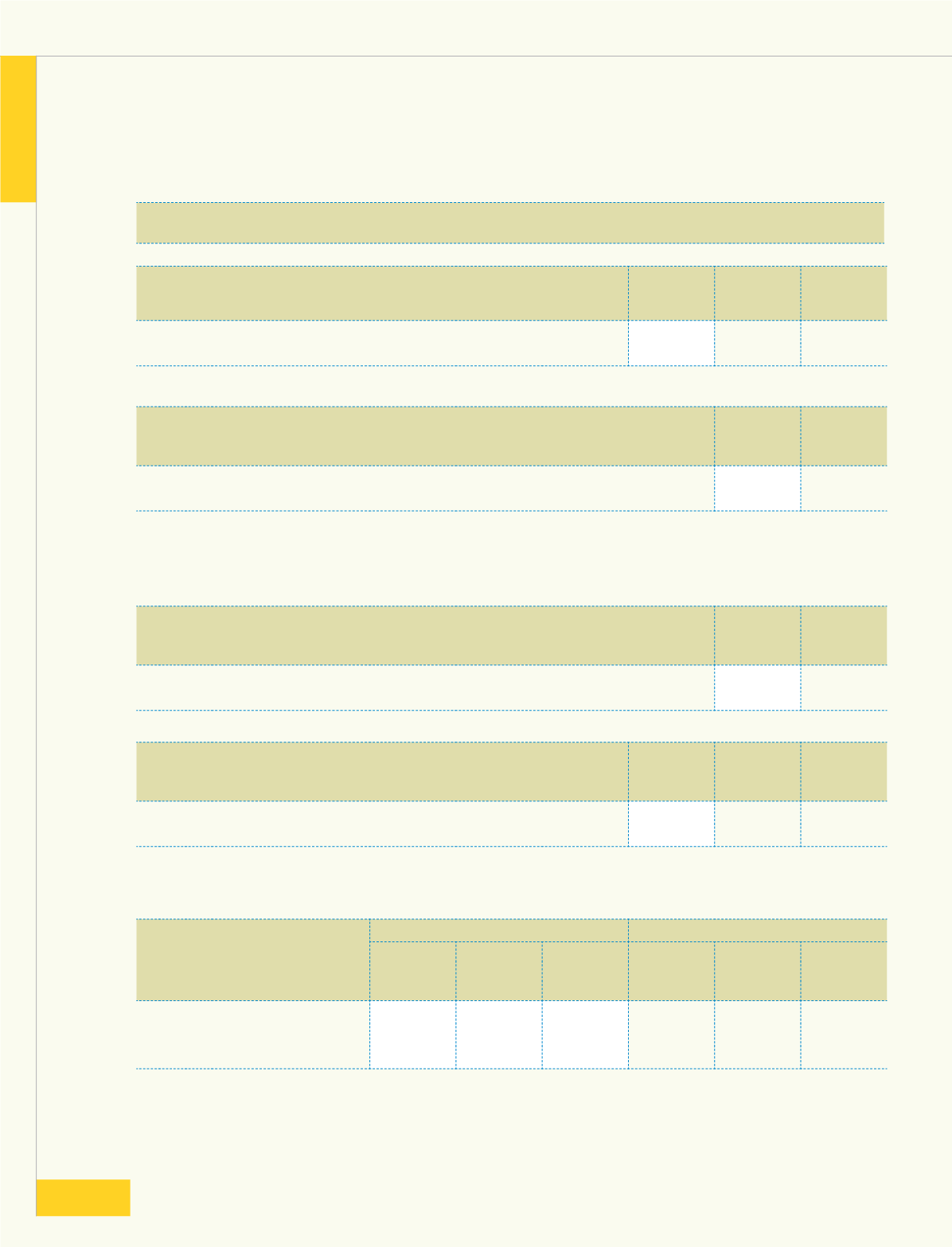

The following are the outstanding forward exchange contracts entered into by the Company:

As at

No of

Contracts

Type

US$

equivalent

(crores)

March 31, 2009

31

Sell

0.57

March 31, 2010

3

Buy

0.04

(2) The Company has outstanding currency option contracts (hedging instruments) which are bought in addition

to forward contracts, to hedge a part of its highly probable forecasted export transactions.

As at

No of

Contracts

US$

equivalent

(crores)

March 31, 2009

8

5.15

March 31, 2010

8

3.35

(3) The Company also uses derivative contracts other than forward contracts to hedge the interest rate and

currency risk on its capital account.

(i) Interest Rate Swaps to hedge against fluctuations in interest rate changes

As at

No of

Contracts

US$

equivalent

(crores)

March 31, 2009

3

0.28

March 31, 2010

-

-

(ii) Currency Swap to hedge against fluctuations in changes in exchange rate and Interest Rate

As at

No of

contracts

US$

equivalent

(crores)

Euro

equivalent

(crores)

March 31, 2009

2

0.36

-

March 31, 2010

2

0.20

-

(b) The year end foreign currency exposures that have not been hedged by a derivative instrument or otherwise are

given below:

Amounts receivable or payable in foreign currency on account of the following:

Current Year

Previous Year

Particulars

US$

equivalent

(crores)

Euro

equivalent

(crores)

Others

equivalent

(crores)

US$

equivalent

(crores)

Euro

equivalent

(crores)

Others

equivalent

(crores)

Debtors

2.34

0.45

0.01

1.68

0.34

0.01

Creditors - (GBP 1402.41)

0.92

-

0.02

0.31

0.01

-

Loans Taken

1.44

-

-

1.94

-

-

Schedule

forming part of the accounts

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

93